Here at Criteo, we’re constantly analyzing our data and conducting new research to understand what consumers are thinking about when they’re shopping – and how they discover and research new products across about both digital and physical channels.

To help marketers prepare for the biggest retail and ecommerce trends of 2020, we surveyed 1,000+ US consumers to understand how people shop, what’s influencing their decisions, and why. We also analyzed Criteo transactional data from around the globe.

Understanding the New Consumer Mindset

Our latest report, Shopper Story 2020: The New Consumer Mindset, investigates how the path from discovery to conversion has evolved, and why it’s more important than ever for advertisers to keep driving web traffic throughout the critical consideration phase.

Here’s a sneak peek at the findings inside the report:

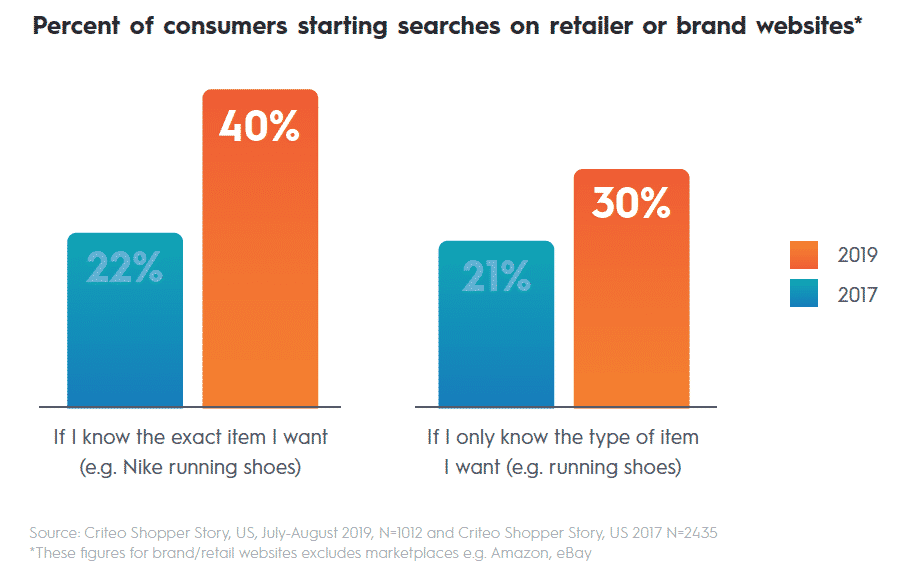

1. Today’s shoppers skip Google and Amazon at higher rates than 2017.

As the chart above shows, a greater share of high-intent shoppers said they began their product hunts outside of search engines and marketplaces (like Amazon) in 2019 compared to 2017. In fact, that share has nearly doubled for those who know exactly what they’re looking for (40% in 2019 vs 22% in 2017).

This may represent the growing popularity of direct-to-consumer brand relationships, which we’ve seen take off with smaller start-up brands as well as through industry developments like Nike pulling its products from Amazon.

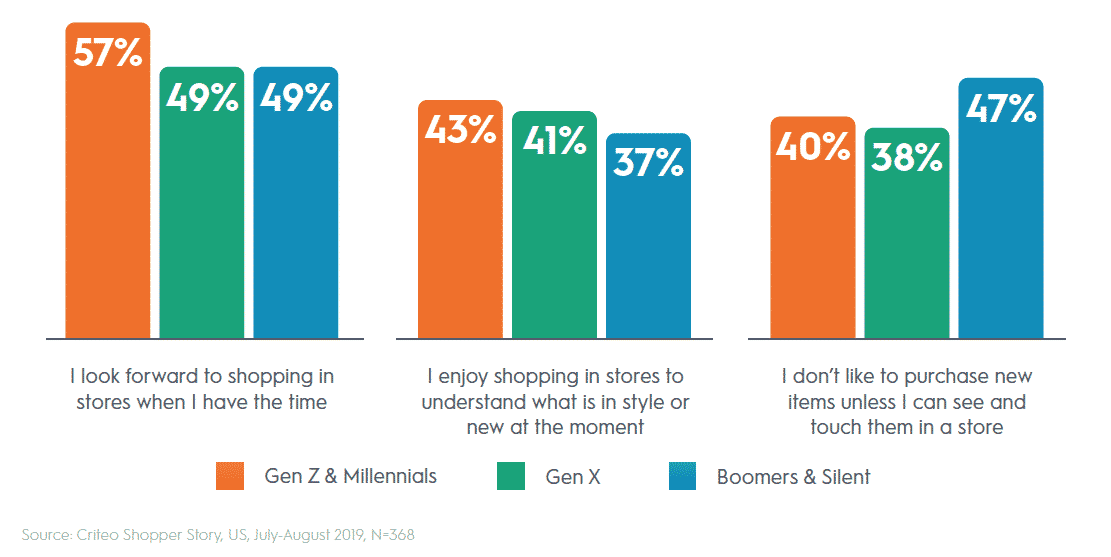

2. Every generation enjoys the in-store experience — when they can.

According to our survey, the majority of Gen Zers are keen on shopping in physical stores: 57% say they look forward to shopping in stores when they have the time.1

3. Brand values matter to consumers.

Over half of our US respondents (51%) in our “Why We Buy” survey said that their purchasing decisions were affected by a brand’s values.2

A global Accenture Strategy survey found that 62% of consumers want companies to take a stand on issues like sustainability, transparency, and fair employment practices. An Edelman study revealed that 64% of consumers around the world “will buy or boycott a brand because of its position on a social or political issue.”

4. Apps are used across the customer journey.

Data from Statista shows that there are over 3.2 billion smartphone users in the world today. By 2023, mobile apps are expected to generate more than 935 billion USD. In step with the growth of apps, our Shopper Story research shows that the majority of US consumers are using retailer apps across the purchasing funnel, from discovery (57%) to evaluation (55%) and conversion (58%).

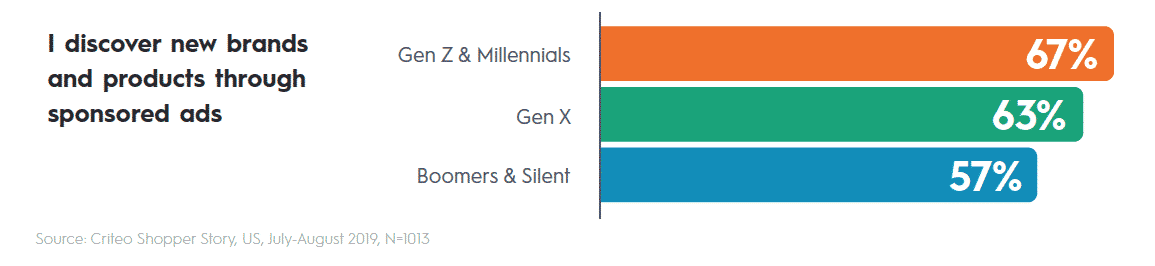

5. Ads work for discovery, not just conversion.

Respondents across all age groups confirmed sponsored ads help them discover new brands and products. This is true for 2 out of 3 Gen Zers and Millennials.

And while spend 50% of their time on search and social, they also spend 50% of their time on the open Internet looking at publisher, retailer, and brand websites that aren’t hidden behind walled gardens.3 This presents a huge opportunity for companies trying to engage consumers outside of closed environments.

6. Consideration is as complex as conversion.

Criteo research shows that most consumers browse between different businesses, websites, and experiences for a while before buying. On average, less than 10% of our respondents said they almost always purchase from the first website they visit.4

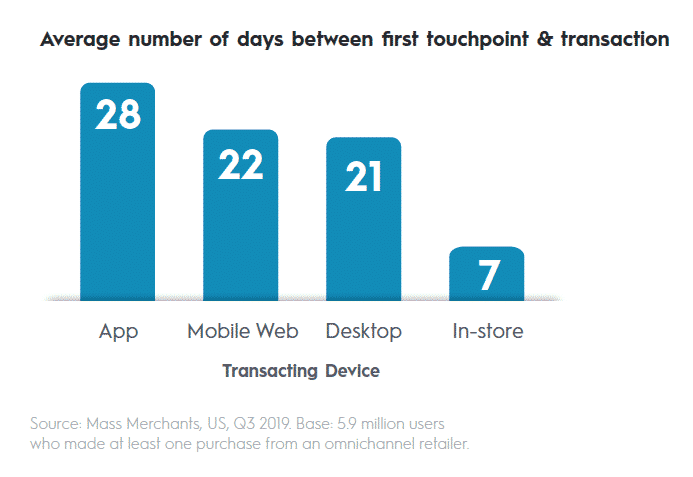

Criteo data shows that the average time between the first touchpoint and a transaction is seven days when the transaction ends in-store, versus up to 28 days when a transaction ends online.5 That means that when a shopper buys something from a store, she’s likely to have seen that item (either online or in-store) about a week prior. But for transactions that end online, we’re looking at a full four weeks for ecommerce shoppers to consider and land on the perfect product for their needs.

2020 Consumers = Detectives

There’s no knowing how a shopper will discover your product, how long it will take them to make a decision, and what will get them to buy. Given the growing importance of things like peer reviews, transparency, and brand values, the time has come for companies to start thinking about how to truly showcase their brand personalities, not just the products themselves, across engaging, great-looking, full-funnel ad campaigns.

Access the full report below:

1Definitions of generations – Gen Z: born after 1994 (under 25). Millennials: born between 1981 and 1994 (25-38 yo), Gen X: born between 1965 and 1980 (39-54 yo), Boomers: born between 1946 and 1964 (55-73 yo), Silent: born before 1946 (74+ yo).

2Criteo “Why We Buy” Survey, US, February 2019, n=1003.

3Nielsen US DCR Trends, eMarketer, ExchangeWire, IDC.

4Criteo “Shopper Story” Survey, US, July-August 2019, n=1013.

5Source: Mass Merchants, US, Q3 2019. Base: 5.9 million users who made at least one purchase from an omnichannel retailer.