Catalyst and Kantar recently teamed up to release a comprehensive study compiled to, in their words, “inform the marketing efforts of brands and advertisers across ecommerce and retail media.” The resulting “State of Ecommerce 2021” is a wide-ranging report based on two surveys – one of online purchasers and one of industry professionals.

Within the 38 pages are dozens of interesting data points and insights, but what stood out most to us were these four retail media findings:

Retailer sites and apps are key throughout the purchase journey

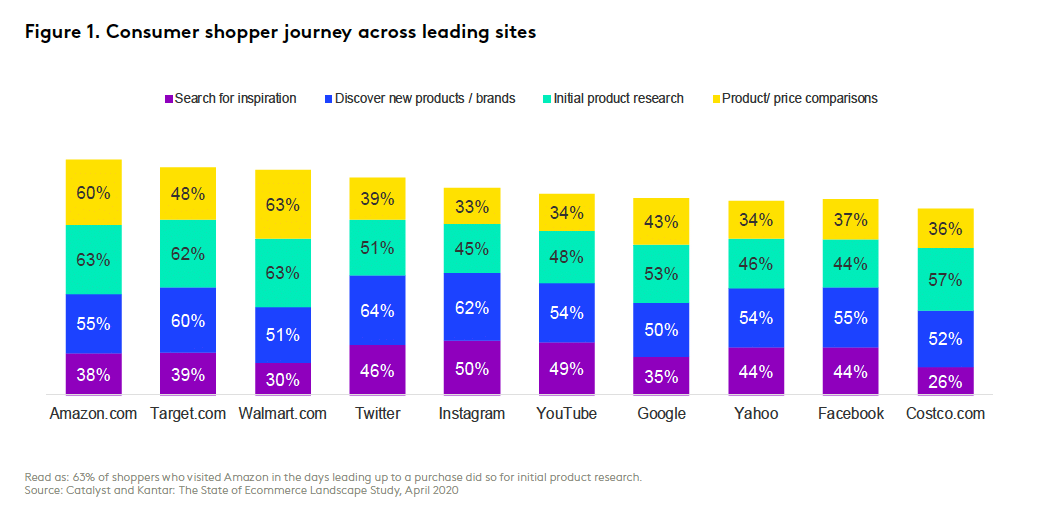

Kantar’s report showed that, when considering a purchase, retailer websites and apps are a critical step in the journey. In fact, according to their research, online shoppers who made a purchase were more likely to visit retailer websites and apps than any other touchpoint (37%), including search and social.

And according to the chart below, it’s not just for product and price comparisons. Retailer websites and apps play a major role in the initial product research and discovery of new products and brands, too.

Our own Managing Director of Retail Media for the Americas, Sherry Smith, who participated in the study, explains, “It’s unsurprising to see that retailer sites are critical in the online path to purchase, and it’s important to remember that a large percentage of people are doing research online prior to completing in-store transactions, as well. Many retailers have digital audiences that are comparable in size to the largest media properties, and advertising on retailer sites offers brands the ability to reach captive consumers with high purchase intent, whether the consumer ultimately chooses home delivery, click and collect, or to go into a physical retail store.”

“Brands need retailers and retailers need brands”

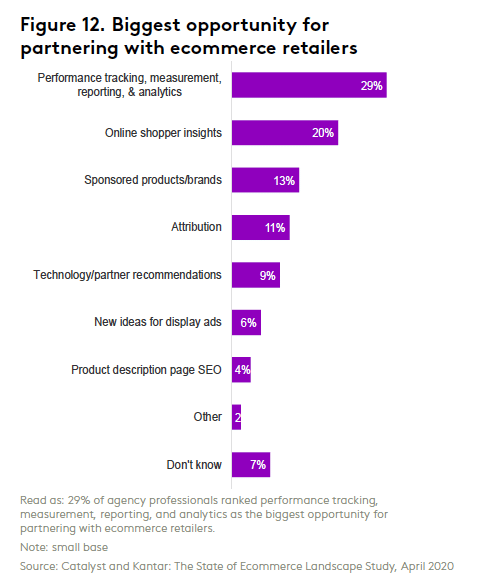

The desire for more collaboration was another interesting takeaway from the report. In the survey, multiple ecommerce professionals called for brands and retailers to increase understanding and the sharing of data and metrics.

The report highlights how brands are eager to elevate their relationships with their retailer partners. “The brands and retailers we work with want to have closer relationships and easier ways to work together. Brands want tools more in line with platforms they use to buy other types of media, and the ability to streamline retail media execution across their major retailer partners,” says Smith. “In order to deliver against this expectation, retailers are increasingly looking for technology partners who can help provide advanced tools to build ads, optimize targeting, and measure performance, and who can create a retail media ecosystem with normalized ad formats and reporting.”

In terms of the top opportunities for partnering with retailers, brands listed performance tracking, measurement, reporting and analytics; online shopper insights; and sponsored products as their top three.

Looking Beyond ROAS

According to the report, many marketers admit it’s tempting to rely primarily on ROAS to gauge success, but ROAS does not provide the full picture. The Director of Commerce Marketing at GSK, Steve Kinsey says, “ROAS is a very crude and very incomplete data point. We look at it, we measure it, we monitor it because it is an easy number to calculate, but it can be highly misleading.” Multiple professionals interviewed for the report recommended considering a range of other metrics to create a more complete picture of performance.

One of the core value props behind retail media is its accountability, but an increasing number of brands want more than just standard media metrics. As brands get more sophisticated, they want to move beyond sales volume and ROAS, and understand metrics such as lifetime value. Some forward-thinking brands are even focusing on metrics such as share of category and share of voice.

Leaning in to the “momentum mindset”

The report also highlighted the “momentum mindset” that ecommerce professionals have had to adopt. In an industry that changes rapidly, the general consensus is that there isn’t time to perfect your strategy. Waiting to do so will slow momentum and delay progress.

Instead, ecommerce professionals are testing continuously, learning from failures, and staying agile. A good example of this are the brands experimenting with a direct-to-consumer (DTC) model. Along with the benefits, there are some “watch-outs”, as the report calls them, that have some brands reversing or modifying their DTC plans. Georgia-Pacific’s Brand Building Leader Ricky Busby says, “Early DTC players are now selling in-store because there is a limit to the volume they can sell online”. In light of the growth and revenue limitations, he predicts that many brands will opt for some kind of hybrid model.

Indeed, brands will continue to rely on their retail partners, and the test and learn approach is especially urgent in the still maturing retail media segment. As browsers phase out third party cookies, retail media also offers brands opportunities to reach valuable audience segments without relying on these tracking mechanisms. Brands that evolve with the medium will be well positioned for the future of ecommerce.

The report sums it up best: “Though navigating the uncharted waters of a new platform or new offering can be uncomfortable, doing so will pay off in the long run with insights, learnings, and expertise that create sustained competitive advantage.”

Access Kantar’s State of Ecommerce 2021 report here.