Ramadan starts on April 23 and lasts until May 23. Traditionally a month of reflection, fasting, and prayer, this holiday is observed by Muslims around the world. As one of the most important periods of the year for Muslims, Ramadan has become a key period for marketers who want to connect with Muslim shoppers.

Ramadan is a holy month marked by gratitude, prayer, family, and community. So, businesses that do build ad campaigns have to think carefully about what is said and how products are advertised. How can you create marketing campaigns that celebrate the holiday and show that your brand really understands shoppers who observe it?

As Criteo data shows, Ramadan marketing can drive significant results for businesses. Here’s what we found:

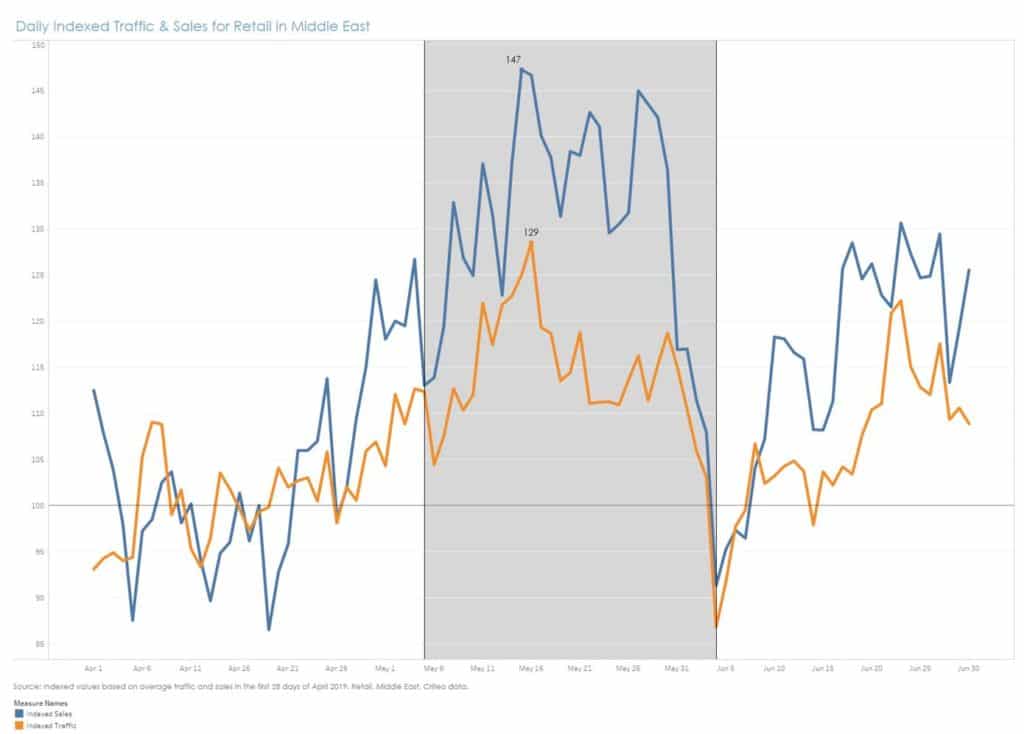

1. Sales & Traffic Rise Before, During, and After Ramadan.

Even before Ramadan starts, our data shows that consumers are searching and buying retail products. When the holy month does start, those patterns become even more prominent. In the third week of Ramadan, sales rise almost 50% when compared to the baseline.

It’s clear that Ramadan is a crucial month for retailers that operate in the region. The question, then, is what happens after Ramadan?

Interestingly, we found that sales don’t slow down. Even after Ramadan, retailers see more web traffic as well as more sales than before Ramadan.

2. The Second Half of Ramadan = Conversions.

Our data revealed that not every week of Ramadan is necessarily a time when people are browsing and buying. During the week of Eid al-Fitr – when Muslims traditionally break the Ramadan fast with festivals and dinners – conversions plummet.

We found that the best opportunity for connecting with shoppers is before Eid al-Fitr, during the second half of Ramadan.

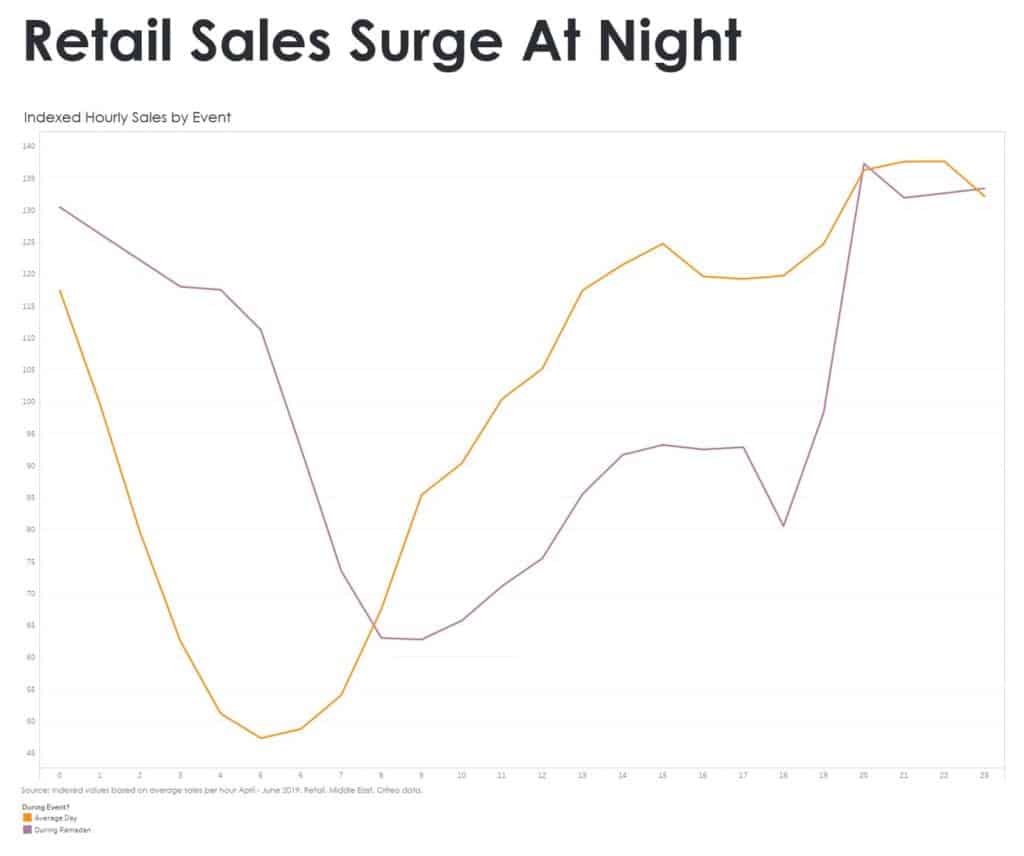

3. Sales Happen at Sundown

Muslims who observe Ramadan fast from dawn to dusk. It’s not until after dusk that they can break the fast with family and friends. That also happens to be when we see a significant spike in sales activity. As we can see in the chart, sales continue to grow throughout the day.

Even right before the fast begins, people are shopping – sales at 4am during Ramadan are 17% higher than an average day.

All that said, we do see a dip around 6pm when the fast ends each day. That’s something to notice, too. When people are having their first meal after the fast, no one is thinking about shopping.

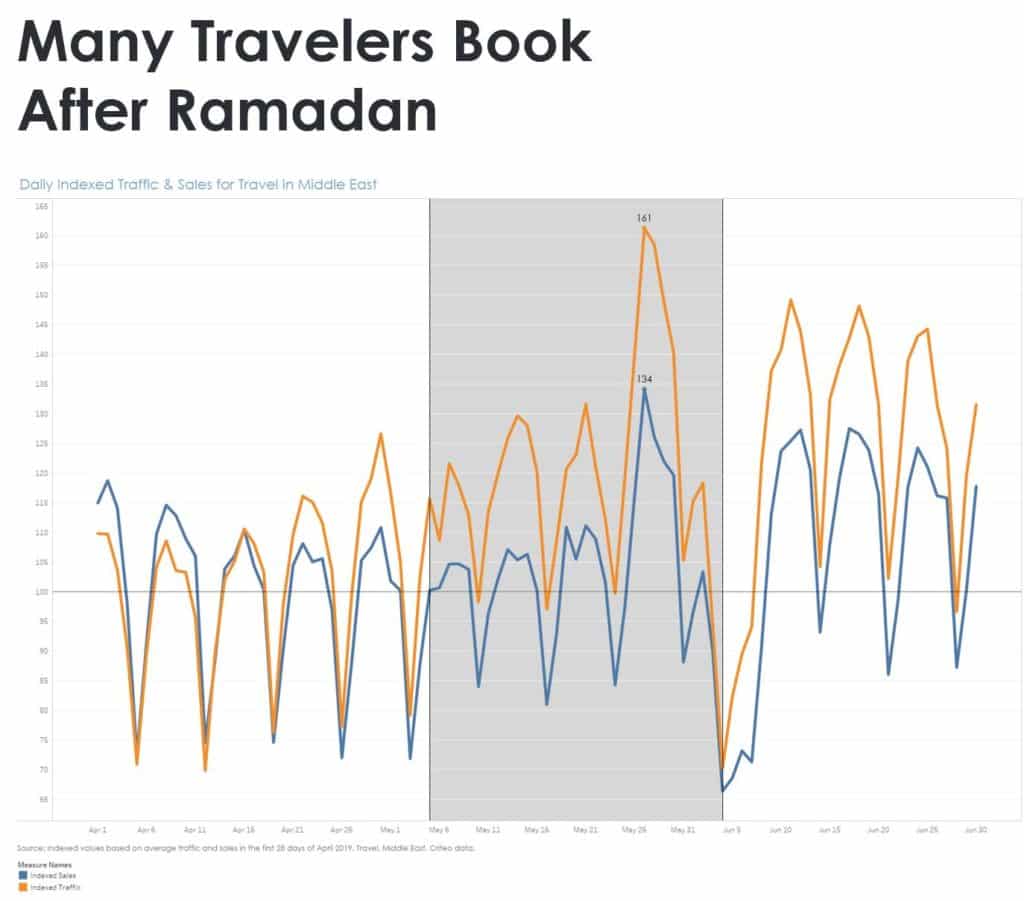

4. Ramadan is a Time to Plan for Travel

After Ramadan, we consistently see both web traffic and sales across travel players start to rise. During Ramadan, it seems that a lot of prospective travelers start to visit different travel websites. However, that doesn’t turn into traveling bookings until late in the month and after Ramadan. This year, experts believe that coronavirus will likely have an impact on travel plans. There’s no telling how this will disrupt the ordinary travel patterns we saw last year.

These numbers may be influenced by travelers who are visiting family for the month, or some travelers may be thinking about booking a vacation post-Ramadan.

5. The Month of Mobile

Desktop sales in the Middle East are extremely strong, accounting for approximately 80% of retail sales. Ramadan shows decidedly different buying pattern. We’ve seen this before – during family holidays, mobile purchases and traffic always go up.

We believe this is simply because people who are visiting home are away from their primary computers, whether personal or business. Since they are with their family and friends during Iftar and Suhoor, phones are usually their primary way to research and buy. Weekly mobile sales grew by 61% during the week of Eid al-Fitr.

How to Build a Ramadan Marketing Campaign

As we covered, Ramadan is a holiday that is about gratitude, community, family, and prayer.

That leaves an opportunity for brands to build a lasting relationship with shoppers who are preparing for Ramadan or browsing during the month. Last year, Oreo built on the message of community and giving, by running an ad across Indonesia that showed a boy giving Oreos out to strangers in the spirit of Ramadan.

Apple, meanwhile, offered an ad that wasn’t an ad, either. This ad showed easy ways to use an iPhone to focus during Ramadan by turning on the “Do Not Disturb” option or using an app to help with mindfulness.

How can you build a great Ramadan marketing campaign in 2020? Here’s what we’ve learned.

1. Go Beyond Price

Ramadan is about family and prayer first and foremost. It’s not a time when shoppers are necessarily looking for deals. In fact, flashy ads that are only about deals and discounts may backfire. Ads specific to Ramadan, as we’ve seen with Oreo and Apple above, should focus on the meaning of the holiday itself. This can play an important role in whether shoppers notice the ad or not. So, as you think about creative, focus more on the holiday and less on the price.

2. Find Your Potential Shoppers

Ramadan marketing campaigns should be targeted to the customer base most likely to shop during the Ramadan period. If you’ve run previous Ramadan campaigns, it’s important to reconnect with those shoppers. With Criteo, you can sync your CRM data, email list, or in-store system and serve ads to any customers who previously shopped with you and opted in for further communications. You may also want to target specifically by region.

3. Products

Ramadan shoppers are likely to be looking for things that help them observe Ramadan – and those purchases vary by time period. Before Ramadan, we could expect groceries, décor, and home goods especially to rise. Travel planning and gift purchases could happen as the holiday progresses.

By knowing what your customers need for Ramadan, you can create more personalized campaigns.

Expanding Your Market

Dozens of countries around the world observe Ramadan. The potential of investing in Ramadan marketing campaigns is extremely high, but only if the ads are relevant to the holiday itself. As you prepare your Ramadan marketing campaign in 2020, it’s important to remember that the more personalized, the better the returns. When it comes to building ads that really make an impact, context is everything.