Completed the Acquisition of IPONWEB, a Market-Leading AdTech Platform Company

Raises 2022 Contribution ex-TAC Guidance with IPONWEB Acquisition

Announces Investor Day on September 26, 2022

NEW YORK – August 3, 2022 – Criteo S.A. (NASDAQ: CRTO) (“Criteo” or the “Company”), the commerce media company, today announced the completion of its acquisition of IPONWEB and financial results for the three and six months ended June 30, 2022.

Completion of the Acquisition of IPONWEB

Criteo completed the acquisition of IPONWEB, a market-leading AdTech platform company with world-class media trading capabilities, on August 1, 2022.

With this strategic acquisition, Criteo accelerates its Commerce Media Platform strategy to better serve its enterprise marketers – and their agency partners – by leveraging IPONWEB’s well-established Demand Side Platform (DSP) and Supply Side Platform (SSP) solutions. This acquisition also expands monetization opportunities for all media owners, including retailers, and provides critical capabilities for first-party data management across the ecosystem.

On December 9, 2021, Criteo announced that it had entered into exclusive negotiations to acquire IPONWEB for $380 million, made up of $305 million in cash and $75 million in treasury shares. In accordance with the revised terms of the transaction, Criteo acquired IPONWEB for $250 million, subject to customary purchase price adjustments, made up of approximately $180 million paid in cash and approximately $70 million paid in Criteo treasury shares at closing, plus potential earnout consideration of up to $100 million to be paid in cash over the next eighteen months subject to certain financial and other performance milestones. The restructured transaction also excludes IPONWEB’s subsidiary in Russia.

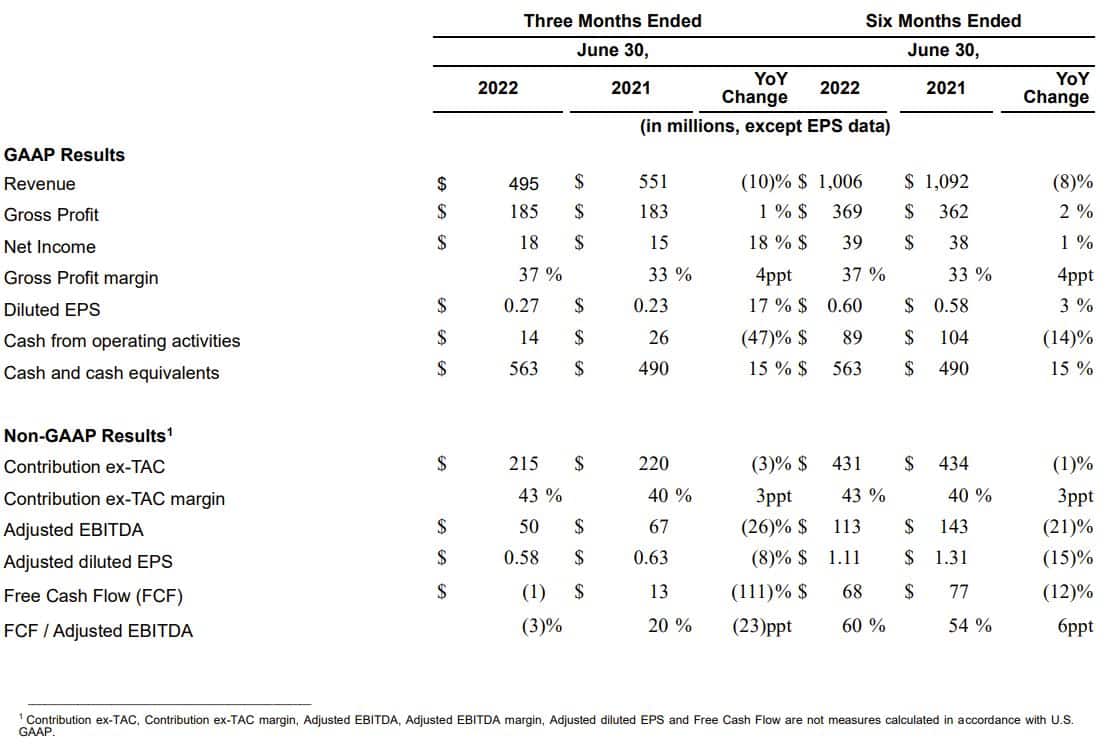

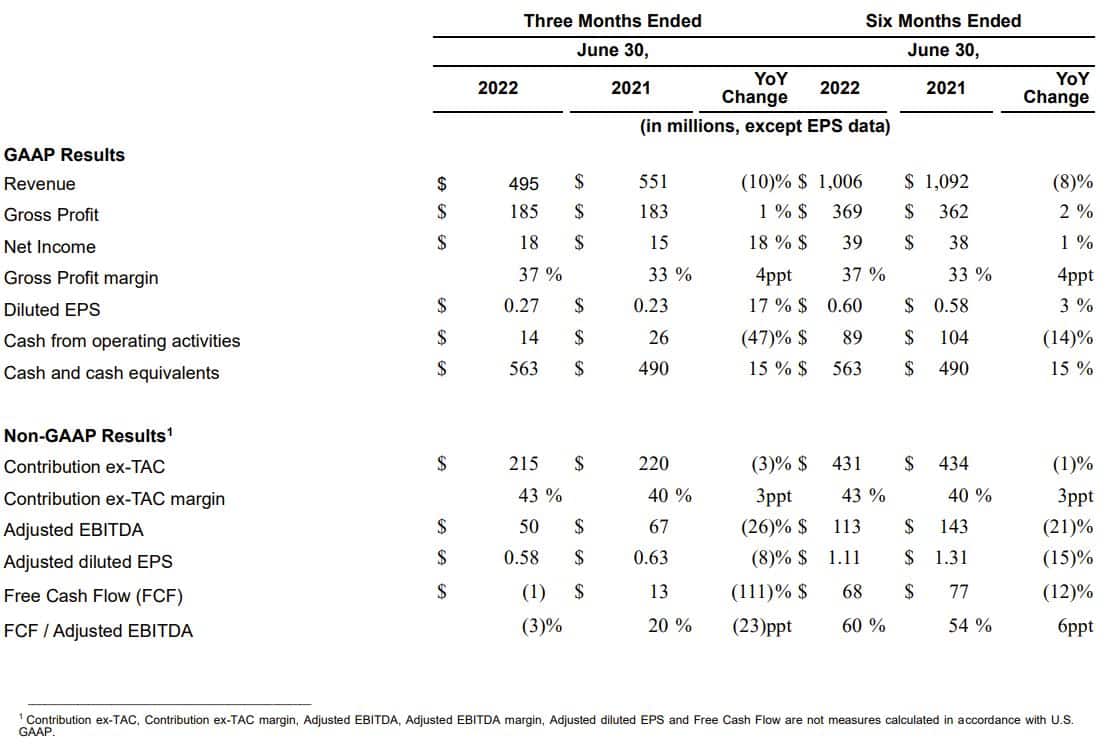

Second Quarter 2022 Financial Highlights:

The following table summarizes our consolidated financial results for the three and six months ended June 30, 2022:

“Our second quarter performance demonstrates our team’s strong execution and the value we bring to our clients,” said Megan Clarken, Chief Executive Officer of Criteo. “We are thrilled to welcome IPONWEB to Criteo. Together with IPONWEB, we expect to have significant scale and differentiated first-party data capabilities to meet the fast-growing demand for Commerce and Retail Media solutions on the open internet.”

Operating Highlights

- On August 1st, we completed the acquisition of IPONWEB for $250 million, including approximately $180 million paid in cash and approximately $70 million paid in Criteo treasury shares at closing, plus potential earnout consideration of up to $100 million.

- Retail Media Contribution ex-TAC grew 42% year-over-year at constant currency2, and same-retailer Contribution ex-TAC3 for Retail Media increased 37% year-over-year.

- Marketing Solutions Contribution ex-TAC grew 2% year-over-year at constant currency2.

- We expanded our platform adoption with large retailers and marketplaces, including Bloomingdale’s, Deliveroo and Lowe’s Canada.

- We rolled out our API Partner Program in EMEA and added ChannelAdvisor as an API Partner in the U.S.

- The French Competition Authority issued a favorable decision that will restore Criteo’s partner status and partner access to Meta ad inventory globally.

- Criteo’s activated media spend4 by the Commerce Media Platform for marketers and media owners was over $2.8 billion in the last 12 months and $676 million in Q2, growing 9% at constant currency2.

- We had 725 million Daily Active Users (DAUs), over 60% of which on the web are addressable through media owners we have direct access to, as we continue to build Criteo’s first-party commerce media network.

- In July 2022, we signed a mandate letter and term sheet, subject to customary conditions, for an expanded €407 million ($418 million) revolving credit facility.

Financial Summary

Revenue for Q2 2022 was $495 million, gross profit was $185 million and Contribution ex-TAC was $215 million. Net income for Q2 was $18 million, or $0.27 per share on a diluted basis. Adjusted EBITDA for Q2 was $50 million, resulting in an adjusted diluted EPS of $0.58. As reported, Revenue for Q2 decreased by 10%, gross profit increased 1% and Contribution ex-TAC decreased by 3%. At constant currency, Revenue for Q2 decreased by 3% and Contribution ex-TAC increased by 7%. Cash flow from operating activities was $14 million and Free Cash Flow was $(1) million in Q2. As of June 30, 2022, we had $573 million in cash and marketable securities on our balance sheet.

Sarah Glickman, Chief Financial Officer, said, “Strong growth in our Retail Media and Audience Targeting solutions, and resilient performance in our retargeting solutions delivered 7% growth in Contribution ex-TAC at constant currency, despite a slower macro environment and the suspension of our Russia operations. We are on pace to deliver sustainable and profitable growth in 2022 and we remain confident in our long-term growth outlook. With our strategic acquisition of IPONWEB and our share buyback program, we are deploying our capital to accelerate growth and drive near- and long-term shareholder value.”

Second Quarter 2022 Results

Revenue, Gross Profit and Contribution ex-TAC

Revenue decreased by 10% year-over-year in Q2 2022, or 3% at constant currency, to $495 million (Q2 2021: $551 million). Gross profit increased by 1% year-over-year in Q2 2022 to $203 million (Q2 2021: $183 million). Gross profit as a percentage of revenue, or gross profit margin, was 37% (Q2 2021: 33%). Contribution ex-TAC in the second quarter decreased 3% year-over-year, or increased 7% at constant currency, to $215 million (Q2 2021: $220 million). Contribution ex-TAC as a percentage of revenue, or Contribution ex-TAC margin, was 43% (Q2 2021: 40%), up 300 basis points year-over-year, largely driven by Retail Media and the acceleration of our client transition to the Company’s platform.

- Marketing Solutions revenue decreased 10%, or decreased 2% at constant currency, and Marketing Solutions Contribution ex-TAC decreased 8%, or increased 2% at constant currency, driven by healthy demand from Retail clients and a rebound in Travel, partially offset by anticipated identity and privacy changes and the suspension of the Company’s operations in Russia.

- Retail Media revenue decreased 14%, or 12% at constant currency, reflecting the impact related to the ongoing client migration to the Company’s platform. Retail Media Contribution ex-TAC increased 36%, or 42% at constant currency, driven by continued strength in Retail Media onsite, new client integrations and growing network effects of the platform.

___________________________________________________

1 Contribution ex-TAC, Contribution ex-TAC margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted diluted EPS and Free Cash Flow are not measures calculated in accordance with U.S. GAAP.

2 Constant currency measures exclude the impact of foreign currency fluctuations and is computed by applying the prior year monthly exchange rates to transactions denominated in settlement or billing currencies other than the US dollar.

3 Same-client profitability or Contribution ex-TAC is the profitability or Contribution ex-TAC generated by clients that were live with us in a given quarter and are still live with us the same quarter in the following year.

4 Activated media spend is defined as the sum of our Marketing Solutions revenue and the media spend activated on behalf of our Retail Media clients.

Net Income and Adjusted Net Income

Net income was $18 million in Q2 2022 (Q2 2021: $15 million). Net income margin as a percentage of revenue was 4% (Q2 2021: 3%). Net income available to shareholders of Criteo was $17 million, or $0.27 per share on a diluted basis (Q2 2021: $15 million, or $0.23 per share on a diluted basis).

Adjusted net income, or net income adjusted to eliminate the impact of equity awards compensation expense, amortization of acquisition-related intangible assets, acquisition-related costs, restructuring related and transformation costs and the tax impact of these adjustments, was $36 million, or $0.58 per share on a diluted basis (Q2 2021: $41 million, or $0.63 per share on a diluted basis).

Adjusted EBITDA and Operating Expenses

Adjusted EBITDA was $50 million, in line with the Company’s guidance, representing a decrease of 26% year-over-year (Q2 2021: $67 million). This was driven by planned growth investments, including investments in our people and marketing events, partially offset by higher Contribution ex-TAC over the period. Adjusted EBITDA as a percentage of Contribution ex-TAC, or Adjusted EBITDA margin, was 23% (Q2 2021: 31%).

Operating expenses increased 8% year-over-year to $176 million (Q2 2021: $163 million), mostly driven by higher headcount-related expense, including equity awards compensation expense, balanced with effective cost management. Operating expenses, excluding the impact of equity awards compensation expense, pension costs, acquisition-related costs, restructuring related and transformation costs, and depreciation and amortization, which we refer to as Non-GAAP operating expenses, increased by 13% or $17 million, to $148 million (Q2 2021: $131 million).

Cash Flow, Cash and Financial Liquidity Position

Cash flow from operating activities decreased 47% year-over-year to $14 million in Q2 2022 (Q2 2021: $26 million).

Free Cash Flow, defined as cash flow from operating activities less acquisition of intangible assets, property, plant and equipment and change in accounts payable related to intangible assets, property, plant and equipment, decreased to $(1) million in Q2 2022 (Q2 2021: $13 million).

Cash and cash equivalents increased $47 million compared to December 31, 2021 to $563 million, after spending approximately $21 million on share repurchases in the second quarter of 2022.

As of June 30, 2022, the Company had total financial liquidity of approximately $1 billion, including its cash position, marketable securities, Revolving Credit Facility and treasury shares reserved for M&A.

2022 Business Outlook

The following forward-looking statements reflect Criteo’s expectations as of August 3, 2022.

Third quarter 2022 guidance:

- We expect Contribution ex-TAC between $223 million and $229 million, or year-over-year growth at constant-currency of +12% to +15%, including the contribution from our IPONWEB acquisition.

- We expect Adjusted EBITDA between $48 million and $53 million.

Fiscal year 2022 guidance:

- We now expect Contribution ex-TAC to grow by 11% to 14% at constant currency, including the contribution from our IPONWEB acquisition.

- We now to expect an Adjusted EBITDA margin of approximately 30% to 31% of Contribution ex-TAC and a Free Cash Flow conversion rate of about 45% of Adjusted EBITDA.

The above guidance for the third quarter and fiscal year ending December 31, 2022 assumes the following exchange rates for the main currencies impacting our business: a U.S. dollar-euro rate of 0.943, a U.S. dollar-Japanese Yen rate of 127, a U.S. dollar-British pound rate of 0.797, a U.S. dollar-Korean Won rate of 1,190 and a U.S. dollar-Brazilian real rate of 5.30.

The above guidance assumes that no additional acquisitions are completed during the third quarter of 2022 or the fiscal year ended December 31, 2022.

Reconciliations of Contribution ex-TAC, Adjusted EBITDA and Adjusted EBITDA margin guidance to the closest corresponding U.S. GAAP measures are not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures; in particular, the measures and effects of equity awards compensation expense specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our share price. The variability of the above charges could potentially have a significant impact on our future U.S. GAAP financial results.

New Revolving Credit Facility

Criteo signed a mandate letter and term sheet, subject to customary conditions, for an expanded €407 million ($418 million), five-year revolving credit facility, which would replace the Company’s prior €294 million ($305 million) facility. The mandate letter and term sheet were signed on July 29, 2022 and the Company expects to enter into a definitive agreement in the third quarter. The increased borrowing capacity reflects Criteo’s financial strength and growth outlook.

Investor Day

Criteo also announced today that it will host an Investor Day in New York City on September 26, 2022. The Investor Day will be an opportunity for the Company to provide an update on its mid-term financial outlook.

Update to Constant Currency Calculation Methodology

Beginning in the second quarter of 2022, the Company updated its methodology for calculating results on a constant currency basis, which are non-GAAP measures. The Company will use the prior year’s monthly exchange rates where the settlement or billing currencies are in currencies other than US dollars. The Q1 2022 constant currency results have been revised consistent with this updated methodology.

Non-GAAP Financial Measures

This press release and its attachments include the following financial measures defined as non-GAAP financial measures by the U.S. Securities and Exchange Commission (“SEC”): Contribution ex-TAC, Contribution ex-TAC margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted diluted EPS, Free Cash Flow and Non-GAAP Operating Expenses. These measures are not calculated in accordance with U.S. GAAP.

Contribution ex-TAC is a profitability measure akin to gross profit. It is calculated by deducting traffic acquisition costs from revenue and reconciled to gross profit through the exclusion of other costs of revenue. Contribution ex-TAC is not a measure calculated in accordance with U.S. GAAP. We have included Contribution ex-TAC because it is a key measure used by our management and board of directors to evaluate operating performance, generate future operating plans and make strategic decisions. In particular, we believe that this measure can provide useful measures for period-to-period comparisons of our business.

Accordingly, we believe that Contribution ex-TAC provides useful information to investors and others in understanding and evaluating our results of operations in the same manner as our management and board of directors.

Adjusted EBITDA is our consolidated earnings before financial income (expense), income taxes, depreciation and amortization, adjusted to eliminate the impact of equity awards compensation expense, pension service costs and restructuring related and transformation costs.

Adjusted EBITDA and Adjusted EBITDA margin are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, we believe that by eliminating equity awards compensation expense, pension service costs, depreciation and amortization expense, acquisition-related costs and restructuring related and transformation costs, Adjusted EBITDA and Adjusted EBITDA margin can provide useful measures for period-to-period comparisons of our business. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors and the market generally in understanding and evaluating our results of operations in the same manner as our management and board of directors.

Adjusted Net Income is our net income adjusted to eliminate the impact of equity awards compensation expense, amortization of acquisition-related intangible assets, restructuring related and transformation costs and the tax impact of these adjustments. Adjusted Net Income and Adjusted diluted EPS are key measures used by our management and board of directors to evaluate operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital.

In particular, we believe that by eliminating equity awards compensation expense, amortization of acquisition-related intangible assets, restructuring related and transformation costs and the tax impact of these adjustments, Adjusted Net Income and Adjusted diluted EPS can provide useful measures for period-to-period comparisons of our business. Accordingly, we believe that Adjusted Net Income and Adjusted diluted EPS provide useful information to investors and the market generally in understanding and evaluating our results of operations in the same manner as our management and board of directors.

Free Cash Flow is defined as cash flow from operating activities less acquisition of intangible assets, property, plant and equipment and change in accounts payable related to intangible assets, property, plant and equipment. Free Cash Flow Conversion is defined as free cash flow divided by Adjusted EBITDA. Free Cash Flow and Free Cash Flow Conversion are key measures used by our management and board of directors to evaluate the Company’s ability to generate cash. Accordingly, we believe that Free Cash Flow and Free Cash Flow Conversion permit a more complete and comprehensive analysis of our available cash flows.

Non-GAAP Operating Expenses are our consolidated operating expenses adjusted to eliminate the impact of depreciation and amortization, equity awards compensation expense, pension service costs, and restructuring related and transformation costs. The Company uses Non-GAAP Operating Expenses to understand and compare operating results across accounting periods, for internal budgeting and forecasting purposes, for short-term and long-term operational plans, and to assess and measure our financial performance and the ability of our operations to generate cash. We believe Non-GAAP Operating Expenses reflects our ongoing operating expenses in a manner that allows for meaningful period-to-period comparisons and analysis of trends in our business. As a result, we believe that Non-GAAP Operating Expenses provides useful information to investors in understanding and evaluating our core operating performance and trends in the same manner as our management and in comparing financial results across periods. In addition, Non-GAAP Operating Expenses is a key component in calculating Adjusted EBITDA, which is one of the key measures the Company uses to provide its quarterly and annual business outlook to the investment community.

Please refer to the supplemental financial tables provided in the appendix of this press release for a reconciliation of Contribution ex-TAC to gross profit, Adjusted EBITDA to net income, Adjusted Net Income to net income, Free Cash Flow to cash flow from operating activities, and Non-GAAP Operating Expenses to operating expenses, in each case, the most comparable U.S. GAAP measure. Our use of non-GAAP financial measures has limitations as an analytical tool, and you should not consider such non-GAAP measures in isolation or as a substitute for analysis of our financial results as reported under U.S. GAAP. Some of these limitations are: 1) other companies, including companies in our industry which have similar business arrangements, may address the impact of TAC differently; and 2) other companies may report Contribution ex-TAC, Contribution ex-TAC margin, Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, Non-GAAP Operating Expenses or similarly titled measures but calculate them differently or over different regions, which reduces their usefulness as comparative measures. Because of these and other limitations, you should consider these measures alongside our U.S. GAAP financial results, including revenue and net income.

Forward-Looking Statements Disclosure

This press release contains forward-looking statements, including projected financial results for the quarter ending September 30, 2022 and the year ending December 31, 2022, our expectations regarding our market opportunity and future growth prospects and other statements that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially. Factors that might cause or contribute to such differences include, but are not limited to: failure related to our technology and our ability to innovate and respond to changes in technology, uncertainty regarding the scope and impact of the COVID-19 pandemic on our employees, operations, revenue and cash flows, uncertainty regarding our ability to access a consistent supply of internet display advertising inventory and expand access to such inventory, including without limitation uncertainty regarding the timing and scope of proposed changes to and enhancements of the Chrome browser announced by Google, investments in new business opportunities and the timing of these investments, whether the projected benefits of acquisitions materialize as expected, including the successful integration of our acquisition of IPONWEB, uncertainty regarding international growth and expansion (including related to changes in a specific country’s or region’s political or economic conditions), the impact of the invasion of Ukraine by Russia, including resulting sanctions, the impact of competition, uncertainty regarding legislative, regulatory or self-regulatory developments regarding data privacy matters and the impact of efforts by other participants in our industry to comply therewith, the impact of consumer resistance to the collection and sharing of data, our ability to access data through third parties, failure to enhance our brand cost-effectively, recent growth rates not being indicative of future growth, our ability to manage growth, potential fluctuations in operating results, our ability to grow our base of clients, and the financial impact of maximizing Contribution ex-TAC, as well as risks related to future opportunities and plans, including the uncertainty of expected future financial performance and results and those risks detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s SEC filings and reports, including the Company’s Annual Report on Form 10-K filed with the SEC on February 25, 2022, and in subsequent Quarterly Reports on Form 10-Q as well as future filings and reports by the Company. Importantly, at this time, the COVID-19 pandemic continues to have, and inflation and rising interest rates in the U.S. could have, an impact on Criteo’s business, financial condition, cash flow and results of operations. There are uncertainties about the duration and the extent of the impact of the COVID-19 pandemic.

Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this release as a result of new information, future events, changes in expectations or otherwise.

Conference Call Information

Criteo’s senior management team will discuss the Company’s earnings on a call that will take place today, August 3, 2022, at 8:00 AM ET, 2:00 PM CET. The conference call will be webcast live on the Company’s website at https://criteo.investorroom.com/ and will subsequently be available for replay.

- United States: +1 855 209 8212

- International: +1 412 317 0788

- France 080-510-2319

Please ask to be joined into the “Criteo” call.

About Criteo

Criteo (NASDAQ: CRTO) is the global commerce media company that enables marketers and media owners to drive better commerce outcomes. Its industry leading Commerce Media Platform connects 22,000 marketers and thousands of media owners to deliver richer consumer experiences from product discovery to purchase. By powering trusted and impactful advertising, Criteo supports an open internet that encourages discovery, innovation, and choice. For more information, please visit www.criteo.com.

Contacts

Criteo Investor Relations

Melanie Dambre, m.dambre@criteo.com

Criteo Public Relations

Jessica Meyers, j.meyers@criteo.com

Download the PDF for financial information