This post was republished from Bankingdive.com

It’s hard to believe there was a time when consumers couldn’t access their bank account from a smartphone or even their laptop. But as recently as the 1980s, what’s commonly referred to today as digital banking was quite a different story. Back then, online banking meant using a terminal, a keyboard and a television or desktop monitor to access a bank account using a landline telephone dial-up. ATMs in stores, at airports and on street corners offered more freedom by enabling customers to get cash and make deposits at places other than inside a bank branch.

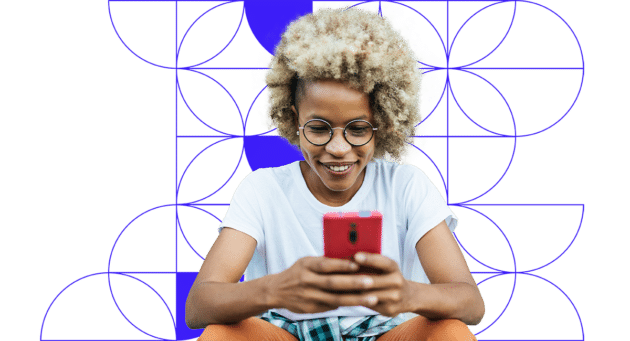

Today, of course, online banking is everywhere, giving consumers 24/7 access to their accounts, investments, bill paying, money transfers, and loan products from anywhere — desktop, laptop, or smartphone. In fact, according to surveys by J.D. Power, nearly 40% of Americans said that during the height of the coronavirus pandemic they were using their bank’s mobile app more than ever before. And with the pandemic forcing consumers to manage their money remotely, including mobile deposits of checks, the trend is likely to continue. “Consumers had to move to mobile apps during the pandemic, but now understand how convenient this can be,” said Dave Sewell, head of lead gen account strategy at Criteo.

“The evolution of the internet and e-commerce changed the dynamic of the banking relationship with consumers,” he said. “Banks very quickly needed to catch up and have their mobile app or mobile website become an extension of their brick-and-mortar location so they aren’t left behind. The pandemic is just speeding all this up.”

Indeed, with consumers on the go — and looking for alternatives to in-person banking — the demand for quick and easy solutions is increasing rapidly. A July 2020 survey of U.S. consumers from Cornerstone Advisors found that 14.2 million Americans — 6% of U.S. adults with a checking account — now consider a digital bank to be their primary bank — a 67% jump from January.

Legacy banks with networks of brick-and-mortar locations are finally realizing that not everyone — and certainly not younger people — wants to visit a bank branch, and in many cases, they’re not able to do so. Online banking is certainly one solution, but newer startups and digital-first challengers are proving that they can provide this — and so much more — right from a smartphone.

These digital-first banks — banks without physical branches — give consumers an even greater degree of convenience by enabling them to quickly open and fund a bank account right from their phone. “When banks essentially shut down during the early days of the pandemic, it didn’t decrease the need for banking,” Sewell said. “It simply forced more consumers to get comfortable with digital banking, in much the same way they had to get comfortable buying groceries online. I don’t think this trend in banking is going away.”

That can still be good news for legacy banks. Unlike fintech startups, these well-established firms have decades of experience, substantial financial resources and long-standing relationships with their customers. They can act quickly to launch more convenient and personalized services that match the needs of their customers.

Sewell used Zelle as an example of this response. In 2017, in the wake of Venmo, Popmoney, and Apple Pay — apps that make digital cash transfers easy and quick — banks realized they were falling behind. So, a group of them, including Bank of America and Capital One, joined together to create a rival product — Zelle. “Banks saw that there was a need for people to get money from one person to another faster, so they responded,” Sewell said. “I think we’re going to see more of that kind of customized response going forward.”

The shift and growth in digital banking is affecting brick-and-mortar locations as well. As banks continue to serve a more remote customer base, there’s a likelihood that there will be fewer of these physical branches, Sewell said. Creating new, attractive uses for the remaining ones will be the next challenge for legacy banks. “For the most part, customers don’t need to come into a branch to open an account or order checks,” he said. “All of these functions can be done online.”

Instead, in the age of COVID-19 legacy banks would be wise to create differentiated offerings that capitalize on the fact that their branches can bring people together in a way that their digitally native competitors can’t. Capital One Cafés, for instance, are the bank’s take on reimagining what a bank branch can be. Launched in 2015, the company says they’re meant to play an active role in the community, giving individuals a place to gather, work, have a cup of coffee—and yes, even get some banking done.

Modern banking is all about making it easier for people to connect to their money faster and more efficiently. And as banks increasingly focus on what customers want from a mobile experience, the way we bank will naturally change. “Personalization is going to be key as we go forward,” Sewell said. “Just as we have digitally native banking platforms, we have digitally native consumers, meaning they are individuals who don’t remember a time without the internet.” Legacy banks are going to have to be flexible and very personalized to match the needs of those consumers.

“I always say it’s smart to meet your customers where they are rather force them to be where you are,” Sewell added. “Banks are learning that in a big way.”