As we navigate 2024, we stand on the brink of a breakout moment for retail media, emphasizing the need for scale to reach the masses. Despite a significant surge in recent years, brands, agencies, and retailers have only skimmed the surface of retail media’s full-funnel potential. The prevailing focus on sponsored products, while lucrative, merely scratches the surface of the $100 billion market opportunity this year. The key to scaling and seizing more of this opportunity lies in unification — a strategic move to combat fragmentation and make buying and selling retail media more accessible.

The number one hurdle for retail media success is fragmentation, which according to Forrester can lead to nearly 20% revenue loss across retail media networks (RMNs). To maximize opportunities in the retail media landscape, simplifying the buying and selling process for brands and retailers is imperative in the face of its current fragmentation. At Criteo, we’re offering streamlined tools, such as our DSP, Commerce Max, as well as collaborating with the IAB, MRC and key industry partners to actively work towards standardization that benefits all stakeholders. While progress is happening, it’s clear that collective collaboration across the industry is essential to fully unleash the potential of retail and commerce media.

Retail media is now full funnel

Retail media has evolved into a full-funnel experience, extending beyond just sponsored ads to onsite display and offsite ads on the open web. This convergence of performance and brand awareness allows for a unified view of the consumer journey from upper to lower-funnel, linking open web discovery to transactions while also providing the holy grail of advertising: closed-loop measurement.

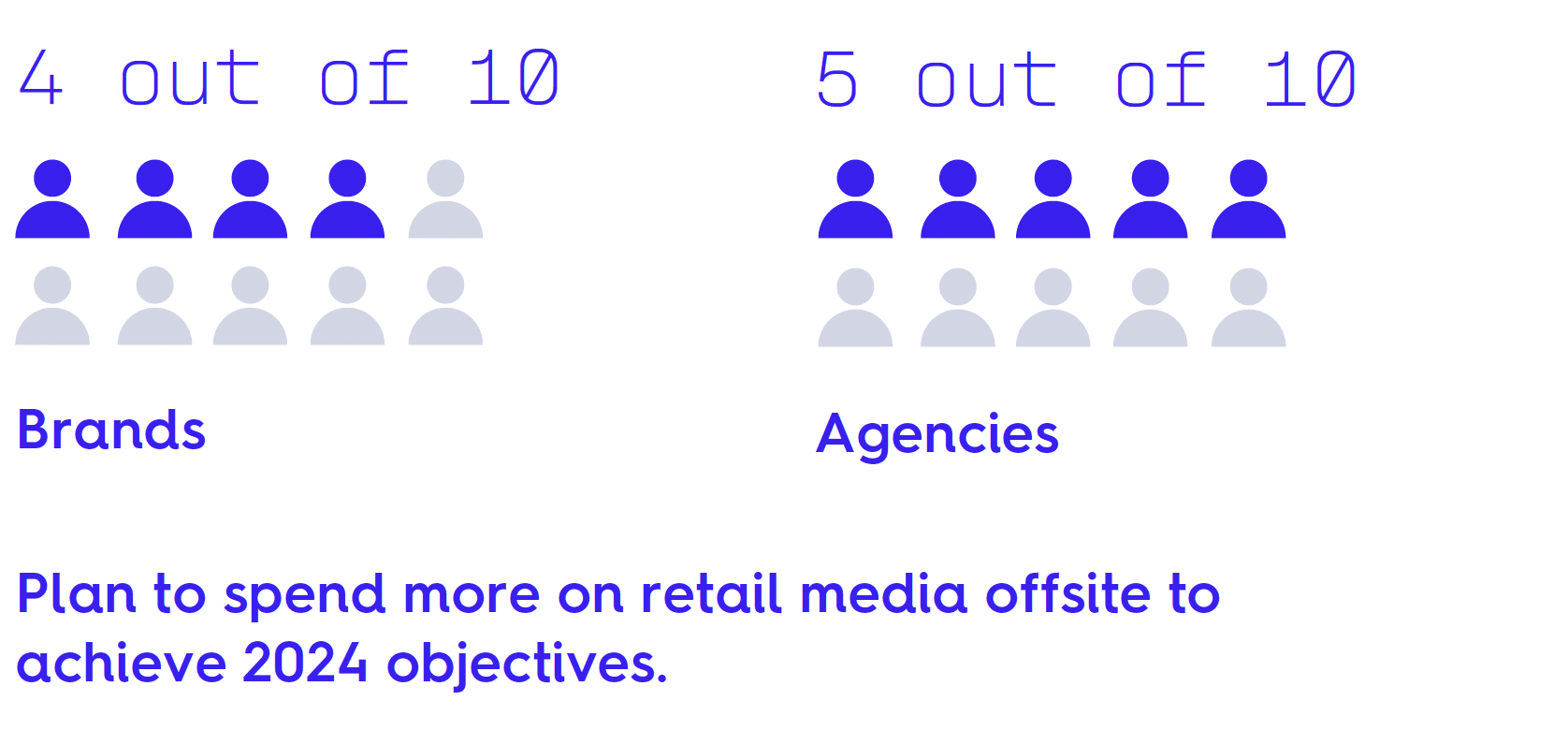

Integrating offsite with onsite sponsored and display ad opportunities has proven to significantly boost sales. According to Criteo’s latest report, “The Great Defrag: How commerce media will unite advertising in 2024” based on insights from 1,000+ global marketing leaders, shoppers exposed to both onsite and offsite ads are five times more likely to convert on the retailer’s site than those encountering only sponsored ads. This is a chance to connect a discovery impression on the open web to a transaction in a way that’s never been done before, and it’s a massive opportunity for brands.

Unlocking opportunities for brands

In 2024, the global trend is clear – 67% of brands are committed to increasing their investment in retail media compared to 2023. This increase isn’t surprising given that the channel consistently delivers results. For brands, retail media presents an invaluable asset that the industry has wanted for nearly 20 years: real-time data about how their products are selling at a given retailer. But to truly achieve scale, brands need to extend their product reach across multiple retailers.

As brands zero in on this scale mindset, there are three key metrics to prioritize:

1. ROAS on retail media channels to benchmark retail media performance against other digital channels and linear TV.

2. Incrementality: Measuring the additional onsite and in-store sales driven by retail media efforts.

3. Profit optimization: Identifying the most lucrative SKUs and exploring diverse formats and channels like display and offsite to promote these products.

This data-driven approach makes for agile optimization. And if brands leverage a DSP that allows them to scale their retail media activations across multiple retailers with full-funnel formats, such as Criteo’s Commerce Max, they’re able to scale and enhance their campaigns as quickly as possible.

How retailers can scale

The key driver for retailers lies in the influx of $100 billion in media spend from brands. But the true unlock is determined by how retailers strategically use this spend to enhance the overall experience for consumers. Retailers can revolutionize their practices, whether through sourcing superior products, expediting delivery or other means that benefit shoppers. Each retailer is on a unique maturity cycle with distinct assets, such as data, loyalty programs, existing onsite media and measurement capabilities.

To best serve their growth, retailers need to ask themselves this fundamental question: Are you primarily a retailer or a media company? This distinction is pivotal in the unlocking process, since the approach to being a media company differs significantly from that of a retailer. The primary focus should always revolve around engaging with consumers and leveraging media to enhance every touchpoint. This strategic approach ultimately leads to increased discovery, more purchases, and the desired outcome – more transactions and growth for retailers.

Taking the simplified path forward

To effectively streamline and scale retail media programs, retailers and brands need the right tools. Criteo is addressing this need with solutions that combat fragmentation, employing a unified approach for the monetization and activation of multi-channel, multi-retailer retail media campaigns. This includes optimization through closed-loop measurement and actionable commerce insights, all accessible from a single platform, Commerce Max.

Retail media is at the forefront of industry defragmentation, leveraging first-party data, closed-loop reporting and full-funnel activations. For brands, our retailers provide invaluable transaction data at the point of purchase, facilitating engagement across our extensive network of 220 global retailers. Beginning with sponsored ads, progressing to display, and considering offsite opportunities is the strategic approach for retail media.

Retail media can be a complex landscape, but it’s our commitment to simplify it for brands, agencies, retailers and publishers alike. The smoother the process of buying and selling retail media, the quicker we can collectively tap into the vast potential of the $100 billion market opportunity together.

For more insights on the 2024 outlook for retail media and how to navigate the hurdles on the path to simplification, download our new report, “The Great Defrag: How commerce media will unite advertising in 2024.”