The acceleration of ecommerce brought on by the pandemic has also brought the importance of omnichannel to the fore. Now more than ever, retailers are leaning into digital and seeing the value in connecting their offline and online data to fuel all channels. As we approach the busiest sales season of the year—and one where ecommerce will play its biggest role yet—helping customers buy in the channels where they are most comfortable has become critical.

During this peak sales season, stores may be closed, fully open, or somewhere in between, and consumer comfort levels will vary. Though this year is unlike any other we’ve experienced, there are learnings from last year that may help inform this year’s omnichannel strategies.

We analyzed 2019 sales data from the tens of thousands of retailers we work with to understand the shifts between online and in-store shopping during the peak season. It’s likely that “in-store” shopping this year will be more heavily focused on click-and-collect, but we believe that delivery costs and delays, and last-minute needs, will still drive shoppers to stores as the season draws to a close.

So, when should omnichannel retailers start optimizing campaigns for in-store sales? Here’s what we saw last year:

In-Store Sales Surpassed Online Sales for Most Categories Right After Cyber Monday

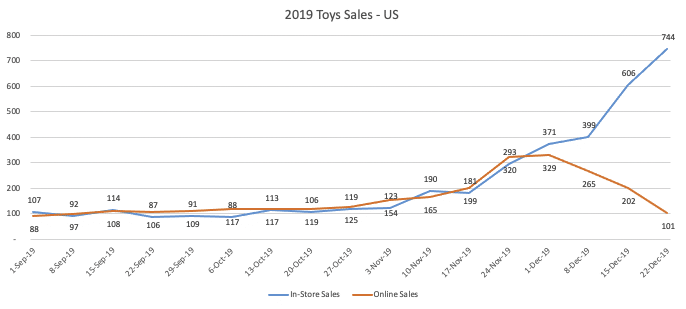

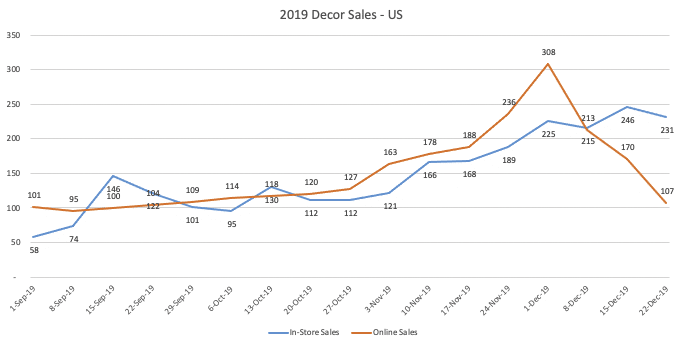

In the US in 2019, the inflection point where in-store sales surpassed online sales was either during or just after Black Friday/Cyber Monday for most categories. The clothing and decor categories were exceptions, with the switch happening around December 8 – shoes shifted even later, on December 15.

In-store sales steadily rose through December. Just a few days before Christmas, in-store clothing sales were up nearly 100%, electronics were up 236%, jewelry was up 300%, and toys grew a whopping 644%, compared to the first four weeks of September 2019.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, US, Criteo data.

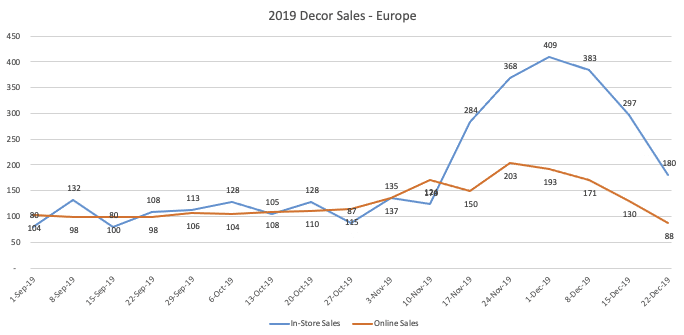

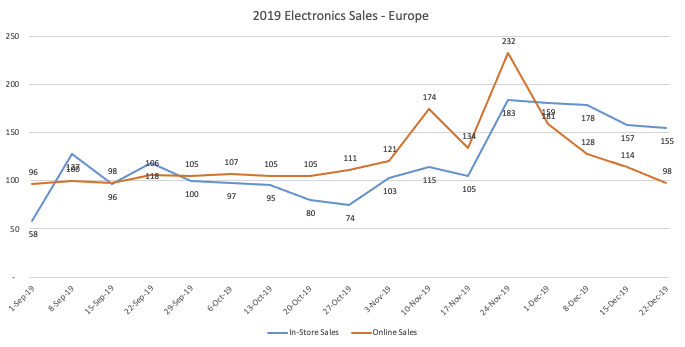

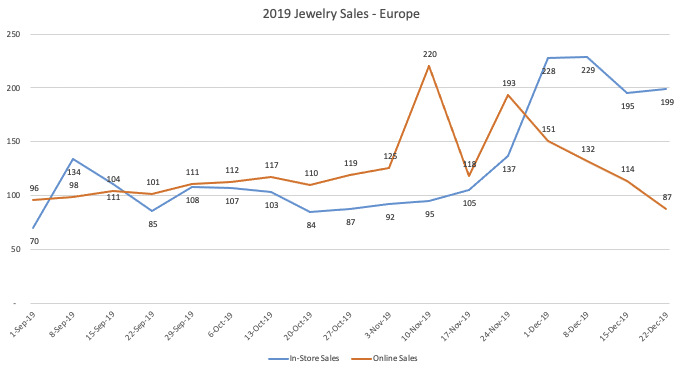

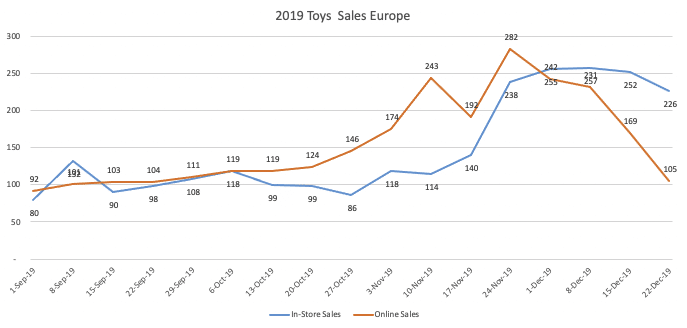

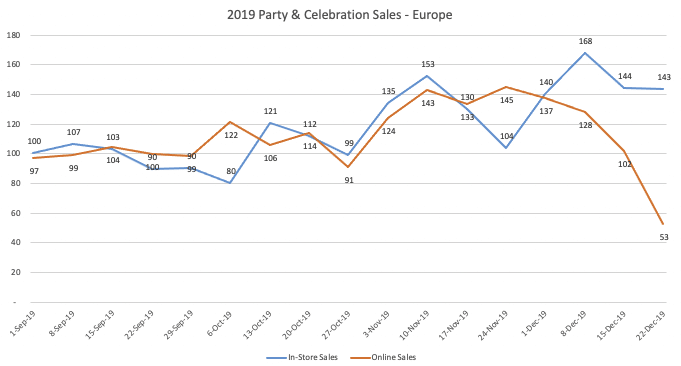

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

In Europe, the point at which in-store sales surpassed online sales in 2019 is less consistent across categories. For some it happened just before or during Black Friday/Cyber Monday, and for others it happened just after.

For many product categories both online and in-store sales reach their peak during Black Friday/Cyber Monday weekend. In-store sales of decor, for instance, reached +309% on Cyber Monday. Both online and in-store sales of Electronics hit their zenith on Black Friday, up 132% and 83%, respectively.

We also noticed that the surge in December 2019 was more rounded rather than continuously increasing as we approach Christmas. This perhaps indicates that Europeans are better planners and less last-minute shoppers than Americans.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

In-store sales of home & garden items (+139% on December 15), jewelry (+99% on December 22), pet supplies (+69% on December 15), and toys (+126% on December 22) were much higher than online sales throughout the month of December.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

Decor & Party Supplies In-Store Sales Started Rising After Halloween

In the US, shoppers started getting their homes ready for the holidays as soon as Halloween was over. In this chart Decor sales were already up 66% in early November. Europeans waited a bit longer, but still started before Black Friday, with Party & Celebration sales up 53% in mid-November.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, US, Criteo data.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

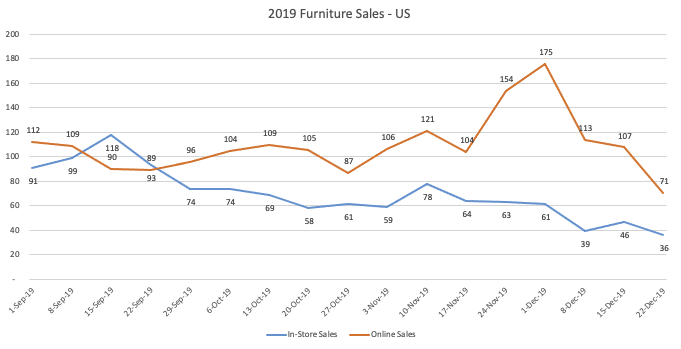

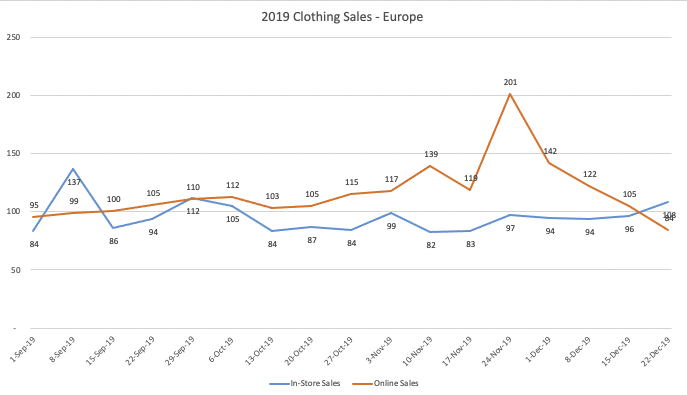

In 2019, Furniture (US) and Clothing (Europe) Saw Low In-Store Sales

Last year in the US, in-store sales of furniture steadily declined throughout the season. In Europe, clothing sales in stores stayed flat, with a very small increase just before Christmas. Black Friday is a good opportunity for retailers to make up some of those sales online.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, US, Criteo data.

Source: Indexed values based on average sales in the first four weeks of September 2019, All Retail, Europe, Criteo data.

Omnichannel Strategies for Peak Season 2020 and Beyond

As the state of Covid-19 changes from month to month and region to region around the world, so, too, does the state of the peak shopping season. To prepare for all possibilities marketers are optimizing their stores for a new world.

According to a Criteo survey of US marketers we conducted this October, 61% already offer contactless checkout and 53% offer click-and-collect/curbside pick-up. Another 37% plan to make click-and-collect available this season.

Many said they were also planning to introduce additional online-meets-offline experiences during the holiday season, including things like appointment-based shopping (33%) and virtual try-on (40%).1 We expect these measures to continue well into 2021.

To optimize for these experiences and defend and grow their share of wallet during the peak sales season and throughout 2021, retailers should connect their offline and online data to drive sales in the right channels at the right time. Here are three ways this can work:

-

Drive-to-Store

According to our Holiday & Festive Survey of consumers conducted in August 2020, more than a third of shoppers in the US, UK, France, and Germany said they plan to start searching for presents in physical stores.2

Where stores are open, whether fully or partially, use your store sales or visit data to optimize your digital ads for in-store outcomes, including visits and sales.

-

Store-to-Web

For customers not yet comfortable with in-person shopping options, or for areas where your stores must be closed, use your store, customer, or other offline data to drive business to your ecommerce site. Ramp up campaigns now to drive interest ahead of and into Black Friday/Cyber Monday.

-

Promote in-store and curbside pick-up

Research from Signifyd shows BOPIS (buy online, pickup in store) orders more than doubled globally in June 2020. It will be a major factor in where consumers decide to shop this season.

As December approaches, consumers worried about delivery delays will look for quicker, but still safe options. Use your data to capture shoppers with an intent to use click-and-collect and promote your in-store or curbside pick-up options in your ads.

Omnichannel Retail Trends to Watch in 2021

The consumer behavior changes we saw this year aren’t blips on the screen, but fundamental shifts that have altered retail as we know it. As we look to 2021 with fresh and hopeful eyes, here are the trends that will likely continue:

Click-and-collect will continue to be in demand.

According CommerceHub, 67% of those surveyed would continue using curbside pickup even after the pandemic.3 Keeping track of trends and analyzing your data to truly understand consumer needs will be key to keeping the right items in stock and maintaining customer satisfaction.

Visual storytelling will grow in importance.

Video ads, CTV ads, shoppable videos, 360-degree product views, influencer video livestreams, retail display ads—these and other forms of visual commerce will all be trends to watch for in 2021 and beyond. From your ad campaigns to your website, app, and in-store, reaching consumers with the power of video will be necessary to break through and create an emotional connection.

Attribution will be top of mind.

Being able to draw a direct line from online and offline sales to specific digital campaigns is important now and will be even more so moving forward. Partners that can help you deliver and measure impact across the full-funnel will be in high demand.

For more data, check out our Seasonal Sales Dashboard and the Criteo Holiday Product Finder. Access Criteo’s latest consumer research by downloading the guide:

1Source: Criteo, Covid-19 Impact on Marketing Survey, U.S., Oct 2020, N=100

2Source: Criteo, Holiday Season Survey, August 2020, US n=1,547; FR n=1,229; DE n=1,134; UK n=1,161.

3https://www.commercehub.com/resources/commercehub-covid-19-consumer-retail-trends-survey-6-months-later/