With the rapid spread of coronavirus and government-imposed travel restrictions being exercised around the world, the travel industry is in the midst of one of its toughest periods to date. What makes this situation especially difficult is that the impact is being felt across the entire ecosystem and not just one component.

In addition, travel brands and marketers face a dilemma when balancing health precautions and building a travel experience with their consumers. This presents an unprecedented challenge for an industry so ingrained in our lives.

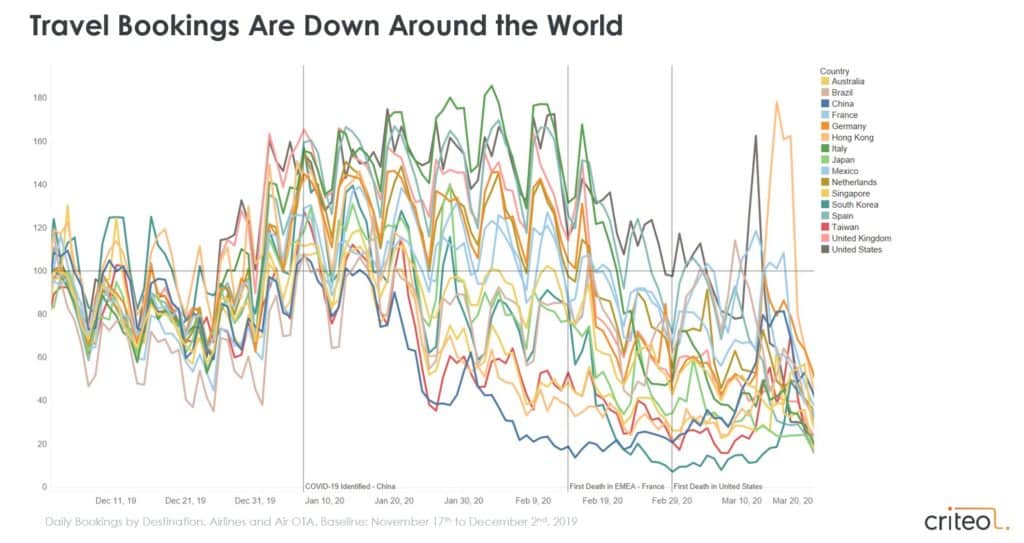

At Criteo, we work with numerous brands, partners, and other businesses within the travel sector. In order to help our advertising partners and others in the industry better understand the impact of the coronavirus and travel restrictions, we tapped into our dataset of 20,000 clients to break down travel booking patterns across the world.

We hope these findings can help businesses in the travel space understand what to expect and help marketers adapt their plans and strategies in the wake of the coronavirus outbreak. The impact has been fluid since the initial outbreak and we have seen traveler tendencies shift almost daily since.

Below, you will find a series of global destination trends our data Integrated Marketing & Analytics team has prepared with the latest data:

Global Travel Trends in Q1 2020

Countries in the EU as well as the US are nearing the same 25% index bottom that was seen in China and Taiwan from Feb. 9 to March 9. More recently, we saw a similar pattern from February 19 to March 16 in South Korea.

As we get closer to the summer months, it will be interesting to see the change in different regions after observing a four-week decline in Asia, where the outbreak first spread.

Bookings in Europe Drop After EU Travel Ban and Global Travel Restrictions

The EU’s drop in bookings occurred at a slower place than it did in the US.

Each country measured here, except for Germany, appears to be in the 25-30 index range that Asia experienced during its peak in cases. With the EU restricting inbound travel on March 16, we expect to see a similar trendline soon.

The Decline in Americas Bookings

Traveler anxiety really began to take hold during the week of February 9, two days after the first case of coronavirus in the US was announced.

A +13% YoY uptick was anticipated for the month of February, largely driven by those booking Spring Break travel.

Over the past two weeks,we’ve seen a much quicker drop in bookings in the US and Latin America, contrary to the slower downward reaction experienced in Asia and more recently in EU. We suspect a large number of state-led ‘shelter-in-place’ orders and lockdowns, as well as the inbound EU restriction on March 12, have led to a sharper decrease in the US and LATAM.

Understanding the Trajectory

While we continue to monitor travel activity and work together to understand the impact of the coronavirus and shutdowns in different regions around the world, it’s important to recognize how collaborative and generally positive people have been:

- Monitoring global trends like these can give us clues into recovery times for travel in impacted areas

- Being open and collaborative as partners can help bring about a quicker resolution to an industry-wide challenge

- Consumer travel behavior will change in the future – so thinking about how to engage people the right way when the time is right

It’s not uncommon to see people come together in the face of adversity and this situation with regards to COVID-19 has been no different. In speaking with internal teams at Criteo, partners, and clients alike, there has been a clear interest in sharing with one another and a willingness to work together that we think will benefit the industry once things begin to normalize.

We appreciate everyone’s collective effort and positivity surrounding such tough set of circumstances and we will continue to do our part and help in any way we can.