Where do shoppers go first when they’re not sure what product they’re looking for? Everyone’s talking about AI, chatbots, and chatGPT—but are consumers actually using them to help them shop? How many people research online before buying in store? As we head into the busy Q4 season, our experts shared some eye-opening data about shopping inspiration that helps answer these questions and more.

Our Insights and Analytics team is constantly mining gold from our trove of commerce data. From product category sales trends around the world, to shopper behavior insights from our monthly consumer surveys, they have their fingers on the pulse of shopping at any given moment. Here’s what you need to know about where and how consumers discover and decide what products to buy:

Online retailers are the #1 destination for shopping inspiration

According to our most recent Consumer Sentiment Index survey, the largest share of US shoppers say online retailers are where they go first to find product inspiration. Nearly 50% of shoppers start their search at an online retailer, and a third begin at an online brand. In the UK, online retailers were second only to search engines, with 44% saying that’s where they start their search, and a third saying that they begin at an online brand. This means brands should consider boosting ad spend on retailers where the most discovery is happening and prioritize online touchpoints for awareness.

Online touchpoints are even more important for last-minute holiday shoppers

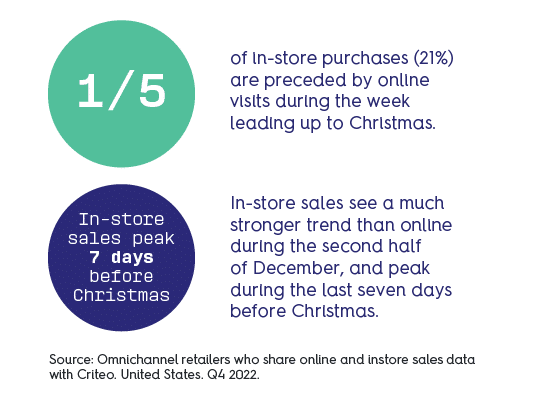

As time runs out, more holiday shoppers research online before buying in a physical store. During the week leading up to Christmas, over 1/5 of in-store purchases (21% in the US, 19% in the EU) were preceded by online visits, as shoppers research and compare online before buying in store. This is up compared to earlier in November, when only 16% of US purchases were preceded by online visits (It’s a smaller increase in the EU, up from from 17%). In-store sales see a much stronger trend than online during the second half of December, and peak during the last seven days before Christmas.

Marketers should be sure to maintain online campaigns through the entirety of the season to influence these last-minute shoppers who are evaluating which physical store to purchase from.

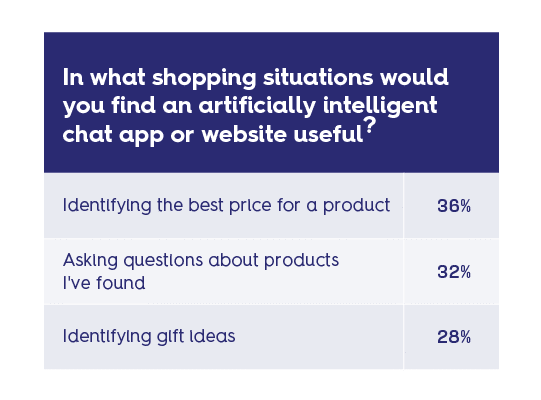

4 in 5 consumers see AI as a useful shopping tool

Shoppers are already seeing the value of AI, with only 18% of US shoppers and 21% of UK shoppers saying they do not find AI useful for any shopping situations. The largest share of respondents cited the following as the best uses for it while shopping: Identifying the best price for a product (36% of US shoppers, 29% of UK shoppers), Asking questions about products I’ve found (32% of US shoppers, 30% of UK shoppers), Identifying gift ideas (28% of US shoppers, 25% of UK shoppers). This makes it clear that starting today, AI needs to be a part of the mix, and leveraged as a tool that can help with product selection and customer experience.

A majority of shoppers click on product links as they’re browsing the open web

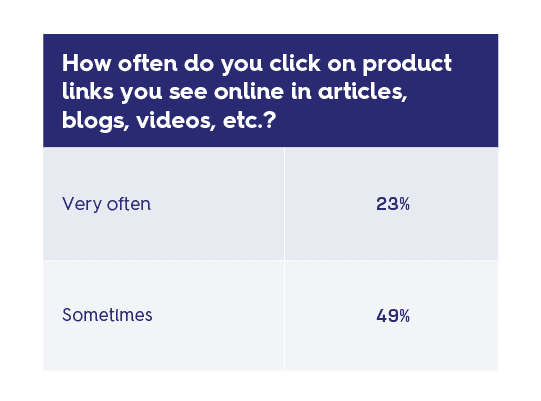

More than half of shoppers (72% in the US, 56% in the UK) said they click on product links sometimes or very often as they’re engaging with content throughout the web. Marketers that innovate with shoppable ads or QR codes in video and CTV ads can seamlessly move shoppers from discovery to purchase.

Takeaways for marketers:

- Boost ad spend on online retailers where many consumers say they begin their product search and prioritize online touchpoints for awareness.

- Maintain online campaigns through the entirety of the holiday and festive season to influence last-minute shoppers who are increasingly going online first to evaluate which physical store to purchase from.

- Make sure you’re leveraging AI (such as a chatbot) to help with product selection and customer experience, which shoppers consider as the top uses for AI.

- Shoppers confirm they click on product links when they’re browsing the open web–innovate with shoppable ads or QR codes in video and CTV ads to seamlessly move shoppers from discovery to purchase.