Prior to the pandemic, walled gardens like Google, Amazon, and Facebook were leading players when it came to delivering seamless online experiences. But since 2019, many retailers and brands have made huge improvements to their web properties—and shoppers have noticed.

Our recent global Shopper Story Survey, which included more than 7,000 respondents from around the world, found that four out of five consumers think searching for and finding a product on retailer and brand websites has improved in the last two years.

Add to that simpler checkout processes and better delivery or fulfillment options, and it’s easy to see why shoppers enjoy the diversity of products, content, and services offered on the open internet. Here are a few more reasons why the open internet is the go-to destination for consumers.

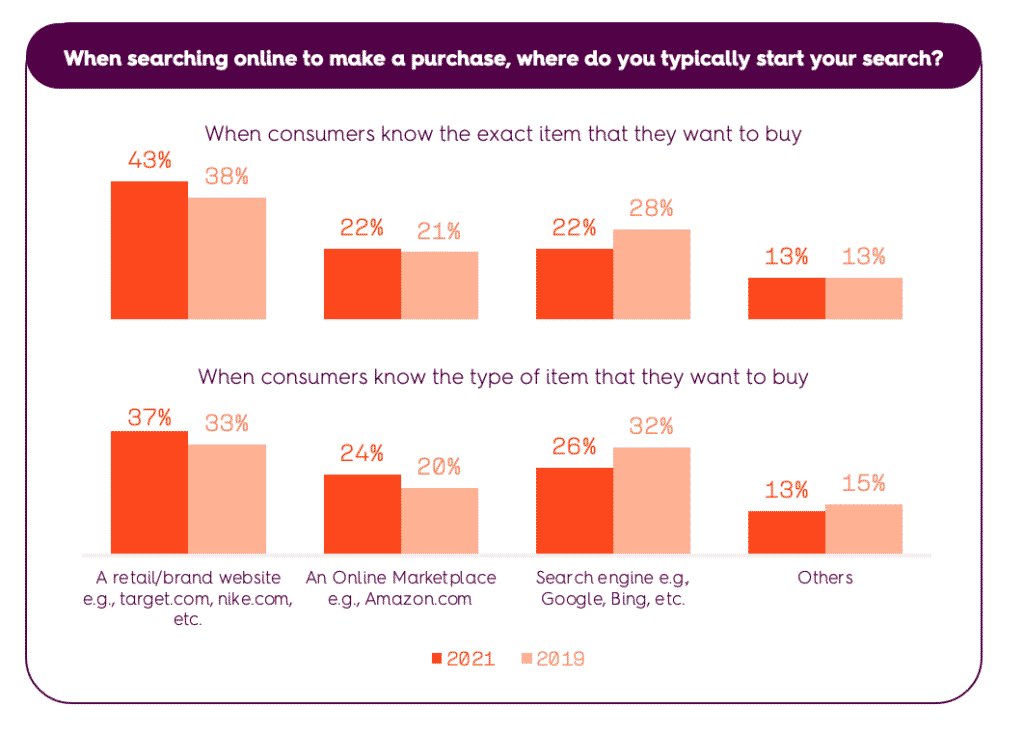

Shoppers often begin their product search on retail/brand websites.

Our research shows that compared to 2019, more shoppers are now starting their product search on retail and brand websites, which are surpassing online marketplaces and search engines as the leading first touchpoint. This trend holds true even when shoppers haven’t settled on a specific item yet.

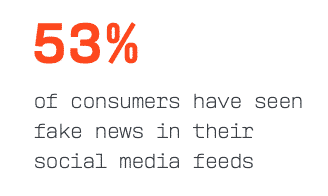

Consumers question the content inside walled gardens.

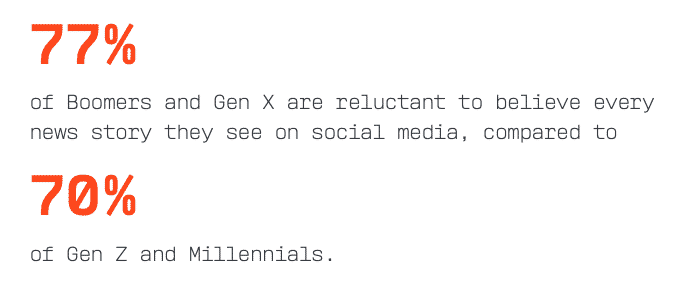

Our global Consumer Sentiment Index survey confirms that over half of respondents have reservations about the news they see inside walled gardens:

Source: Criteo Consumer Sentiment Index, Global (Australia, France, Germany, India, Italy, Japan, South Korea, Spain, UK, US), November 2021, N=3805.

Our study further reveals that older generations are more likely than their younger counterparts to put social content under scrutiny: 77% of Boomers and Gen X are reluctant to believe every news story they see, versus 70% of Gen Z and Millennials who say the same thing.

Mature audiences are even more skeptical in the US and UK, where close to nine in 10 Boomers told us they question the news in their social feeds. Shoppers also question the legitimacy of products themselves: The same Criteo study shows that about half of consumers suspect that some of the products they see on Amazon are counterfeit.

Consumers turn to the open internet for valuable information.

Seven in 10 (68%) of consumers told us that before buying products they’ve never bought before or important products, they frequently read informative articles on the open internet. Think, reading home improvement blog posts on “best lawn mowers in 2021” or looking at tech websites to compare different cloud-connected security systems.

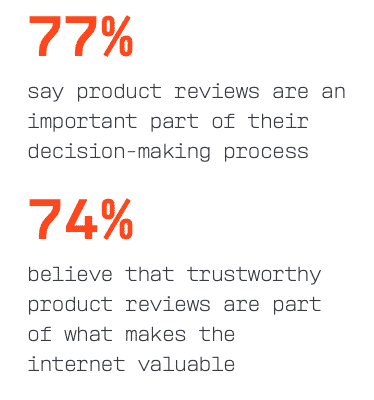

Most consumers value product reviews, with 77% saying they are an important part of their decision-making process and nearly three quarters reporting that trustworthy product reviews are part of what makes the internet valuable.

Source: Criteo Consumer Sentiment Index, Global (Australia, France, Germany, India, Italy, Japan, South Korea, Spain, UK, US), November 2021, N=3805.

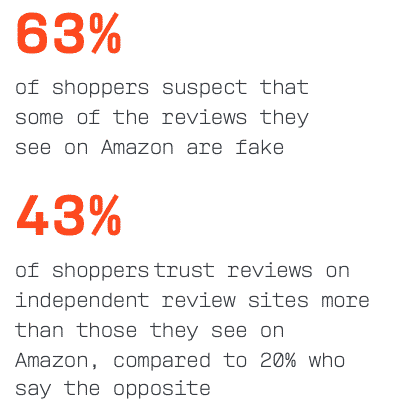

But their influence depends on where they appear. Nearly two-thirds of shoppers suspect that some of the reviews they see on Amazon are fake, and 43% trust reviews on independent review sites more than those they see on Amazon, compared to just 20% who say the opposite.

Source: Criteo Consumer Sentiment Index, Global (Australia, France, Germany, India, Italy, Japan, South Korea, Spain, UK, US), November 2021, N=3805.

In short, most consumers know that walled gardens have limitations when it comes to commerce, and they’re intentionally visiting publisher, retailer, and brand websites before making a purchase.

For the full story, download our report:

Want more insights on consumers’ online shopping habits? Download Criteo’s 2023 Onsite Shopper Behavior Report: How Brands Can Maximize Retail Media Campaigns on how shoppers are buying on retail sites, the impact of ads on shopper purchases, and how brands can use these insights for immediate impact.