Think brand loyalty doesn’t exist anymore? Think again. Kind of.

In Criteo’s recent “Why We Buy” survey, we asked over 2,000 US and UK consumers what makes them keep coming back to brands – and what makes them look for a new company. We unpacked a lot of insights across social media, brand perception, and discovery.

Here are five major takeaways from the research:

1. Brand loyalty is up for grabs.

Our research shows that nearly 3 out of 4 people (73%) in the US are willing to consider a new brand in at least one major shopping category, including apparel, consumer electronics, home and garden, sporting goods, health and beauty, accessories, groceries, books and stationary, and jewelry and luxury goods. This percentage is a bit lower in the UK, but it’s still a major portion of consumers.

And it makes sense. With the rise of direct-to-consumer brands (think Warby Parker, Away, Casper, Birchbox, and Everlane), shoppers may be more open to taking a chance on companies they’ve heard positive things about but haven’t yet tried.

2. Brand values matter.

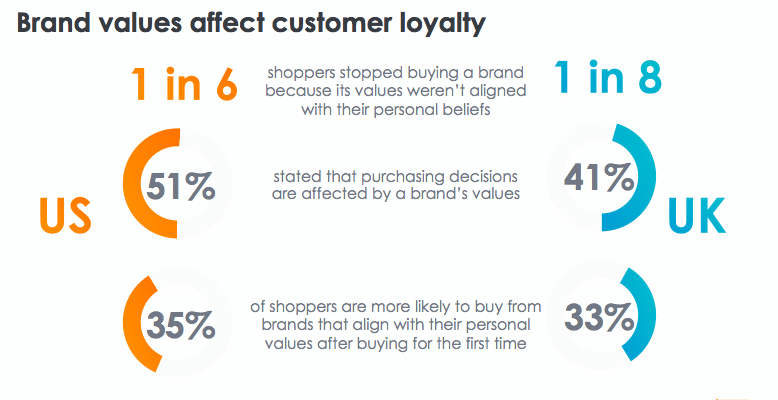

Everyone knows that if your quality or value declines, you’ll lose business. Our “Why We Buy” research revealed something much more interesting — that brand values are also highly influential:

- We found that 1 in 6 shoppers from the US stopped buying a brand because its values weren’t aligned with their personal beliefs. In the UK, that number is 1 in 8.

- We also found that 51% of US shoppers and 41% of UK shoppers say their purchasing decisions are affected by a brand’s values.

- Lastly, more than 30% of shoppers in the US and the UK are more likely to return to brands that align with their personal values.

One thing is clear: In an age of transparency, shoppers are paying more attention to the mission and the values of businesses.

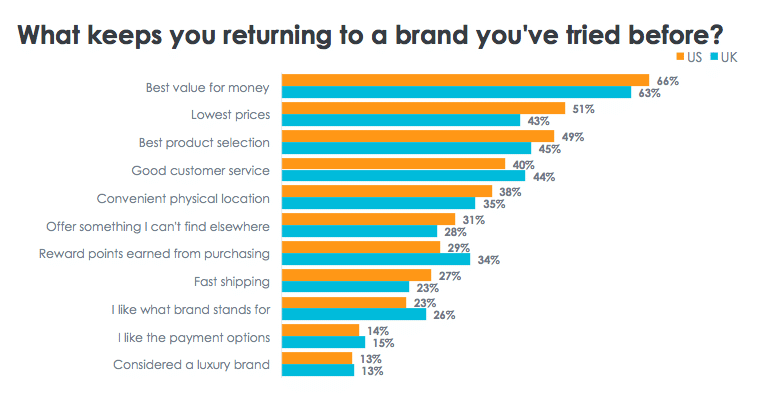

3. Loyalty depends on more than just low prices.

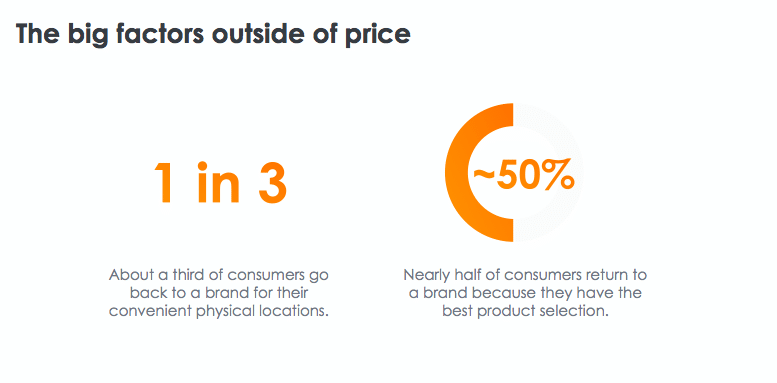

While our survey found that, yes, consumers do like getting the best value for their money and they love a good deal, there are many other reasons they stay loyal to a brand. Consumers appreciate a great product selection, great customer service, convenient store locations, and fast shipping.

About a third of US and UK shoppers go back to a brand for their convenient store locations. Nearly half of US and UK shoppers return to a brand because they have the best product selection.

This just goes to show that rock-bottom prices aren’t everything, and physical retail is far from dead. In fact, it may have a big impact on customer retention.

4. Brand discovery is omnichannel.

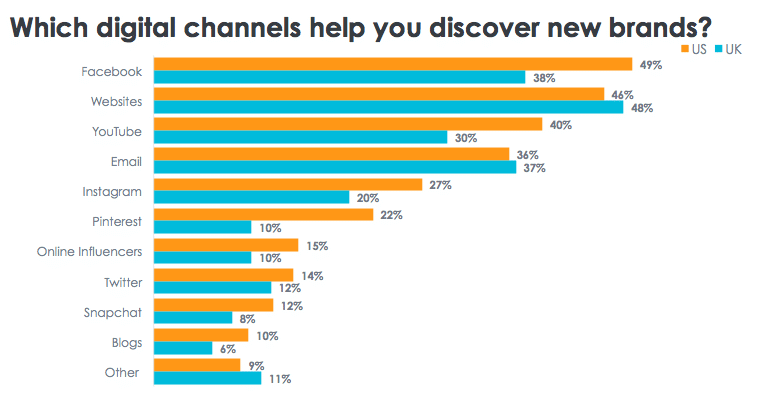

While Facebook was the #1 discovery channel for US shoppers in our survey, websites came in second. And for UK shoppers, websites ranked #1. These are followed by YouTube, email, and Instagram.

Conclusion? Consumers really do still explore across the board when looking for new brands and aren’t simply sitting idly by inside of social and search environments.

5. Relevance makes a difference.

When we asked US shoppers, after you try a new brand for the first time, what factors make you want to buy from that company again? 60% said getting a discount that’s personalized and relevant to them. The same goes for 49% of UK shoppers.

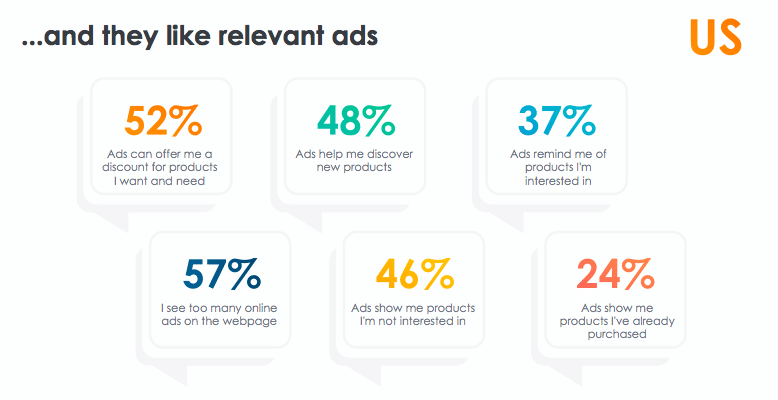

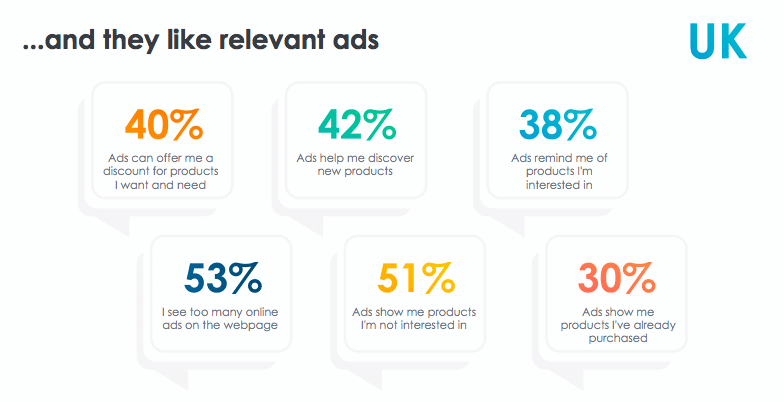

We also asked shoppers how they feel about online advertising. Many of the positives go back to relevance.

Our US respondents said they like that online ads can:

- Offer discounts for products (52%)

- Help them discover new products (48%)

- Remind them of products they’re interested in (37%)

But people dislike when online ads:

- Are too prevalent no the webpage (57%)

- Show products they’re not interested in (46%)

- Show products they’re already purchased (24%)

These numbers are very similar for UK shoppers.

What’s clear is that consumers are open to receiving ads. As long as they’re relevant.

Achieve more on the Open Internet.

As our study shows, websites themselves are top channels for new brand discovery, and relevance matters. To ensure you’re reaching your entire audience across channels, it’s crucial to deliver hyper-relevant ads, and to balance your investments in search and social channels with ads on the Open Internet.

Criteo defines the Open Internet as all those websites across publishers, retailers, and brands that aren’t behind walled gardens.

- Consumers spend 50% of their time online on the Open Internet, but marketers are investing more in search and social walled gardens.**

- Ad spend captured is 70% on Facebook/Google and 30% on the Open Internet, but actual time spent by consumers is 50% on each.**

This leaves a lot of opportunity on the table. Not only is the Open Internet a win for consumers, it’s a win for marketers by offering more ways to engage with your audience and different placements to connect with them in meaningful ways.

For more, check out our Customer Lifetime Value UK study, and download our Smart Marketer’s Guide to Customer Loyalty:

*Sources: Criteo “Why We Buy” Survey, US, February 2019, n=1003 and Criteo “Why We Buy” Survey, UK, March 2019, n=1020.

**Based on Nielsen US DCR trends, eMarketer, ExchangeWire, IDC