A year of upheaval and change has made this end-of-year shopping season a bit of a question mark. To add some certainty to an uncertain time and help marketers prepare, we analyzed our traffic and sales data from more than 600 product categories and thousands of retailers from 20 countries around the globe. We also surveyed more than 20,000 consumers worldwide to learn more.

Here’s what we discovered about what people bought last year, what’s trending in 2020, and what shoppers plan to buy in the weeks ahead.

2019’s Hot Peak Shopping Season Products

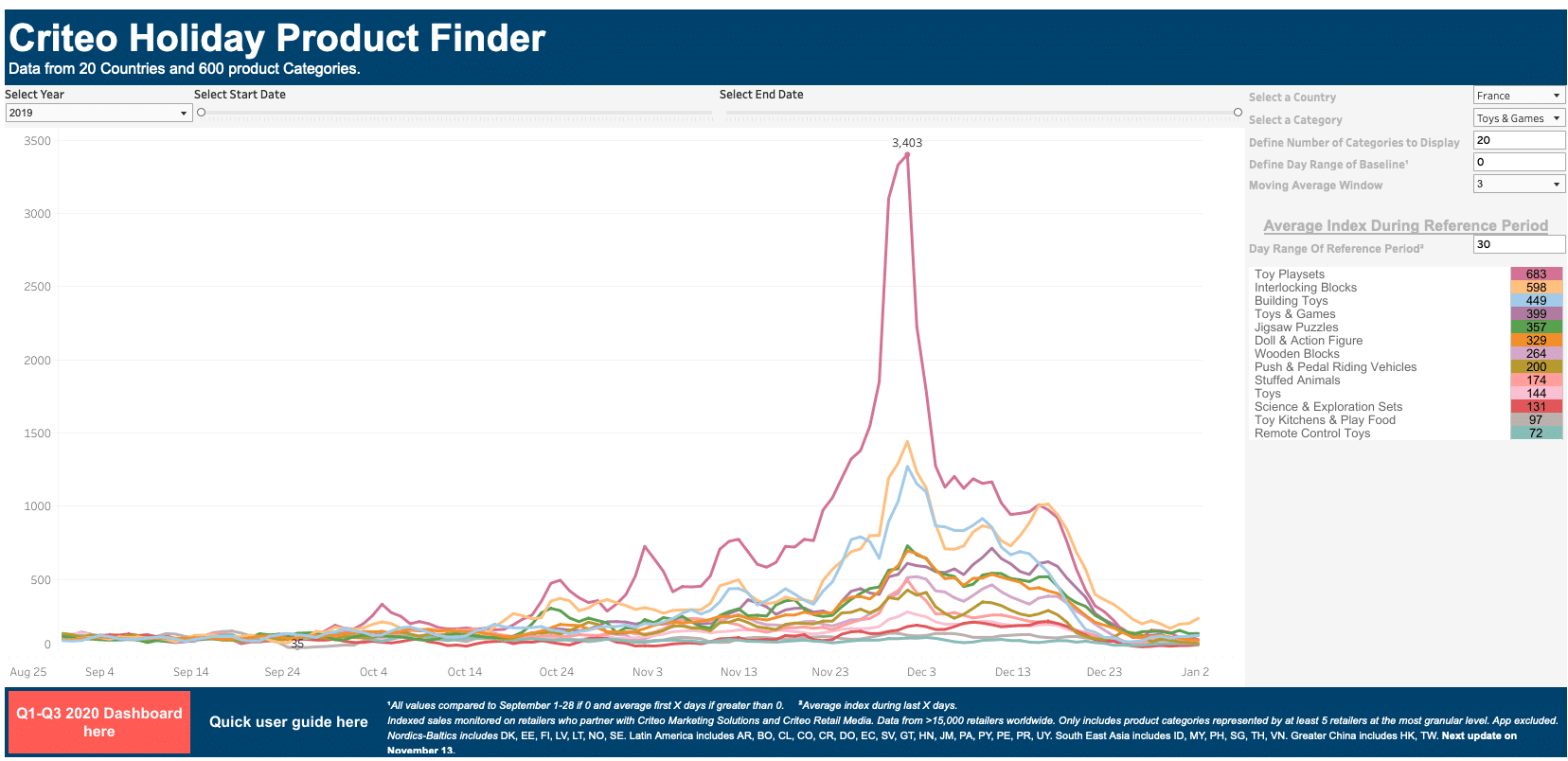

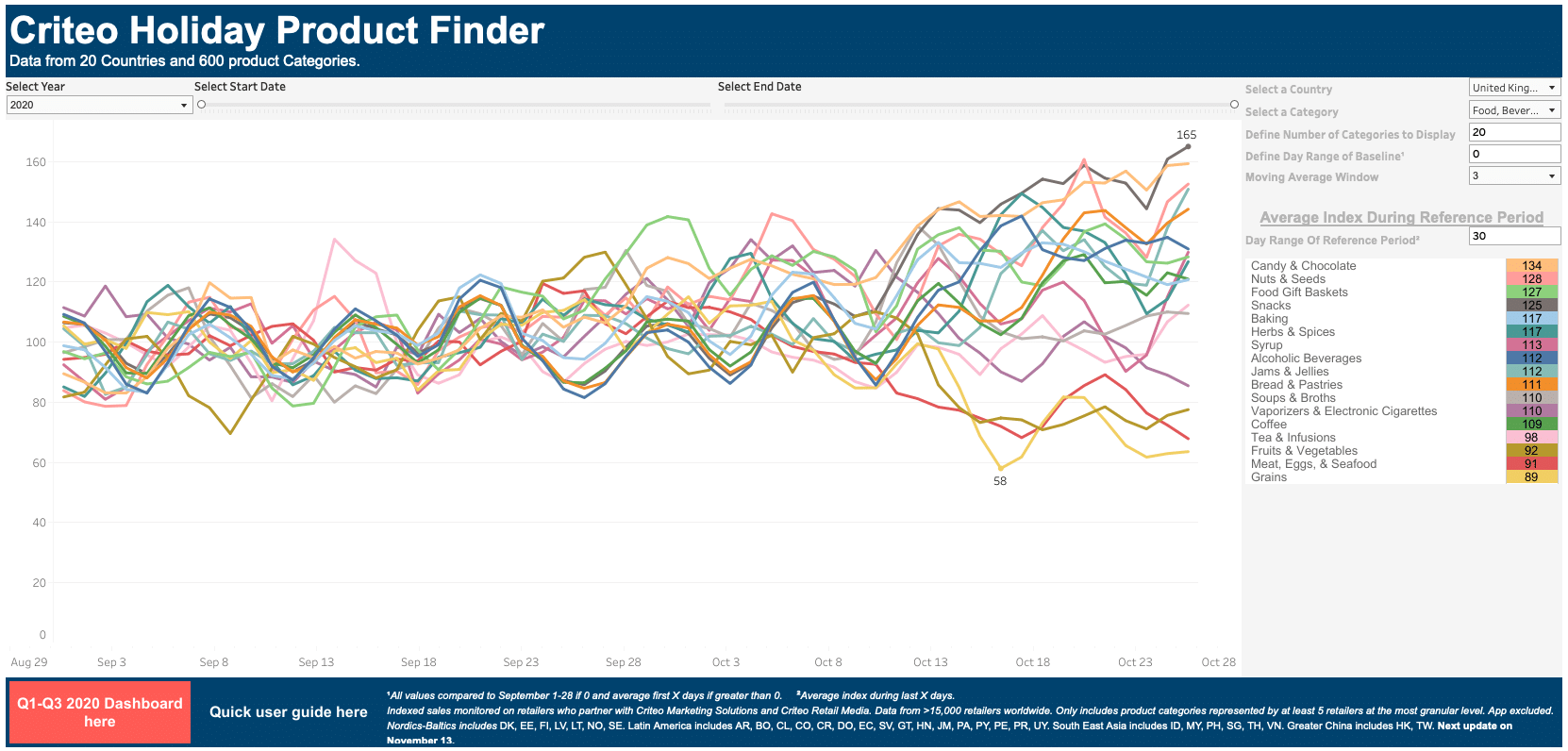

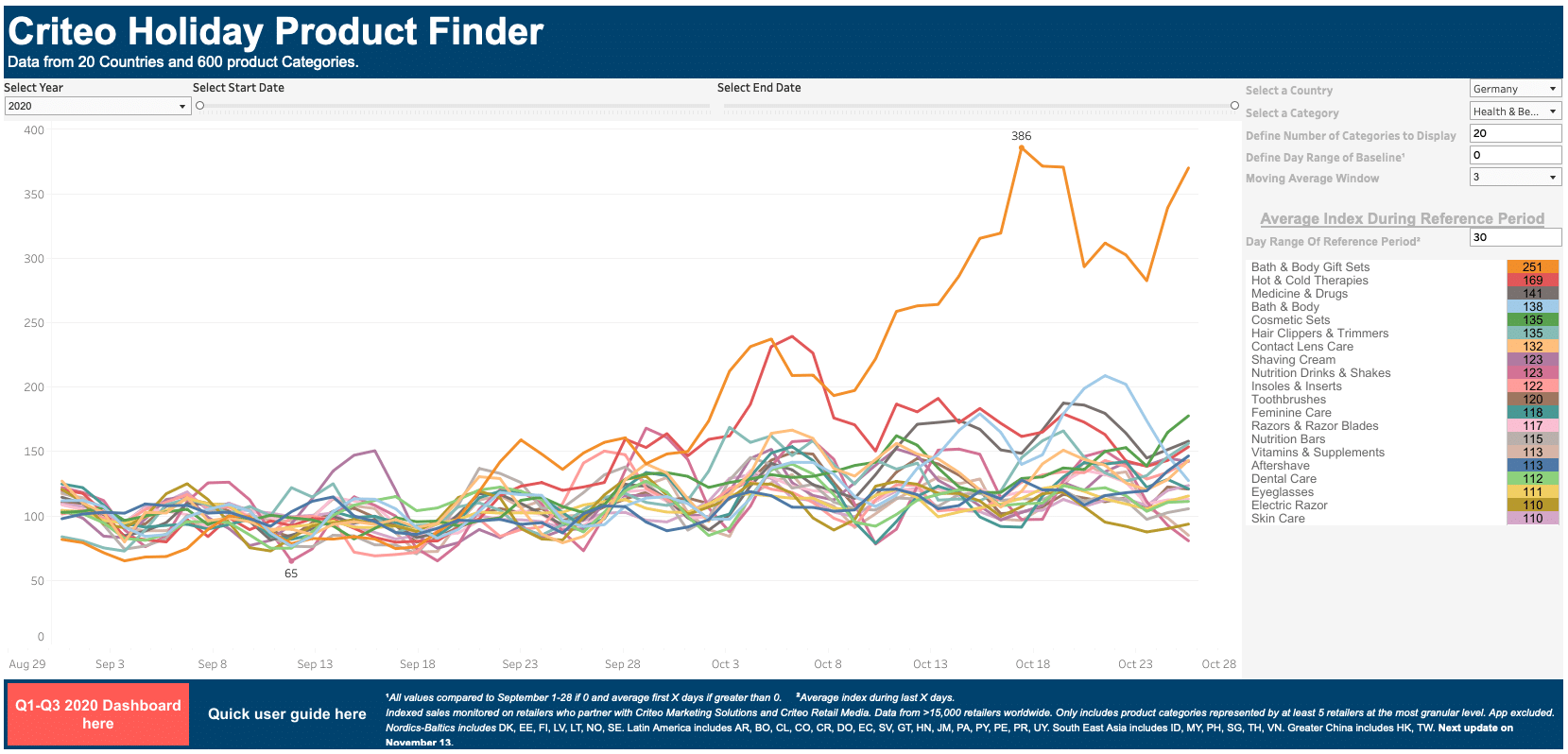

Though it’s a year unlike any other, a quick look backward can help provide some benchmarks. That’s why we built the Criteo Holiday Product Finder—to give every business access to the same data we’re seeing so they can plan their marketing with the most informative insights possible. We reviewed a few top product categories to see what shoppers were buying most last holiday and festive season:

Toys & Games

In France, toy playsets were up an astounding +2403% in early December 2019, compared to first four weeks of September 2019. In the US last year, puzzles reigned supreme, up 1,300 points at its peak in early December 2019. Science sets, toy playsets, and blocks were also big sellers. In Japan, Toy Kitchens & Play Food shot up to +454% in sales in mid-December.

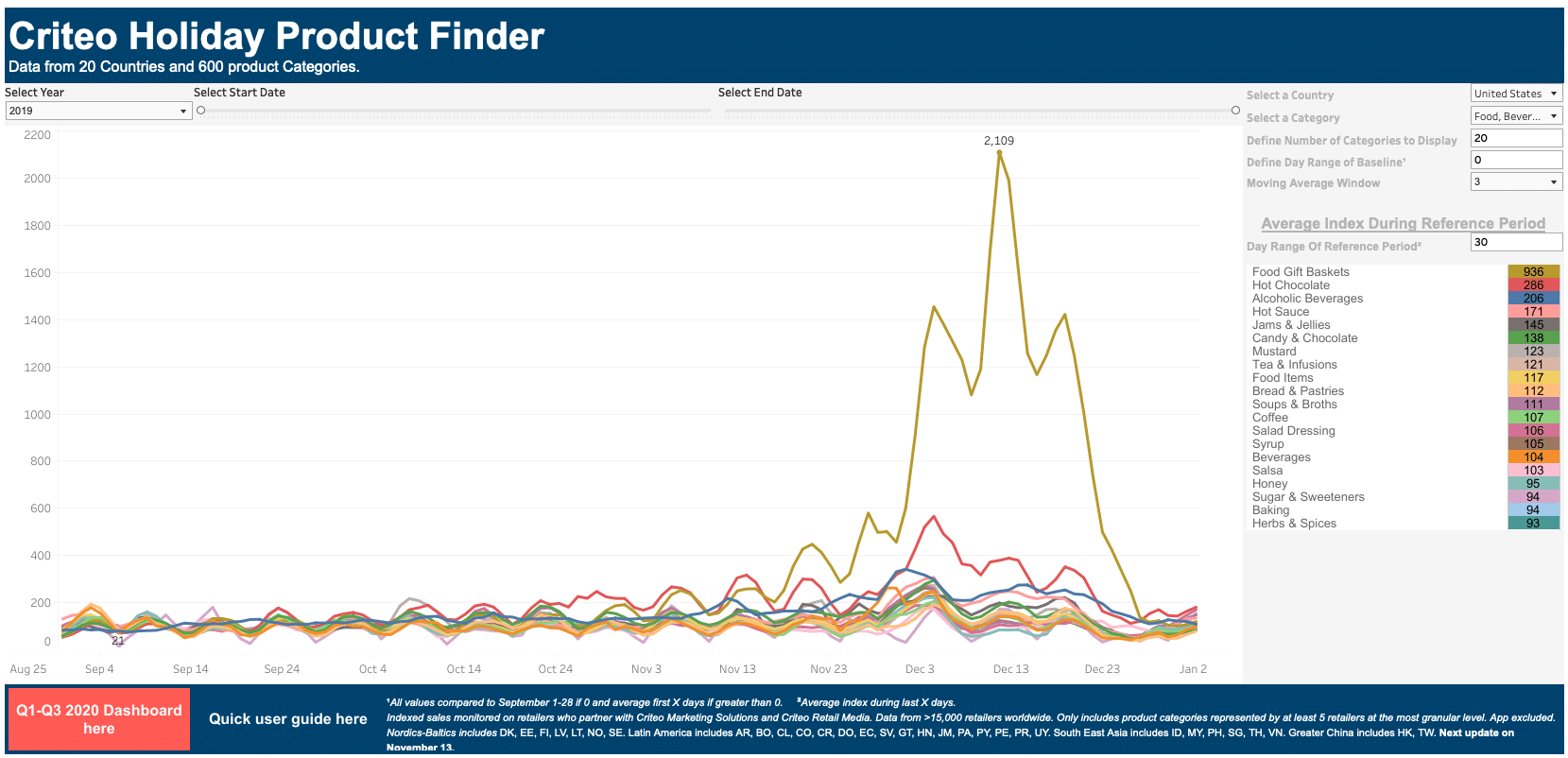

Food/CPG

Food gift baskets in the US rose sky high last December, reaching a peak of 2,000 points above index (Sept 1-28, 2019). America’s favorite winter beverage, hot chocolate, also saw a significant increase in sales. On the other side of the Atlantic in the UK, baked goods grew to nearly 400% above index in early December. In Japan, the meat, seafood, and eggs category peaked at more than 4x their September levels, at +331% in early December.

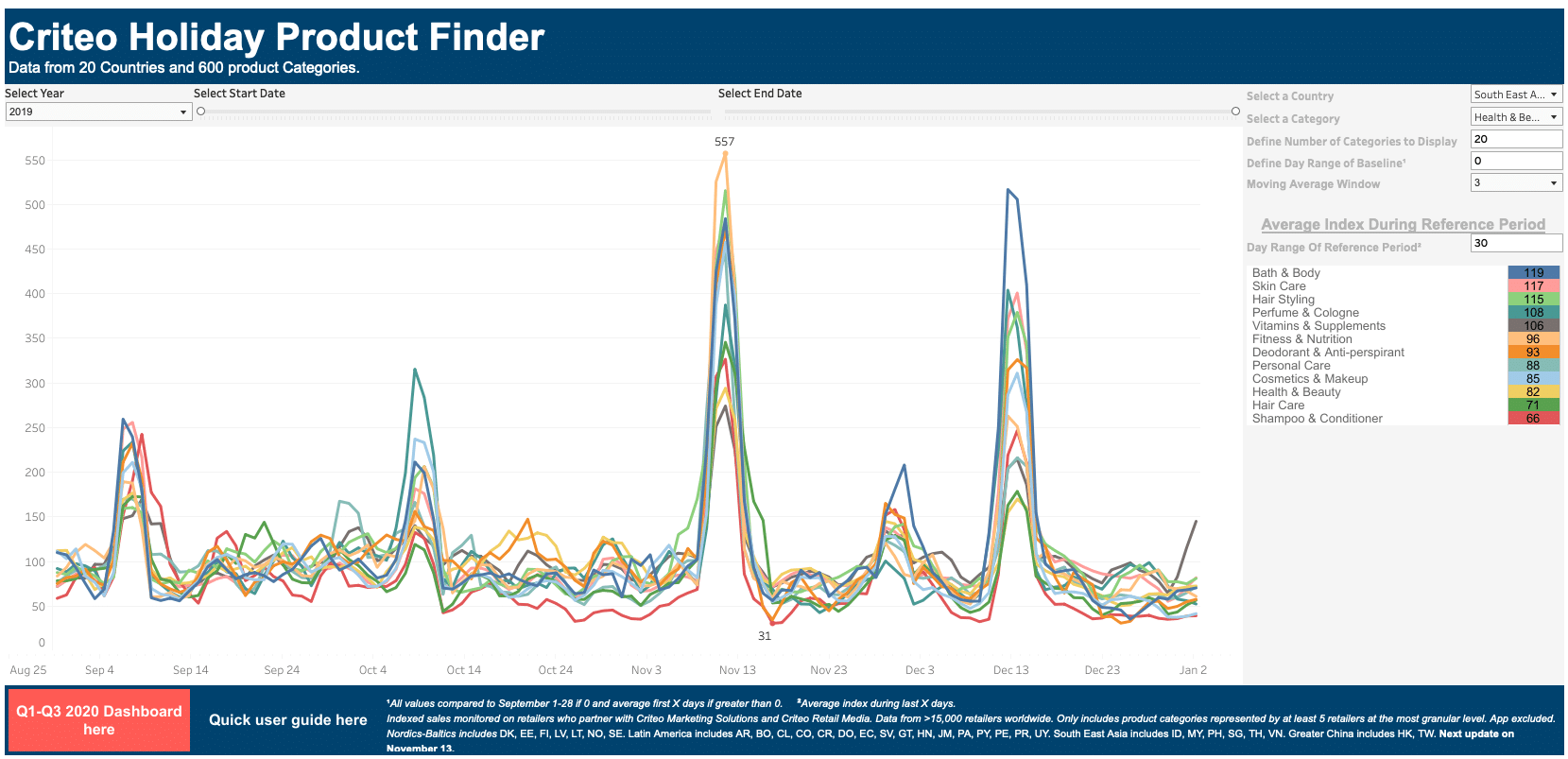

Health & Beauty

Last holiday, massage & relaxation gifts topped the Health & Beauty category in America, up +790% in sales in December. Cosmetics/makeup and bath & body gift sets were also popular gifts in 2019. Bath & body gifts were prominent in Southeast Asia and Germany as well, and perfume/cologne were also big sellers throughout EMEA.

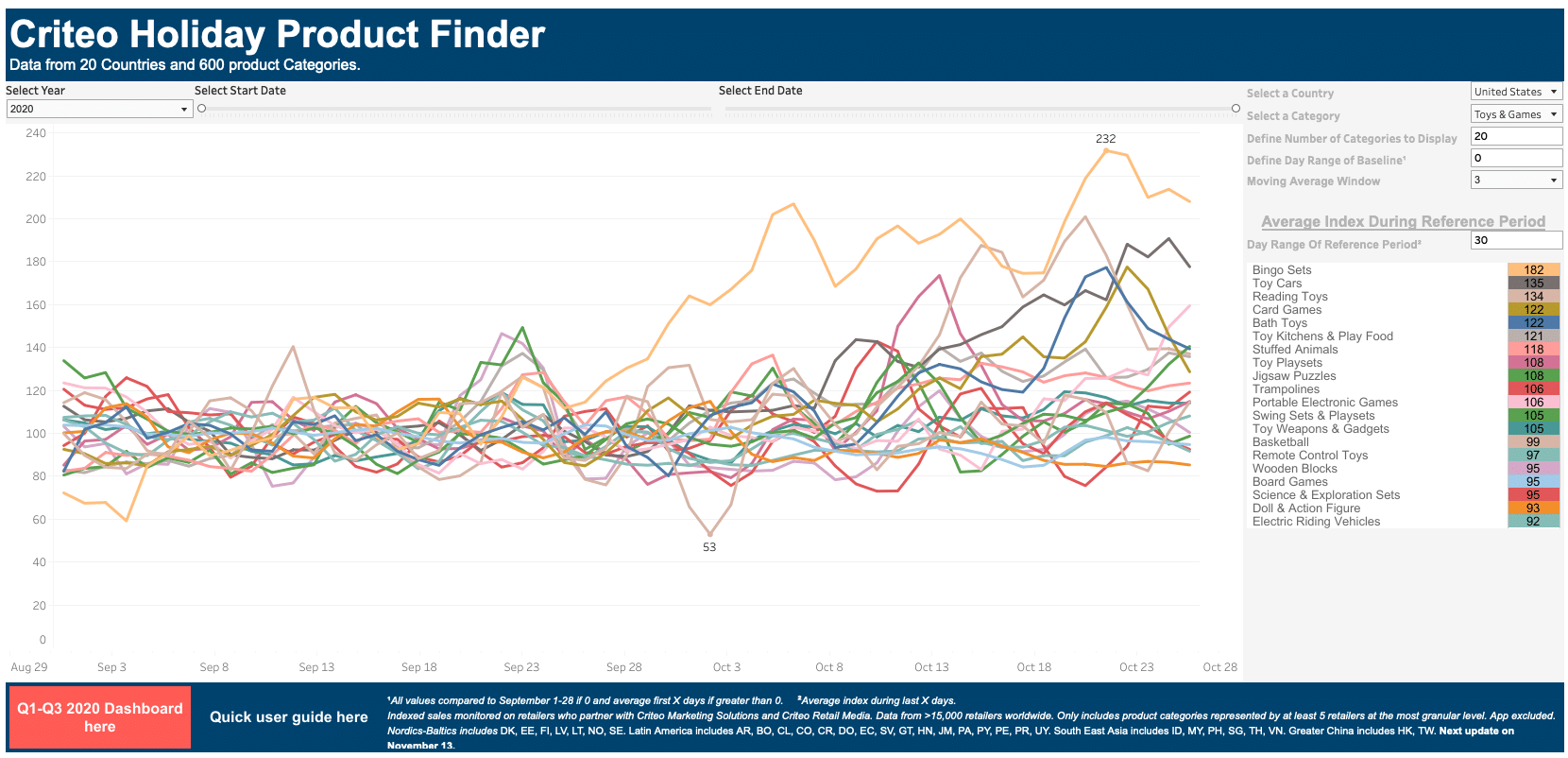

2020 Trending Products… so Far

As the holiday and festive season begins to ramp up, we’re starting to see some products breaking away from the pack. Some are the same as last year, and others are new in response to the new normal. Looking at the same categories, here are the standouts to know:

Toys & Games

In the US, bingo is replacing puzzles as the big winner this holiday season—sales have more than doubled since September. In Germany, puzzles are still winning the season so far, up 276% over the index period. And in Japan, interlocking blocks are trending up significantly, reaching +264% sales in late October. These were a top seller on 9/9 in Southeast Asia as well.

Food/CPG

Food gift baskets are on the rise again, up 54% in the US in mid-October vs. the average in September. Jams and jellies were up 62% at their peak in mid-October and are up 48% YoY. Europeans are favoring candy and chocolate, which hit +59% in the UK and +78% in Germany in mid-late October. In Southeast Asia, pasta and noodles were tops during the 9/9 holiday, up 119%. Since then, meat, seafood, and eggs have been on the rise, doubling compared to the index period.

Health & Beauty

Massage gifts are noticeably missing in the US so far this year, but they didn’t spike last year until Black Friday, so we’ll need to keep an eye on this one. Current trending products in the US include electric razors and nail care products, as people prepare for more home haircuts and manicures this winter. An evergreen favorite, bath & body gifts continue to be popular this year across the US, EMEA, and Southeast Asia, hitting +124% on 9/9 in SEA, +286% in Germany in mid-October, and +180% in the US on October 23.

More Online Holiday and Festive Season Shopping

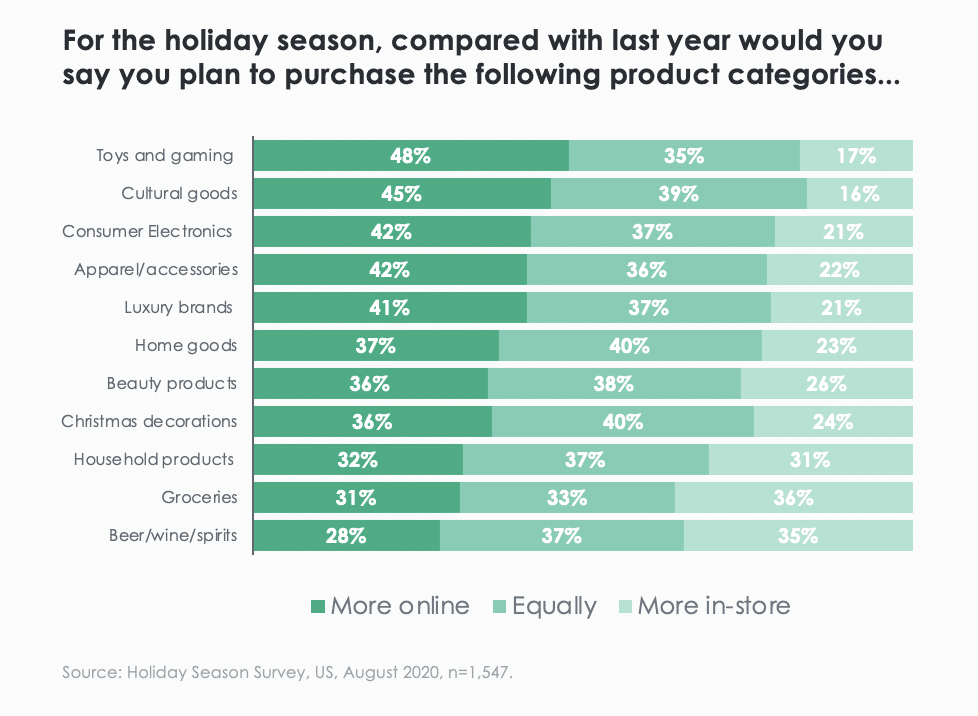

As these trending products continue to grow and shift, one thing will stay steady – the increase in online shopping. According to our holiday survey, 4 out of 10 Americans plan to buy more products online this year including toys and gaming items, cultural goods, consumer electronics, apparel/accessories, and luxury brands.1 The same is true for 30% of our respondents in Europe2 and 40% of those in APAC.3

Practicality rules this year, with one-third of consumers globally planning to spend more on groceries and household products. Categories that will be the most challenged include toys and gaming, cultural goods, consumer electronics, home goods, apparel, and luxury brands, where shoppers planning to purchase less outnumber those planning to purchase more than last year.

To explore more product category trends and plan your marketing strategy with the latest data-backed insights, visit our Holiday Product Finder dashboard here, or scroll down to the bottom!

1Source: Holiday Season Survey, US, August 2020 n=1547

2Source: Holiday Season Survey, EMEA, August-October 2020, n=15,296

3Source: Holiday Season Survey, APAC, August 2020, n=4,550