- The unprepared are in the minority

- More brands need to employ a mix of alternative solutions to prepare for the future of advertising

- Retailers are prioritizing offsite monetization despite deprecation

- Publishers are doubling down on first-party data and diversifying revenue streams

- The open web will continue to be a key driver of scale and reach

- What else do brands, retailers, and publishers think about the future of advertising?

In January, Google deprecated third-party cookies for 1% of Chrome traffic. Because Google Chrome represents 63% of open internet traffic, this brings a heightened sense of urgency to the marketplace to shift to viable alternatives to third-party cookies.

It’s important to note that the full deprecation of third-party cookies on Chrome depends upon a 5-month testing period and an evaluation of test results by the UK’s Competition and Markets Authority. No further deprecation will happen without the CMA’s approval to do so, and the timeline is subject to change based on their ruling.

Testing results aside, as we approach this milestone and the potential of a new modus operandi for digital advertising, we wanted to better understand the level of preparedness across the ecosystem. To that end, we surveyed more than 1,000 leaders at brands, retailers, and publishers across the US, Europe, and Northeast Asia. Here’s what we discovered.

The unprepared are in the minority

All players are prepared for the deprecation of third-party cookies on Chrome to some degree. Seventy-six percent of brands and 68% of retailers globally say they are somewhat or extremely ready. US brands and retailers had the highest levels of preparedness (83% and 74% were somewhat or extremely ready, respectively) followed closely by Europe. Publishers, who will face the largest impact, feel the least ready, with 47% rating their readiness as ‘neutral’ or ‘not sure’ and 15% saying they are ‘somewhat unprepared’.

In the minority? Get up to speed on how to prepare at addressability.info.

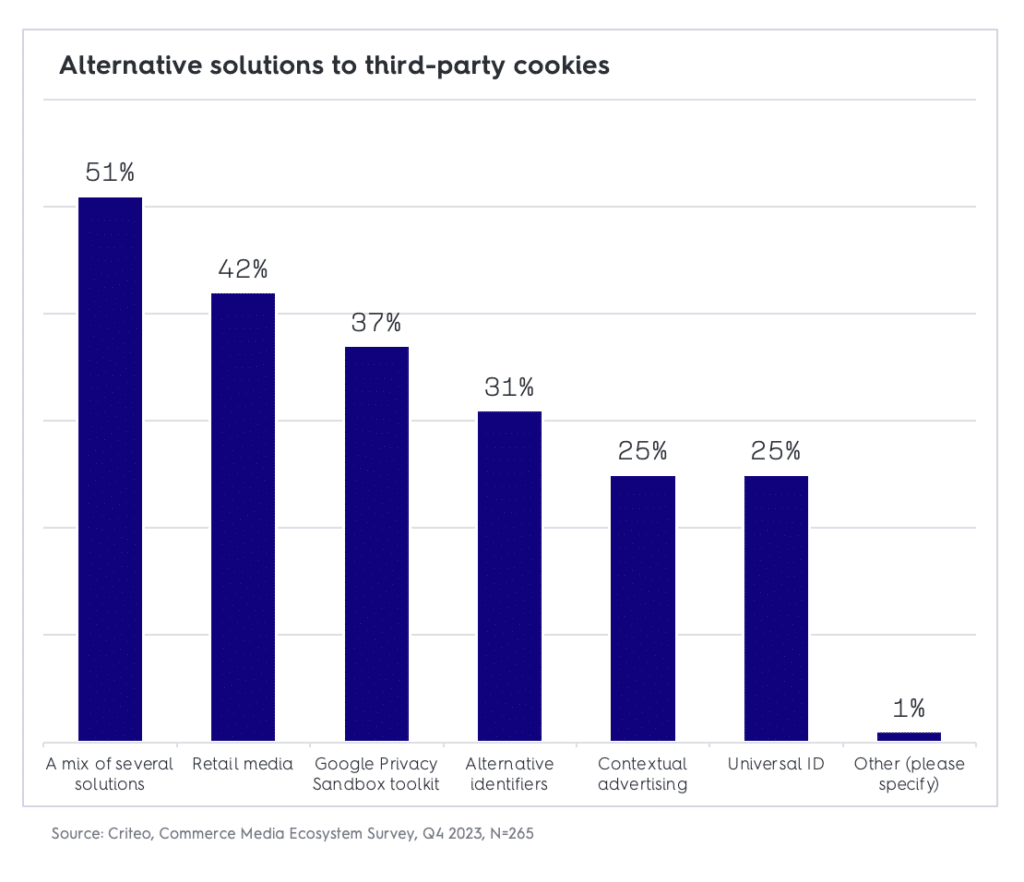

More brands need to employ a mix of alternative solutions to prepare for the future of advertising

Though a majority of brands say they are prepared for deprecation, our survey findings showed that only half of brands globally are taking a diversified approach: 51% said they plan to invest in a mix of solutions once third-party cookies are deprecated. Those that prioritize a mix of addressability solutions stand to fare better in terms of scale and performance.

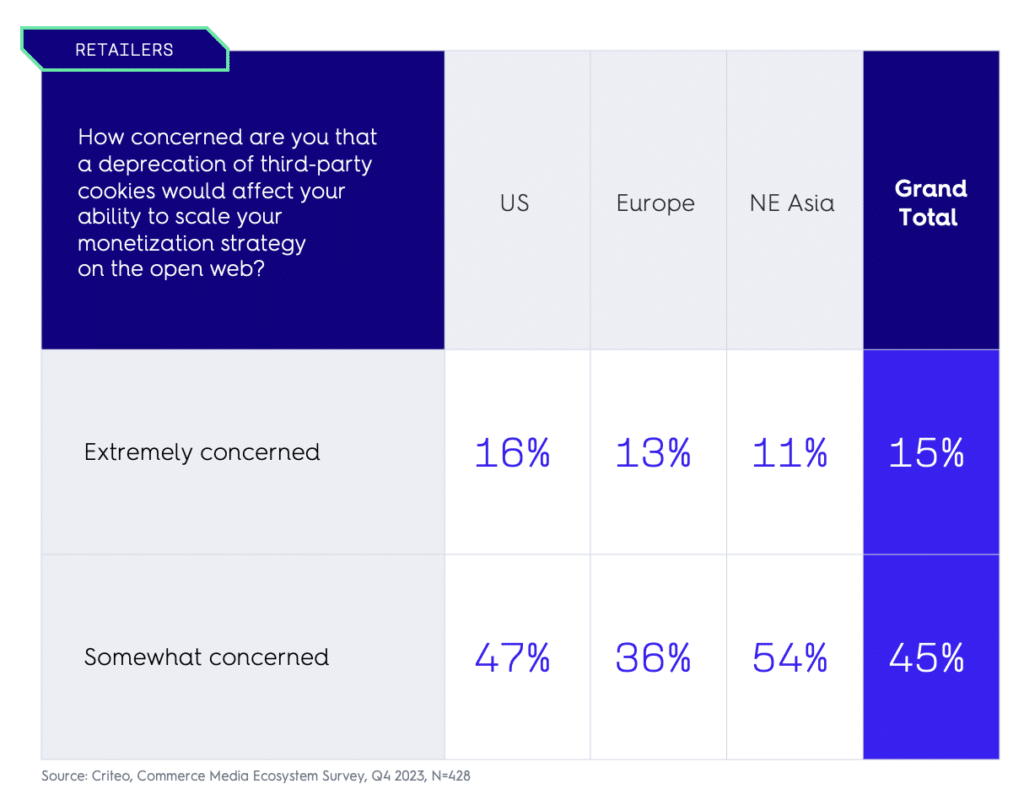

Retailers are prioritizing offsite monetization despite deprecation

Retailers that have a retail media offering are likely to see onsite growth in the post-cookie world, thanks to their wealth of first-party data and owned inventory. However, one area where third-party cookie deprecation could have an impact is in offsite monetization (engaging retailer audiences across the open web).

Though a majority of retailers worldwide are somewhat worried about the effect of cookie deprecation on their ability to scale monetization on the open web, it’s not stopping them from moving forward with retail media offsite. Half plan to offer offsite to help meet 2024 objectives, and half also believe that it will be a key area of growth for retail media. Maximizing coverage and performance from this additional revenue stream for retailers will come down to finding the right mix of addressability solutions.

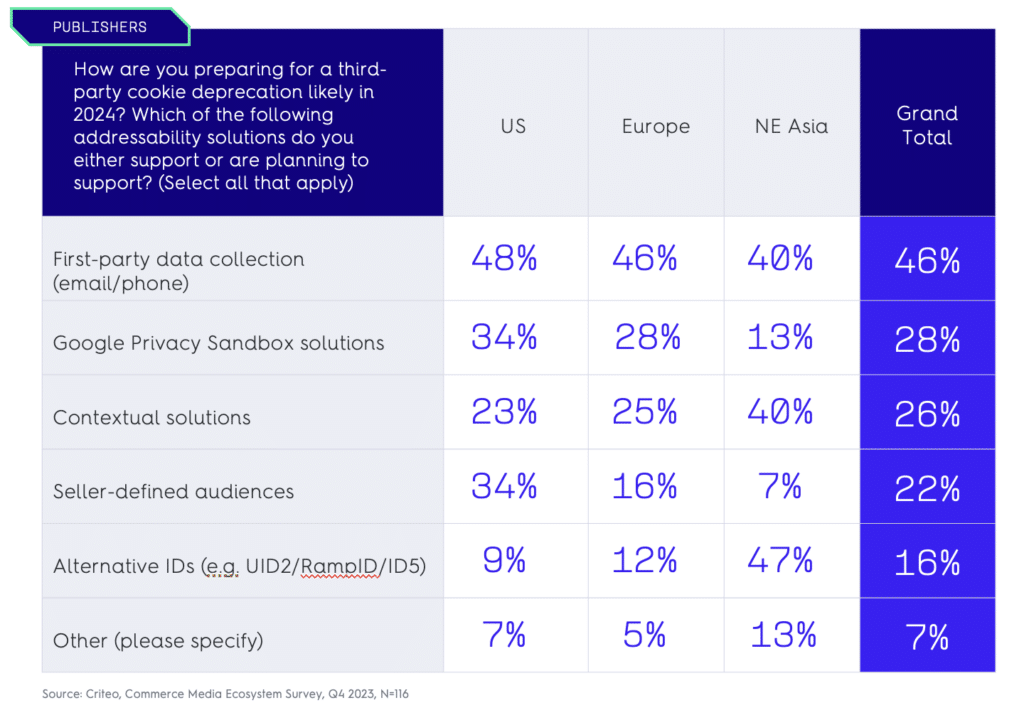

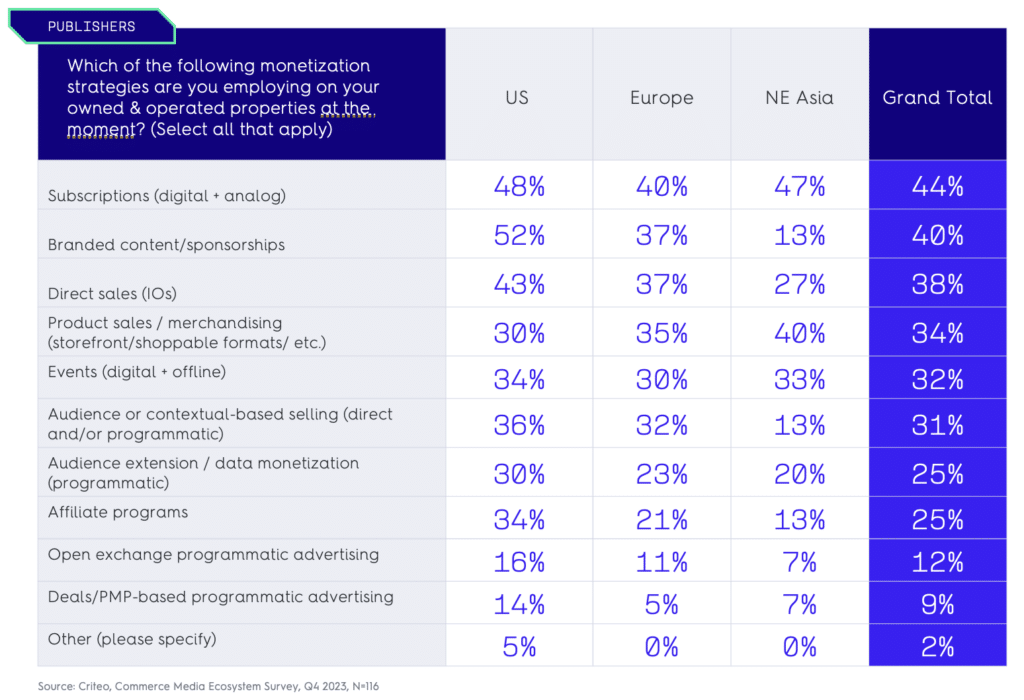

Publishers are doubling down on first-party data and diversifying revenue streams

Publishers will feel the effects of cookie deprecation most keenly but are prioritizing first-party data and new revenue streams to mitigate the impact.

Publishers understand the value of a first-party data strategy, especially with cookieless on the horizon. The biggest share selected ‘first-party data collection’ as their addressability solution. More than a third in the US and one fourth globally also plan to support Google Privacy Sandbox and Seller-Defined Audiences, which presents another way for publishers to maximize their first-party data strategies.

From a monetization perspective, more than four in 10 publishers globally are already leveraging subscriptions. More than a third of publishers globally are monetizing through product sales such as shoppable formats, and a quarter through audience extension/data monetization.

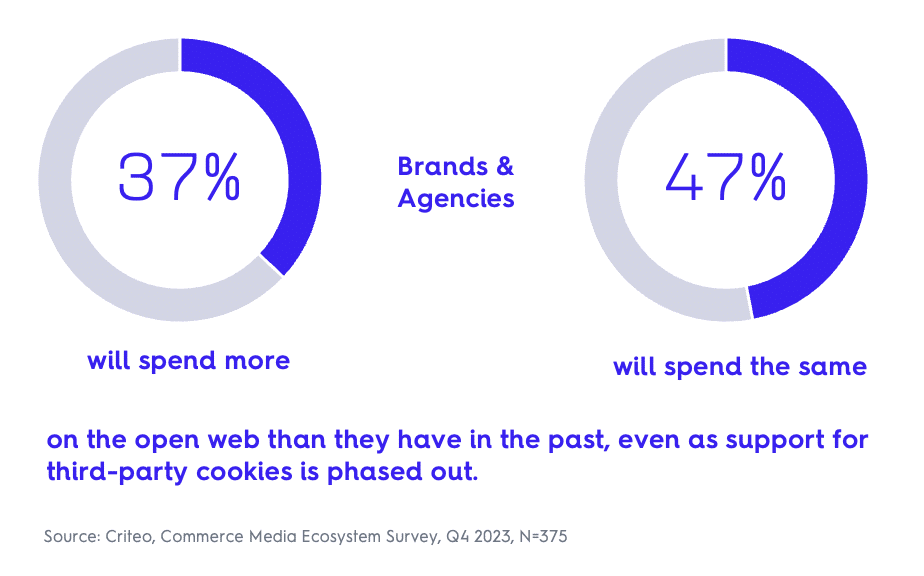

The open web will continue to be a key driver of scale and reach

A significant share of brands, agencies confirmed that efforts focused on the open web will be sustained. 37% of brands and agencies globally say they will spend more on the open web than they have in the past, even as support for third-party cookies is phased out. Almost half (47%) will spend the same.

And it makes sense: Combining commerce data with open web inventory will be critical for advertisers looking to achieve cross-channel scale and reach in the addressable future, while creating new revenue drivers for publishers.

What else do brands, retailers, and publishers think about the future of advertising?

Explore more insights from our global survey of more than 1,000 commerce leaders in The Great Defrag report. Click below to download!