Over the last few years, consumers have adapted to drastically different routines. Many have changed jobs, moved house, or otherwise entered a new stage of life. They’ve also fundamentally changed the way they shop, from where they turn to discover new brands and products, to how they evaluate and complete a purchase.

To understand just how much commerce has evolved, we analyzed the results from multiple Criteo surveys across more than 17,000 respondents globally and unpacked commerce data from our 22,000 advertiser clients worldwide. We also ran our Shopper Story survey again, comparing the 2021 findings to 2019’s to see how consumer behavior and preferences shifted during the pandemic.

Our latest report, “Shopper Story 2022: Consumer Trends & the Future of Commerce,” brings it all together and features exclusive insights you simply won’t find anywhere else.

Here’s a preview of some of 2022’s top consumer trends every business should know.

Trend 1: Ecommerce has grown, and consumers still like stores.

In 2019, eMarketer forecasted that the growth rate of ecommerce in 2020 would be 19% year over year. Two years later, eMarketer data showed that the actual growth of rate of ecommerce in 2020 was 25.7%—amounting to an eye-popping 4.21 trillion US dollars.1

That said, Criteo data shows that in-store sales from omnichannel retailers in 2021 grew in places where pandemic restrictions were lifted, such as the US, where in-store sales increased by 20% during the year.2

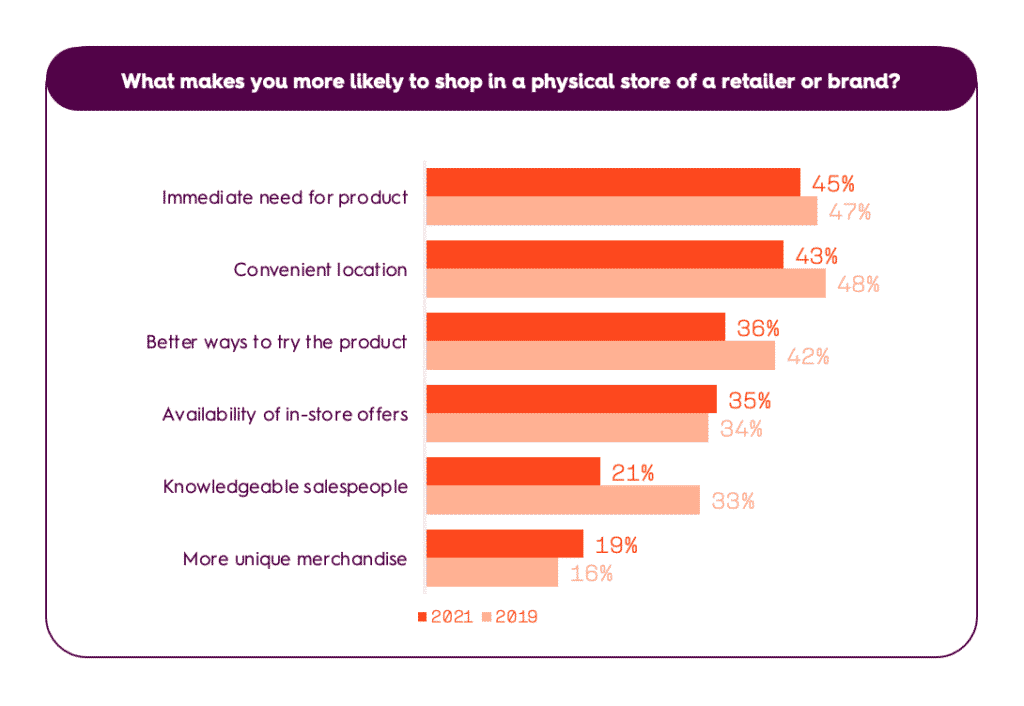

Our most recent Shopper Story survey confirms that people still appreciate stores: Four in 10 consumers say that “convenient location” (45%) and “immediate need for a product” (43%) are among the main reasons why they shop at stores. These figures, however, are less than what they were when we ran the same survey in 2019, indicating a lower dependency on stores for immediate fulfillment.3

Trend 2: Social lives will have a resurgence in 2022.

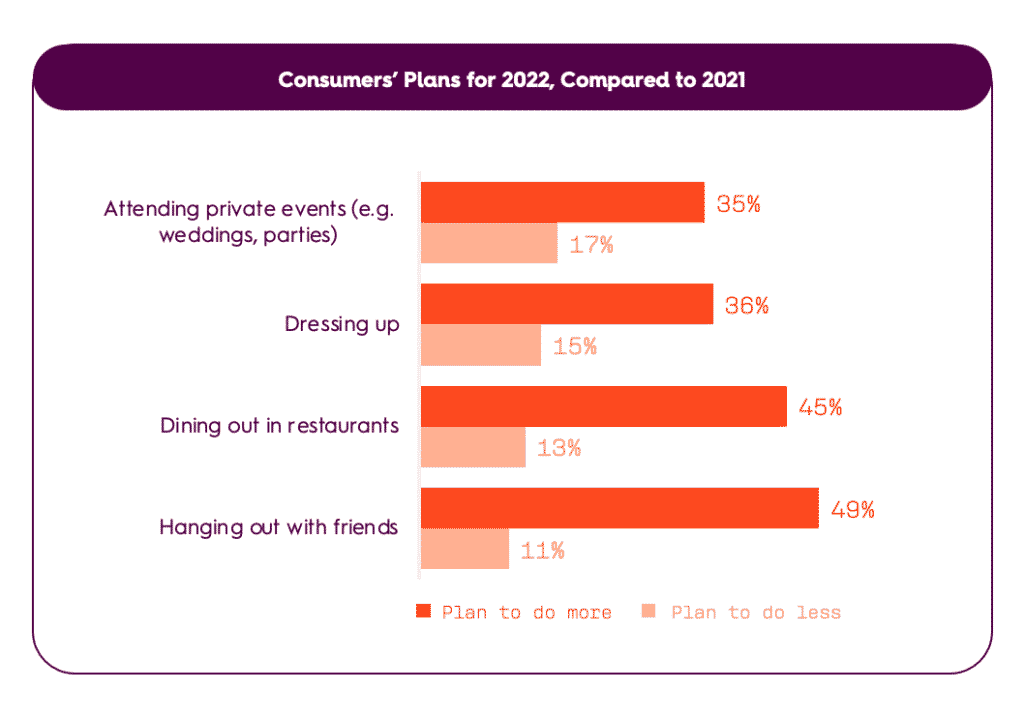

Apart from understanding how shopping behaviors and preferences have changed since 2019, we also wanted to know what activities consumers anticipate getting back to in 2022.

Criteo research shows that a sizeable portion of consumers are looking forward to stepping out in the real world. Over one-third expect to have more occasions to get dressed up in 2022, like weddings and parties, than they did in 2021. About half (49%) plan to get together with friends more often.4

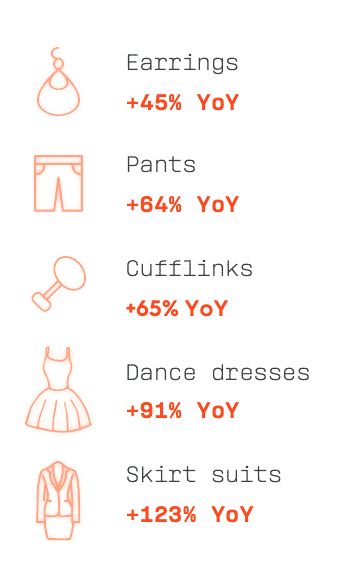

Our apparel category insights tell a similar story. People are readying to connect over more than just video calls, and they want to shine. Criteo data indicates that lots of shoppers intend to swap out their pandemic athleisure for more fashion-forward attire.

During summer 2021 in the US, party-ready item sales were up:

Source: Criteo Data, United States, based on total web sales August 2021 compared to August 2020.

And it doesn’t stop at fashion. Consumers are also nurturing their inner glow. By the fall of 2021, Americans were becoming more mindful of how they look, feel, and smell:

Source: Criteo Data, United States, based on total web sales September 2021 compared to September 2020.

Consumers are clearly down to get down—and many are ready to get hitched, too: Bridal party dresses reached +172% YoY, indicating more couples might be tying the knot in 2022.5

Trend 3: CE is dominating share of wallet.

No other retail category adapted to the needs of a new world as quickly and seamlessly as consumer electronics. Tech gadgets made people’s lives more productive, more entertaining, and more connected. And shoppers can’t get enough.

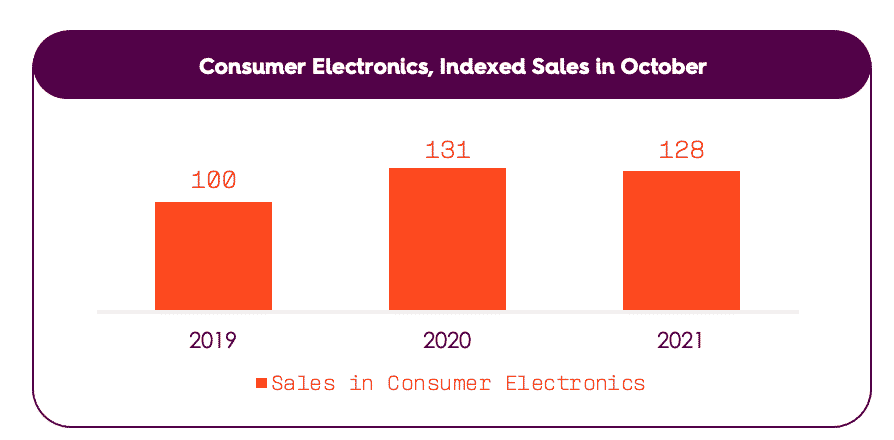

2020 was a banner year for consumer electronics as much of the globe moved to work- and school-from-home. Even so, and despite the 2021 global chip shortage and other supply chain issues, Criteo commerce data shows that as of October 2021, online sales in the CE category still surpassed 2019 levels, at +28%.

This shows that although many consumers geared up in 2020, they still made room to acquire more CE goodies in 2021.

According to Criteo research, consumer spend on CE has beat out even apparel. During a six-month period in 2021 in the US6:

- 47% of consumers reported spending over $200 on CE items in a physical store, and 36% spent more than $200 on CE products online.

- In contrast, only 34% reported spending over $200 on Apparel & Accessories in physical stores, and just 26% bought Apparel & Accessories online during the same period.

Among all CE trends, one has been charging to the top: batteries. During the two weeks leading to Black Friday 2021, overall CE category sales were up +29% compared to the first week of November. When we dug deeper and analyzed the specific terms included in product names throughout millions of goods, we found that views of product pages with words such as “cordless”, “battery”, “wireless”, and “rechargeable” hit +39%, +46%, +67%, and +71%, respectively.

Combined with the growing global trends of high-ticket items like electric cars, bikes, and scooters, this data suggests that consumer interest in battery-operated products is leading the CE category straight into an energy-conscious era.

Trend 4: Video is the Now and Future Influencer

Video consumption skyrocketed during the pandemic, and for good reason: In the absence of in-person entertainment, video is the most immersive, engaging way to experience content—including advertising.

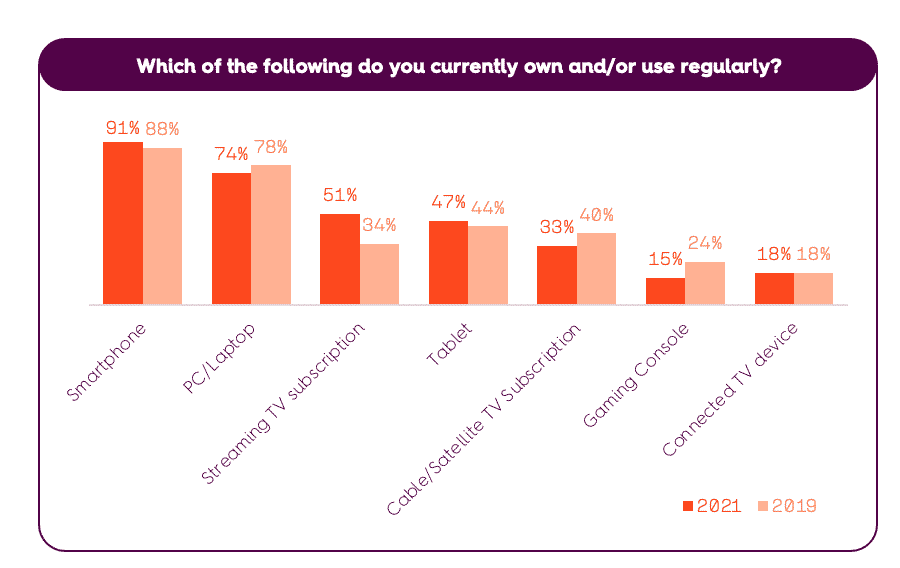

Our Shopper Story study shows that in the last two years, the share of internet users with cable/satellite TV subscriptions has dropped while the share of internet users who have products to stream content, like gaming consoles and internet TV devices, has grown:

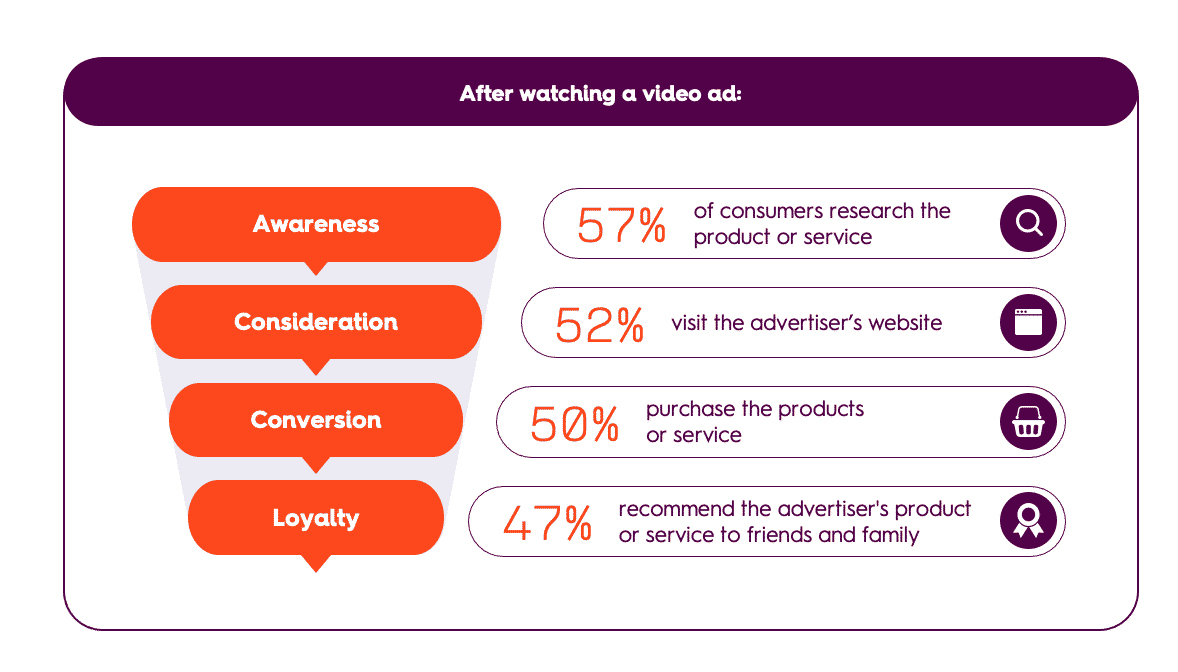

In a separate Criteo survey, we asked consumers what actions they take after seeing a video ad and found that video advertising drives searches and purchases. Globally, half of viewers say they purchase the products and services they see in video ads. More than half say they’ll search for the product or service on their computer (58%) or mobile device (57%) or visit the advertiser’s website (52%).

Among Millennials and Gen Z, these rates are even higher. Almost 70% will search for products on their mobile device and 60% of viewers in these generations will purchase products they see in video ads.

In addition, more than half of viewers (58%) use the same email ID to access different video streaming services across various devices. Of those, three-quarters (76%) use that same email ID when they’re shopping online and in apps. This means that marketers can connect video viewing with shopping behaviors across devices and channels using privacy-safe hashed email addresses.

For the full story on these trends and more—plus tips on how marketers can prepare for the future of advertising—download the full report:

1Source: eMarketer, Global Ecommerce Forecast 2021

2Source: Criteo Data, US, Omnichannel Retailers, November 2021 compared to average in January 2021.

3Source: Criteo Shopper Story, Global (Australia, France, Germany, Japan, South Korea, UK, US), August-November 2021, N=7282 / July-October 2019, N=7102.

4Source: Criteo Consumer Sentiment Index, Global (Australia, France, Germany, India, Italy, Japan, South Korea, Spain, UK, US), November 2021, N=3805.

5Source: Criteo Data, United States, based on total web sales September 2021 compared to September 2020.

6Source: Criteo Shopper Story, US, August-November 2021, N=548.