- Retailers without a retail media offering are in the minority

- A large share of retailers plan to offer offsite, more insights, and more ad formats this year

- Retailers are using tech as a key way to attract and retain more advertisers

- A vast majority of brands and agencies are investing in retail media

- For brands and agencies, the retail media keyword for 2024 is “more”

- Unique audiences and multi-retailer networks factor highly in brand and agency tech partner requirements

- What else is new in retail media?

In terms of retail media are you keeping pace with your cohort? What should you be investing in this year? What should you expect from your technology partners?

For answers to these questions and more, we surveyed retailers, brands, and agencies to understand the state of retail media for each player in the ecosystem, in each region of the world. Want to see how you stack up? Read on to find out what other retailers, brands, and agencies are doing today and what’s new in retail media, based on our global survey of more than 1,000 commerce leaders.

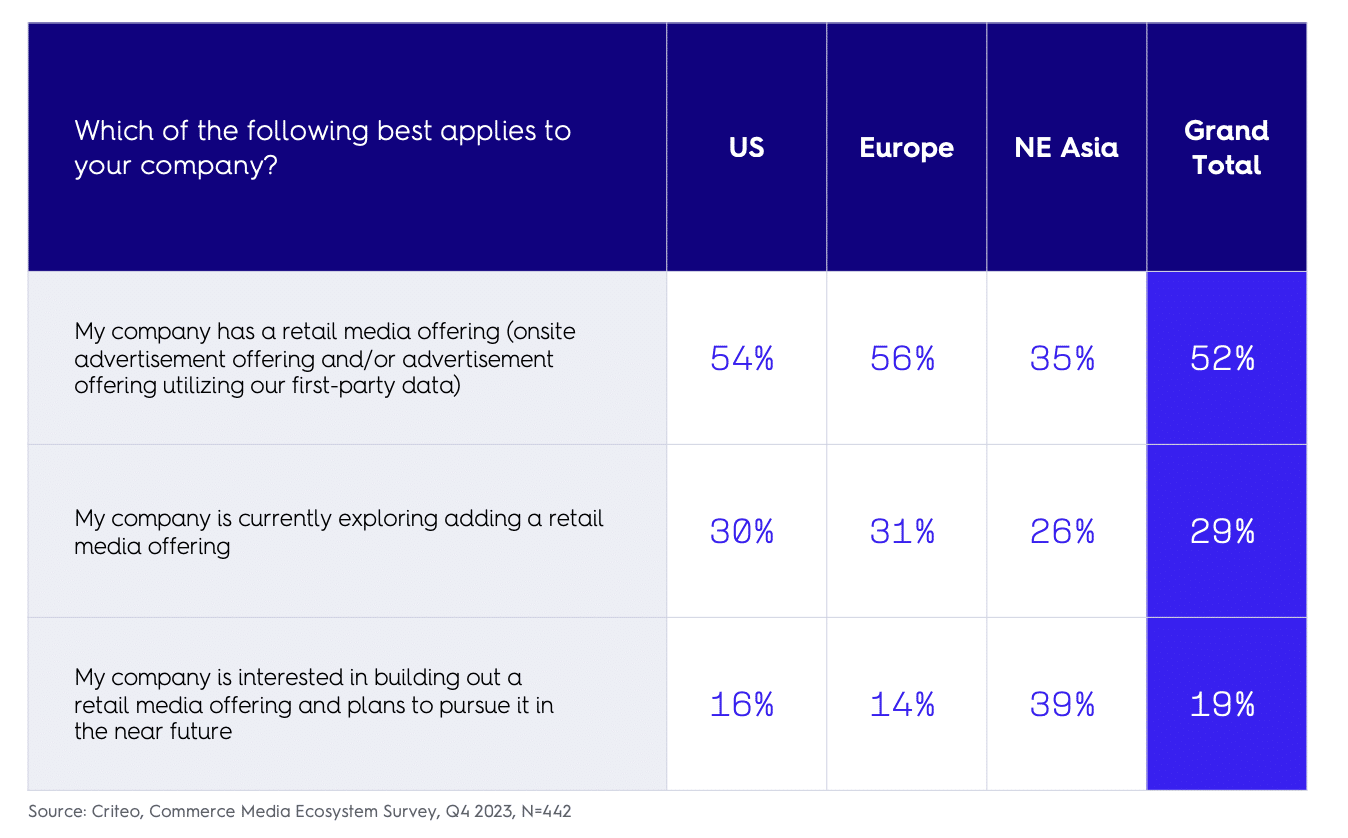

Retailers without a retail media offering are in the minority

In terms of retailers, the biggest adopters globally of retail media are the US (54%) and Europe (56%), followed by Northeast Asia (35%). This said, we expect retailers from all regions to expand their brand offerings in 2024: Nearly half of retailers globally say they’re currently exploring or are interested in building out a retail media program in the near future.

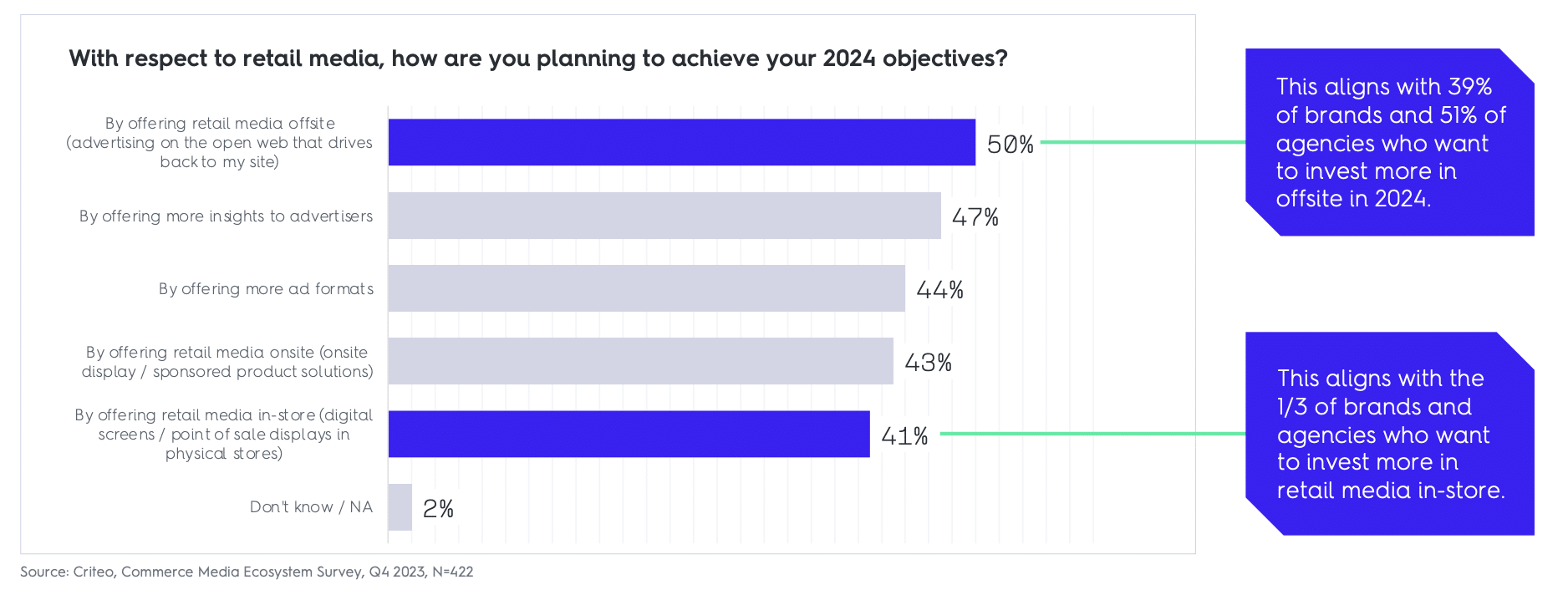

A large share of retailers plan to offer offsite, more insights, and more ad formats this year

Retailers recognize the interest from brands to move up the funnel and, as such, are expanding their offerings beyond onsite sponsored product ads. Half of them plan to offer offsite to meet 2024 objectives, and 56% say it will be a key area of growth for retail media. Forty-seven percent plan to offer more insights to advertisers and 44% will be rolling out more ad formats in support of upper funnel goals.

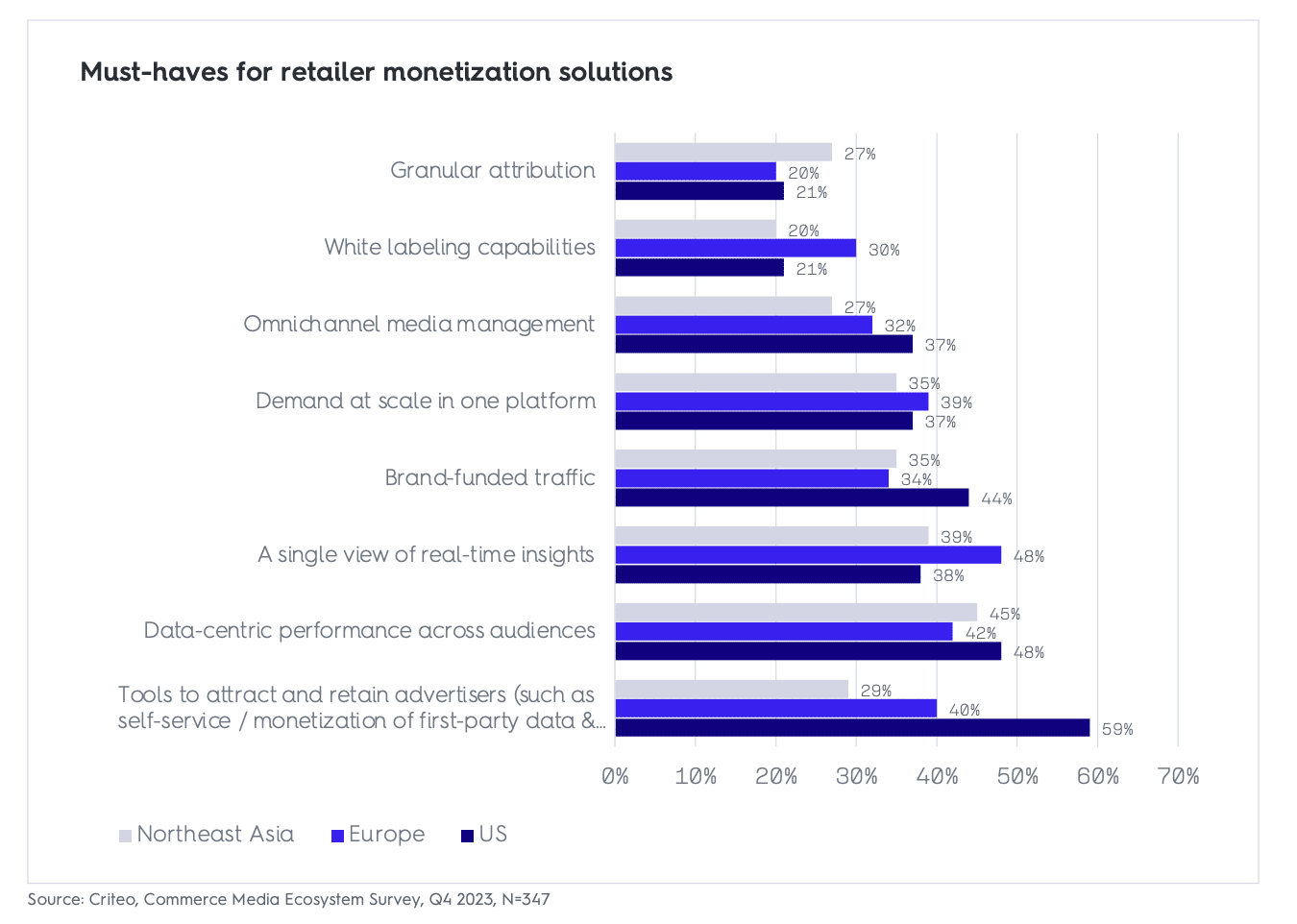

Retailers are using tech as a key way to attract and retain more advertisers

A large proportion of all retailers are looking for technology partners who can provide tools that will help them stand out to advertisers, such as self-service and monetization of first-party data and audiences. This speaks to the shifting dynamic between retailers and brands, and the need for retailers to have a more brand-centric approach.

The largest share of US retailers (59%) cited tools to attract and retain advertisers as a must-have, along with brand-funded traffic and omnichannel media management, which shows the maturity of retailers in this region, who are actively looking to expand their retail media programs offsite and offline.

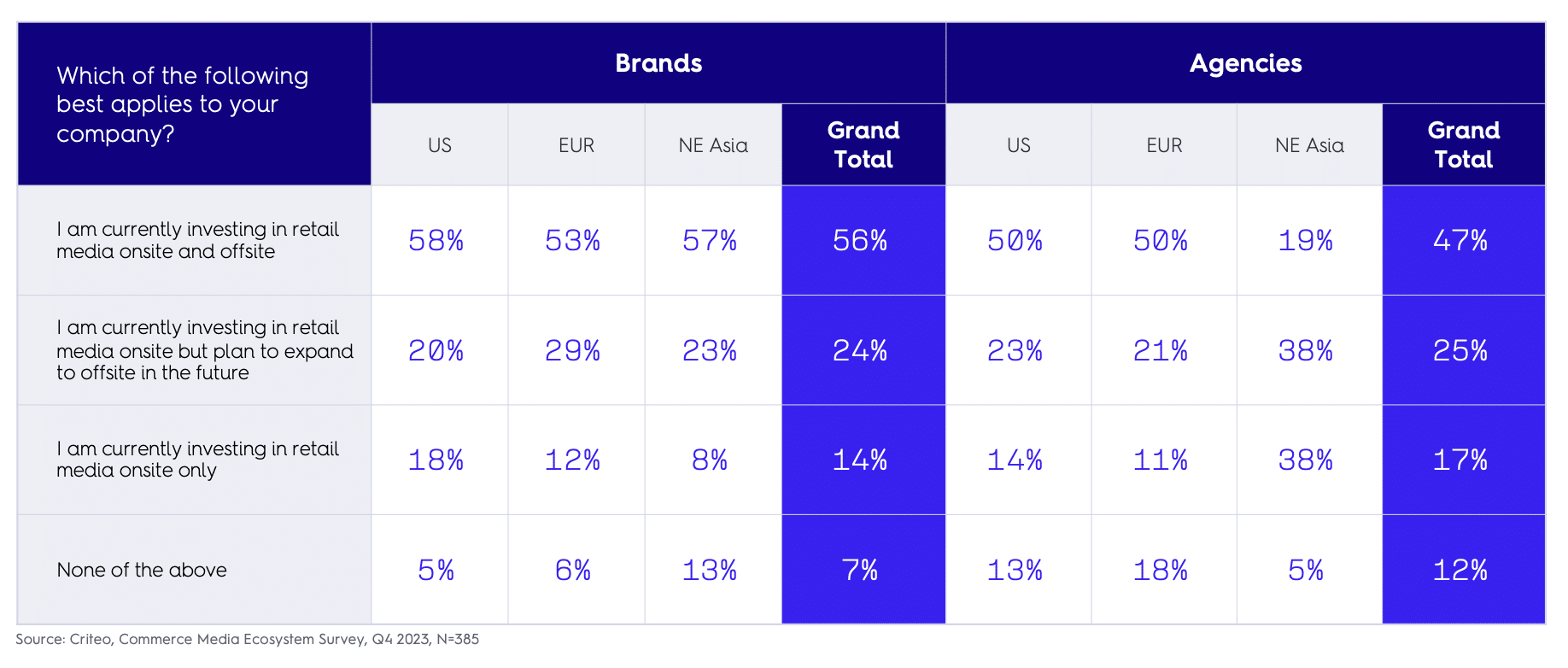

A vast majority of brands and agencies are investing in retail media

Just 7% of brands and 12% of agencies in our survey said they weren’t doing any kind of retail media. Though retail media offsite is still nascent, our survey shows that brands and agencies are sold on it. A majority of brands and half of agencies in most regions are currently investing in both retail media onsite and offsite. Another 20-30% across the regions plan to expand to offsite in the future.

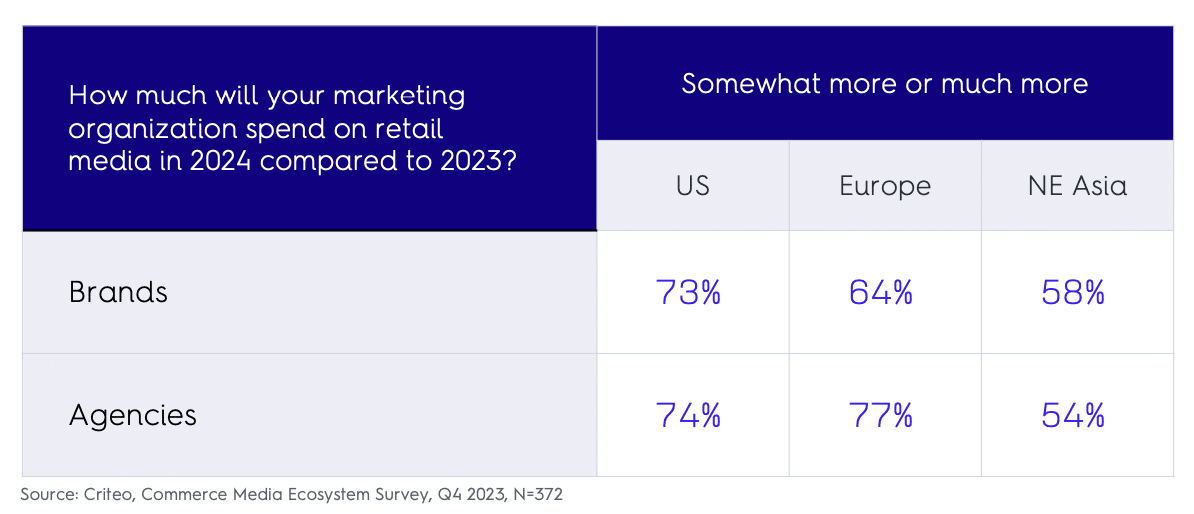

For brands and agencies, the retail media keyword for 2024 is “more”

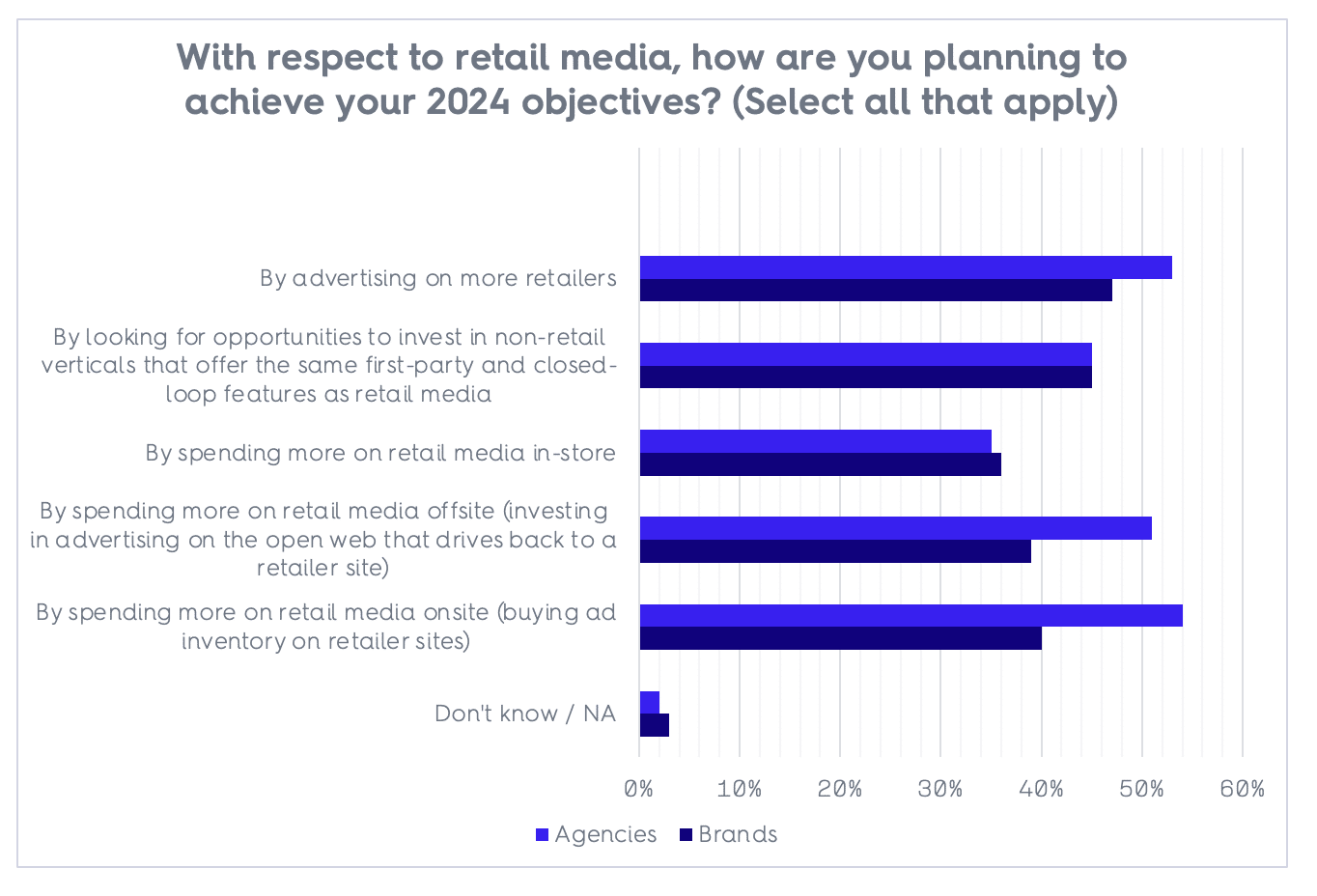

An overwhelming majority of both brands (78%) and agencies (83%) in our survey said that retail media spend is somewhat or much more effective in terms of sales impact compared to other channels. It makes sense, then, that a majority of brands and agencies everywhere plan to spend more on retail media in 2024.

In terms of where that additional spend will go, both groups said they plan to expand to more retailers and are also interested in non-retail verticals with retail media-like models. A larger share of agencies than brands also plan to spend more on both retail media onsite and offsite this year.

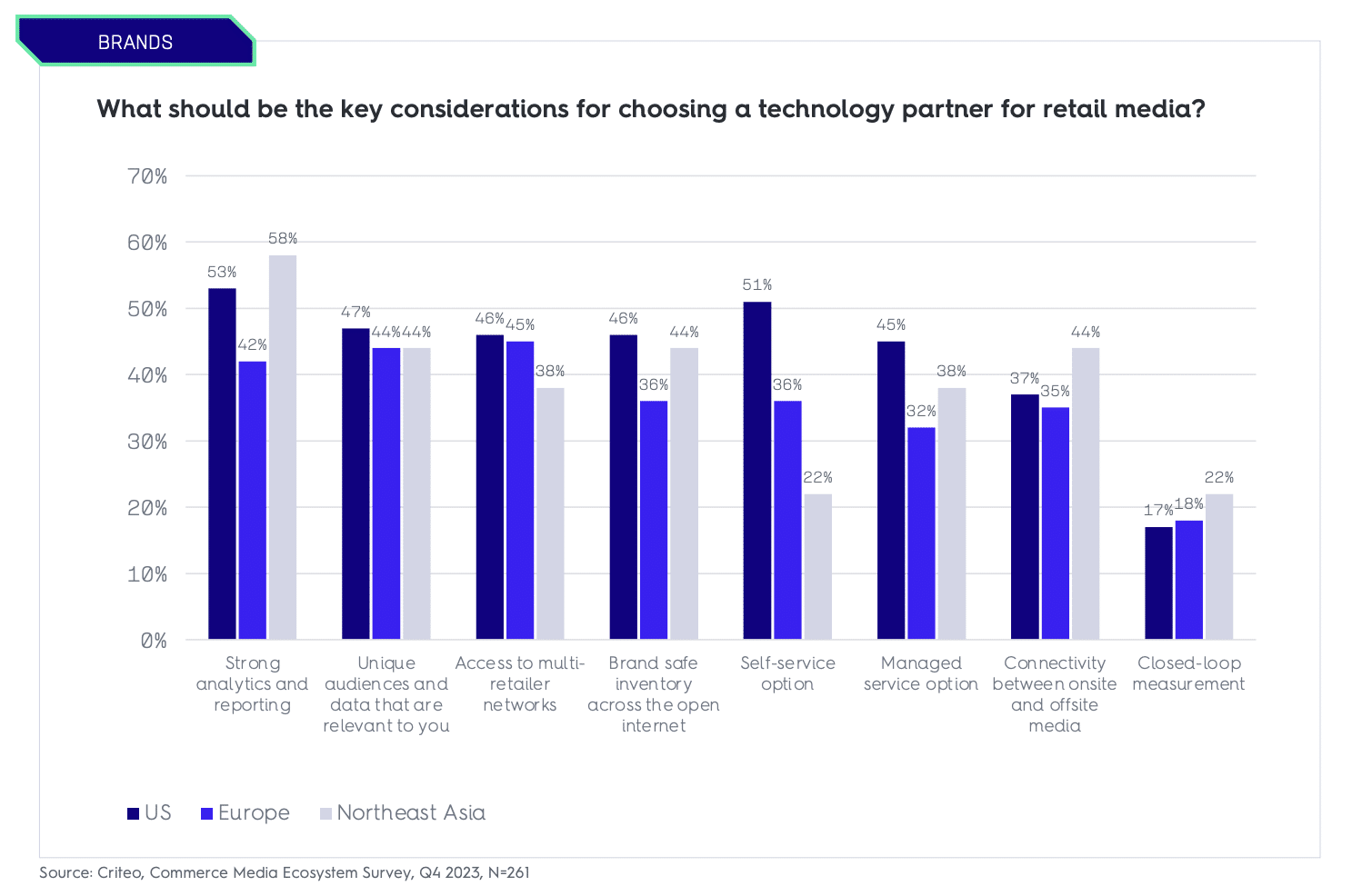

Unique audiences and multi-retailer networks factor highly in brand and agency tech partner requirements

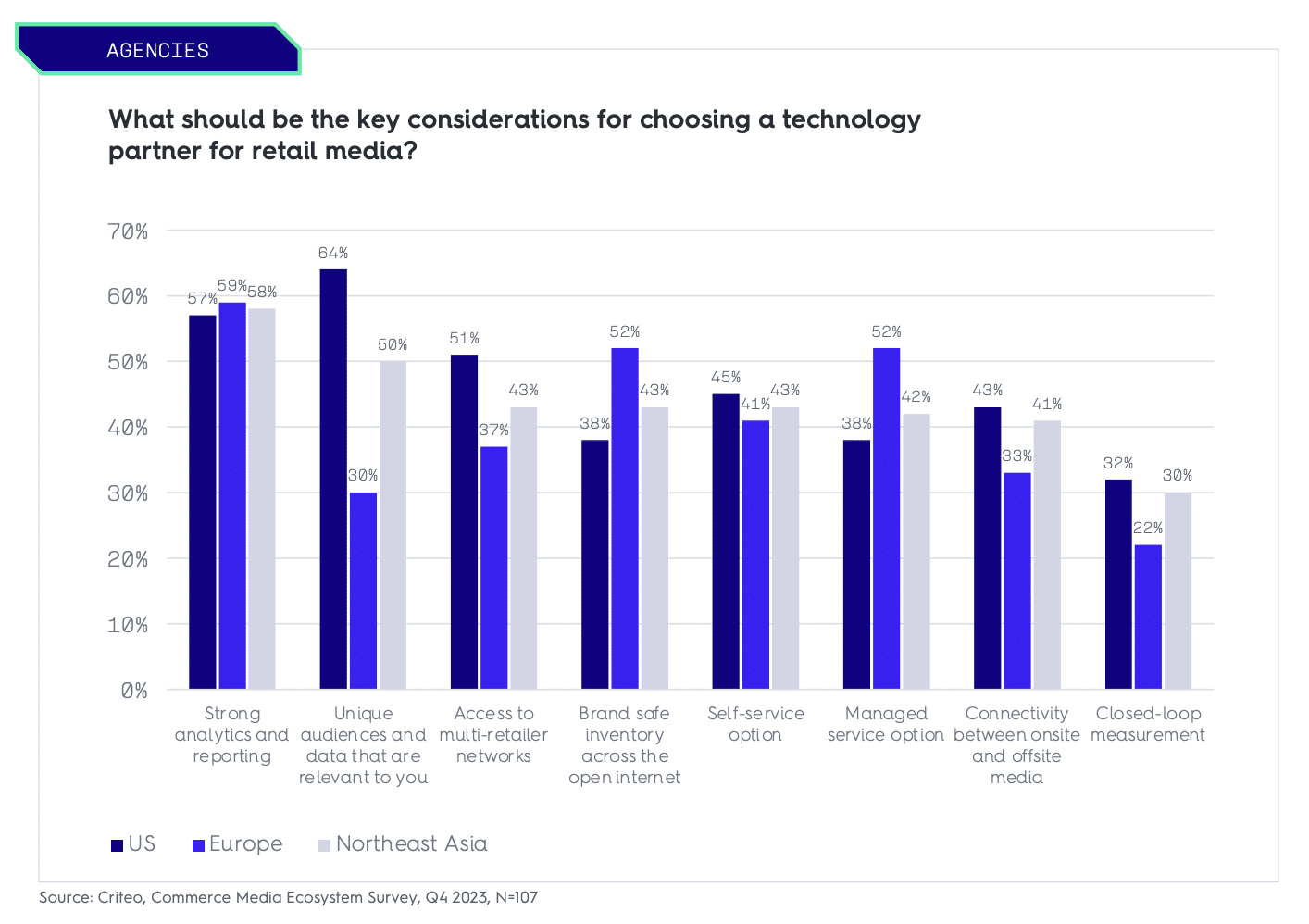

Brands in all regions listed strong analytics and unique audiences and data as top criteria when choosing a technology partner for retail media. An almost equal number are also looking for partners who can give them access to multi-retailer networks. This is likely because as more retailers throw their hat in the ring, managing and optimizing budgets across multiple networks and platforms becomes unsustainable. Multi-retailer networks can save brands and agencies time and resources and optimize spend across retailers more efficiently.

When we look at agency must-haves for technology partners, US agencies far outindexed the other regions in their desire for unique audiences and data. European agencies were more likely to prioritize brand safe inventory. Like brands, agencies in all regions were keen on access to strong analytics and multi-retailer networks.

What else is new in retail media?

Retailers, brands, agencies, and publishers had a lot more to say about where retail media and commerce media are headed in our survey. For all the insights from 1,000+ commerce leaders around the world, download the full The Great Defrag report by clicking below.