More than two years into the COVID pandemic, it’s safe to say that the work from home (WFH) phenomenon is here to stay. The emergence of this home-based workforce doesn’t just affect workplaces, but also consumption patterns.

To understand how this new group of consumers differs from non-WFH consumers, we analyzed data from over 49,600 global survey respondents, about a fifth of whom say they worked primarily from home between April and December 2021.1 When paired with our new Shopper Story report, which analyzed the results from multiple Criteo surveys across more than 17,000 respondents globally and unpacked commerce data from our 22,000 advertiser clients worldwide, we get a unique and holistic view of the 2022 WFH consumer. Here’s what you need to know about this new and powerful audience:

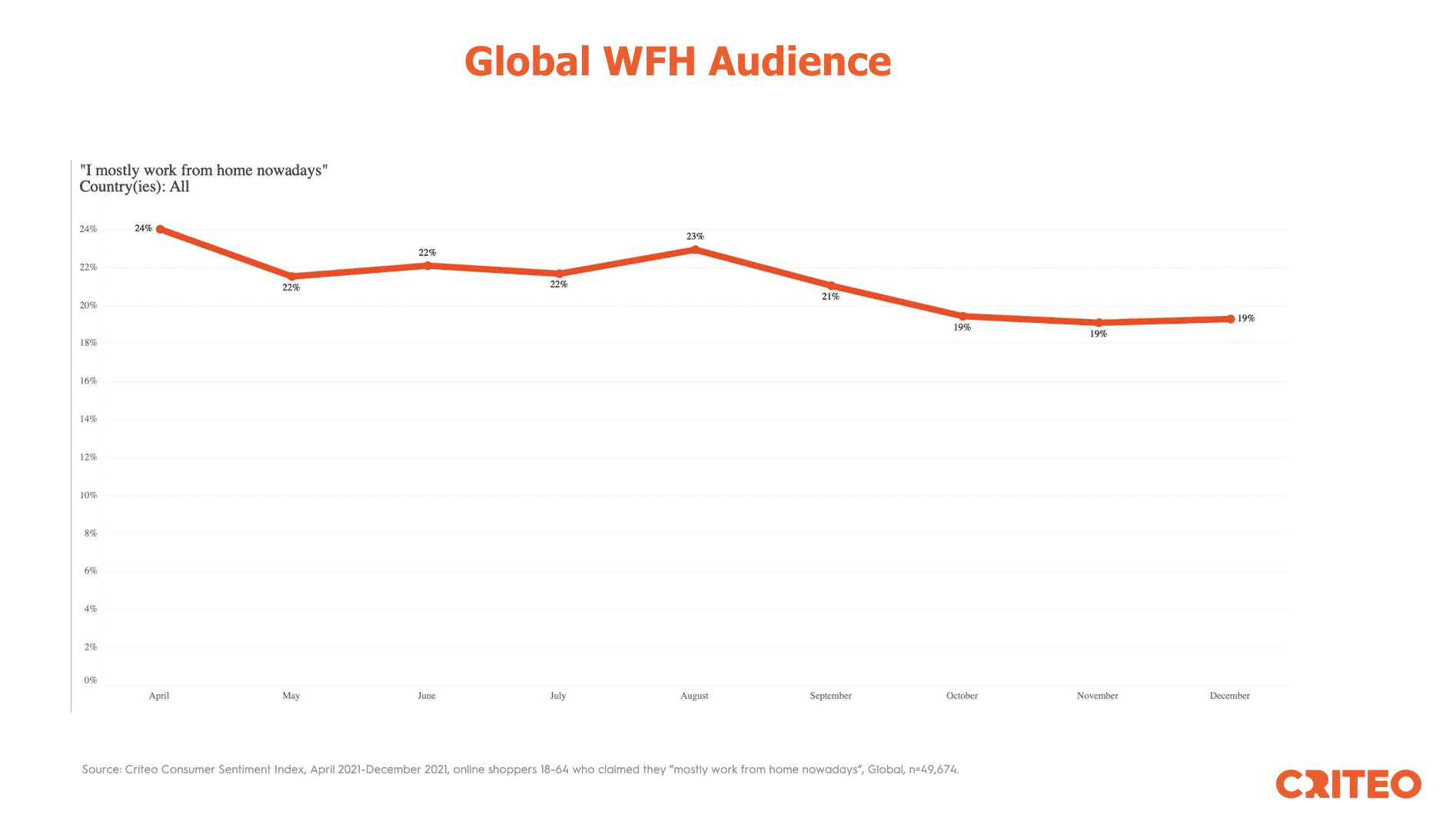

A fifth or more of global workers primarily work from home

According to our survey, home workers accounted for about a fifth (19%) of global consumers in Q4 2021. In the US, 22% identified themselves as home workers, and in the UK, more than a quarter (26%) of respondents were primarily working from home. Although our latest survey wave took place between December 2 and 9, when the Omicron variant was already making headlines, it didn’t yet show a significant uptick in the proportion of global workers working from home.

Global WFHers have a unique demographic profile

Survey results showed that the work from home group tends to be slightly younger (-1.2 years on average). Millennials account for 38% of all WFHers (against 35% for the rest of the population), making those between 25 and 38 the dominant contingent of the WFH workforce around the world.

In the US, WFHers are 2.3 years younger than non-WFHers, and Millennials account for 43% of the total (vs 34% for non-WFHers). In the UK, Millennials make up 38% of the WFH group.

According to the global findings, 19% of women work from home and 51% of people working from home have children (vs 46% of non WFHers). In the US and UK, men have a higher propensity than women to work from home: over a quarter of men (26% in the US, 28% in the UK) are WFHers, against about a fifth of women (21% in the US, 23% in the UK). More American WFHers also tend to have children at home (61%, against 46% for others).

Knowing that the work from home group skews slightly younger and male and is likely to have children, marketers can optimize both their targeting and messaging for this audience.

WFHers have more purchasing power and buy more discretionary items

Because of the varying currencies, identifying a global trend is difficult, but our data shows that in both the US and UK, the work from home group’s purchasing power is significantly above average.

Two-thirds of American WFHers (67%) live in households earning at least $50,000 per year, against 52% for shoppers not working from home.

In the UK, 62% of home workers live in households earning at least £38,000 per year, compared to 44% among the non-WFH base.

As can be expected from higher-income consumers, they tend to purchase more discretionary items than average. The fact that this groups stays at home more than others also leads them to purchase more video games and home appliances than the non-work from home group.

Globally, WFHers bought more cosmetics (43% vs 40%), books & movies (37% vs 33%), home appliances (28% vs 24%), consumer electronics (27% vs 24%), and video games (28% vs 24%).

American WFHers bought more alcohol (53% of WFHers bought some in the last month, compared with 49% of non-WFHers), cosmetics (41% vs 37%), and cultural goods (32% vs 27%). Those working from home in the UK also bought more alcohol (62% of WFHers bought some in the last month, compared with a 59% average), as well as more home appliances (26% vs 21%), and books & movies (31% vs 28%).

Clearly, the WFH audience is a highly valuable one, and a group willing to spend on home, beauty, and entertainment at higher rates than those that don’t work from home. This knowledge, combined with the demographic profile detailed above, gives marketers a strong direction for how best to engage work from home consumers.

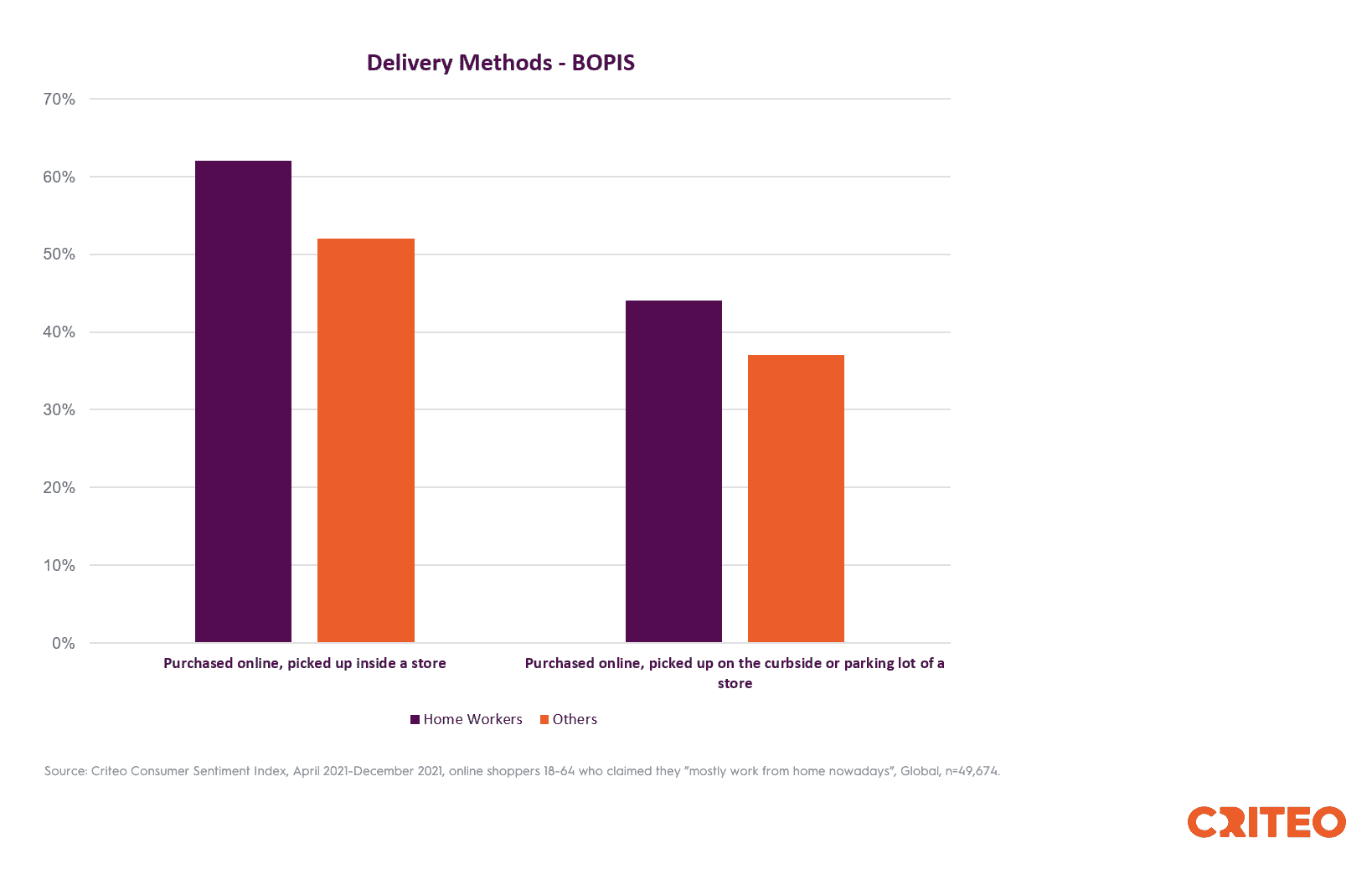

WFHers are also at the vanguard of new delivery methods

More than 6 out of 10 (62%) WFHers globally have purchased online and picked up the merchandise inside a store (vs just 52% of non-WFHers), and 44% have picked up goods purchased online on the curbside or parking lot of a store (against 37% of non-WFHers).

This share is even greater in the US, where over seven out of 10 (71%) WFHers have purchased online and picked up the merchandise inside a store (against only 59% of non-WFHers), and close to seven out of 10 (68%) picked up goods purchased online on the curbside or parking lot of a store (against 61% of non-WFHers).

Based on this data, including the availability of BOPIS and curbside pickup in ad messaging can be an important tool for connecting with this audience.

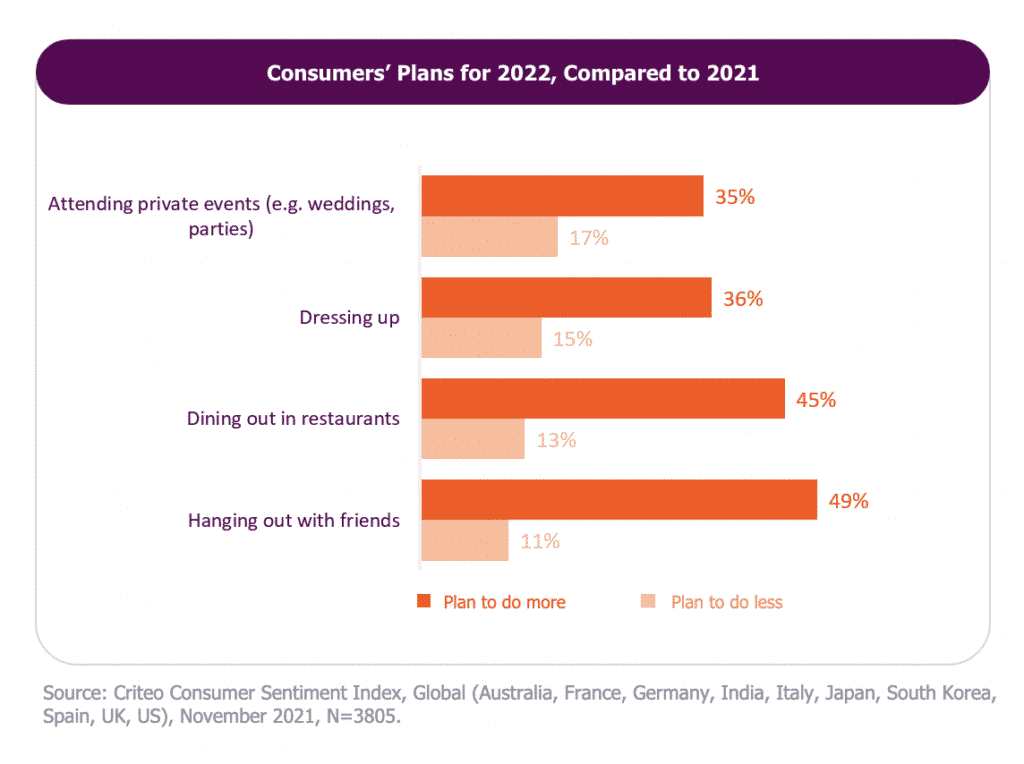

WFH or not, everyone is eager to get out there

Those who work at home have distinct shopping behaviors, but when it comes to finally getting our social lives back on track, everyone is on the same page. Our Shopper Story report found that over one-third of survey respondents expect to have more occasions to get dressed up in 2022, like weddings and parties, than they did in 2021. About half (49%) plan to get together with friends more often.2

To prepare for more real-world adventures, consumers are stocking up on look-good, feel-good products. In the US, sales of party-ready items like dance dresses and earrings were up significantly this past summer,3 and sales of beauty and wellness products like perfume & cologne and shaving cream also spiked this past fall.4

Engage WFHers with commerce media

The insights detailed here show that the work from home audience is still buying for their new at-home lifestyle but they’re also ready to step out in the world, and they’re savvy when it comes to new ways to purchase and pick up items.

With commerce media, marketers can leverage large scale commerce data and AI to understand audiences like this and reach them across the open internet with products in the categories and at the price points that they’re most likely to be interested in.

For more consumer trends, download our report:

1Source for WFH data: Criteo Consumer Sentiment Index, April 2021-December 2021, online shoppers 18-64 who claimed they ”mostly work from home nowadays”, Global=49,674, US=7,840, UK=6,181

2Source: Criteo Consumer Sentiment Index, Global (Australia, France, Germany, India, Italy, Japan, South Korea, Spain, UK, US), November 2021, N=3805.

3Source: Criteo Data, US, based on total web sales August 2021 compared to August 2020.

4Source: Criteo Data, US, based on total web sales September 2021 compared to September 2020.