When it comes to travel, what makes people loyal? Do travel loyalty programs actually work? At Criteo, we wanted to know what factors compel people to return to certain providers (and what makes them leave). In our new survey, “Global Travel & Loyalty Programs”*, we asked over 4,000 travelers across the US, UK, and APAC to find out. Here were the top findings.

1. Travel loyalty programs are working… sort of.

Overall, respondents in the survey are extremely satisfied: 82% say they enjoy travel loyalty programs, and 81% value the rewards they get. Three out of four (76%) understand very well the value they get from air miles and hotel points, and 72% enjoy perks going beyond just discounts (even if 73% say free flights/nights remain a crucial reason for signing up).

But while travel loyalty programs appear to be somewhat effective (79% of respondents mentioned loyalty programs as a main reason for choosing specific airlines or hotel brands), problems remain. More than 1 in 4 (27%) often forget they signed up to a loyalty program, and 28% sometimes opt out because they get too many emails.

2. Young travelers don’t think about travel loyalty (yet).

Only 25% of respondents in the 15-24 age bracket are members of a loyalty program (Airline/Hotel/Rail), compared to 43% in the 65+ age bracket. Almost half forget they have signed up for a loyalty program, and therefore don’t benefit from it.

For Millennials and Gen Z, traditional loyalty programs are no longer enough. Our research shows that for them (and many others), customer loyalty depends on more than just prices.

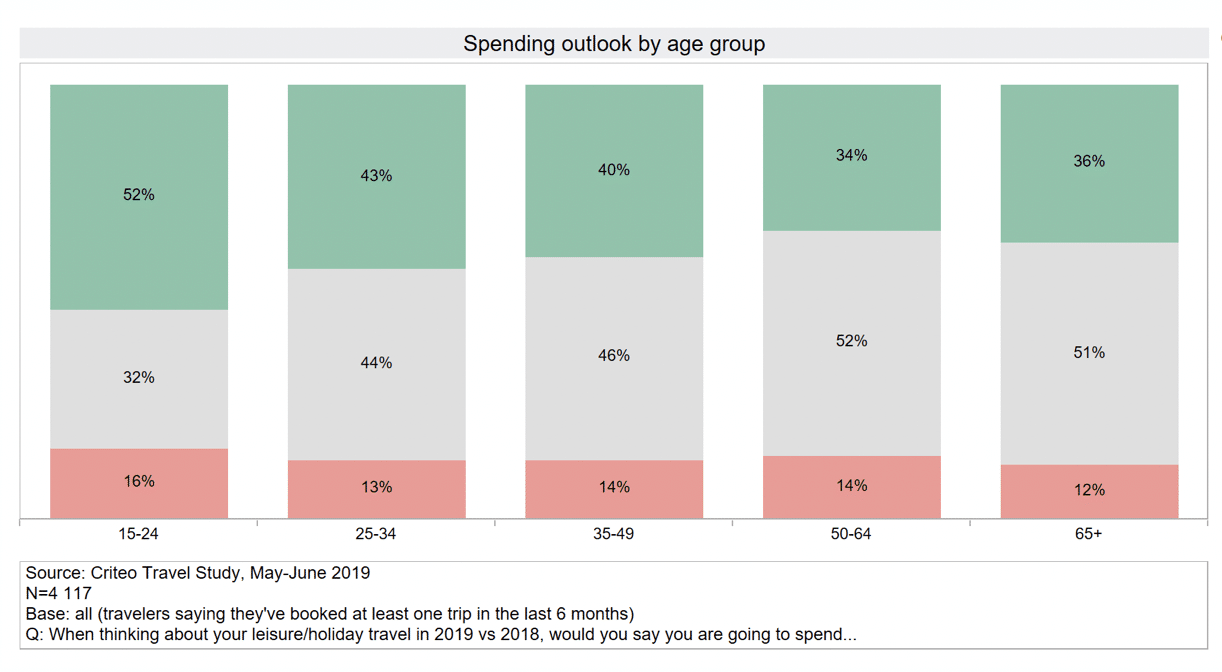

3. Gen Z and Millennials are the biggest opportunity.

Of the respondents we surveyed, 15-34 year olds plan to increase their travel budget significantly. So, even though many aren’t part of a loyalty program – or may not know they’re part of one! – this is a core demographic for growth for any travel company.

To capture more travel spend, travel providers should think outside the discount box and look for ways to drive engagement with consumers beyond a good deal. Showering young people with rebates on meals and seats might drive incremental sales for one holiday, but loyalty in the long run is more nuanced.

4. Travel loyalty varies by region.

“Loyalty programs” and “brand loyalty” have very different meanings depending on the region. The market penetration of travel loyalty programs vary drastically:

-

In the US, Americans love loyalty.

- 46% of respondents subscribe to at least one Loyalty Program in the United States. That number drops to 23% in the United Kingdom. Additionally, 24% of US respondents with an income of under $20,000 belong to a travel loyalty program. This drops to 13% for low income households in the UK.

-

In APAC, younger travelers are into loyalty.

- Here loyalty programs are more among the young generation. 84% of people ages 15-34 like them, compared to 79% of those 65+.

-

In the UK, older travelers like loyalty.

- While loyalty programs are less popular among the younger set (only 16% of those aged 15-34 in the UK participate), loyalty programs have found their audience in the 50-64 age bracket (89% of English travelers enjoy loyalty programs).

5. User-friendliness drives loyalty.

Our research shows that the success of loyalty programs hinges not on deals, but rather on ease-of-use and familiarity.

When booking directly with an airline, a hotel or a train company, the two most important factors our respondents cited were user-friendliness (it is “easier”) and force of habit (“I am used to booking this way”). Being a member of a loyalty program is still a factor for booking with a specific airline (35% agree). However, that factor becomes significantly less important when it comes to Hotels (26%), OTAs (17%), or Trains (14%).

The hottest destination in 2019 is relevance.

The future of the travel industry depends on much more than traditional, points-based loyalty programs. To win more bookings and build strong customer relationships (especially with Gen Zers and Millennials), travel players should prioritize delivering on relevance, from ads and email comms to frictionless, memorable customer experiences.

Want more loyalty research? Our “Why We Buy” survey revealed surprising insights into modern consumer shopping behavior. Download the guide below:

*Source: “Why We Book”, Criteo Travel Study, May-June 2019, N=4117.