Online retailers are under pressure to offer the lowest prices and the fastest shipping. And they’re competing with Amazon, which has a 38% share of total ecommerce sales in the US—not to mention a thriving media business.

As retailers plan for 2020, many are looking for opportunities to grow their digital businesses. They’re focused on increasing online sales and getting a bigger slice of the ecommerce market.

But there’s something missing in their plans: retail media.

What is retail media?

Retail media takes the advertising model used by digital publishers and applies it to ecommerce sites.

Advertisers are attracted to digital publishers because they have large audiences and engaged readers. Digital retailers have these same engaged audiences, and something extra: Their site visitors have a high intent to browse and buy products. It’s the perfect context for brands, who once paid for the best shelf space in physical stores and now want better visibility on retailers’ digital shelves.

Retailers also possess valuable first-party data that brands need to attribute their ad campaigns back to SKU-level sales. (Brands that sell most of their products through retailers don’t have point-of-sale data, so they can’t see what their customers actually bought.)

When retailers open up their websites to brand advertising, they can offer these benefits to their brand partners and create a new steady revenue stream for their businesses.

According to Forrester’s “Retailers: You’re the Next Media Moguls” (December 2018, subscription required), written by Sucharita Kodali with Fiona Swerdlow, Susan Bidel, Collin Colburn, Joanna O’Connell, and Heidi Anderson: “Commerce is still brutally competitive, and shoppers continue to hunt for the cheapest price, further depressing retailer margins. Advertising represents an ancillary revenue stream that has higher margins than many traditional retail categories like grocery or electronics.”

Online retailers that want to survive in a price- and convenience-driven world and compete with Amazon have to start building up their retail media businesses. Look at Best Buy, Expedia, Target, and Walmart; these established retailers are successfully monetizing their digital storefronts and first-party customer data.

Why aren’t more retailers trying retail media?

Brands are ready to invest in new commerce-driven advertising channels, and retailers have the foundation to build their retail media businesses. So what’s shopping retailers?

Let’s look at three big misconceptions holding retailers back, and how to fix them.

Myth #1: I Don’t Have the Expertise In-House to Build My Retail Media Business

Retailers know that for their retail media business to be successful, it needs to be scalable and cost efficient. It also has to be easy for brand advertisers to manage their own campaigns through a self-service platform and get full transparency into performance—just like brands are used to from their other advertising partners.

For a company like Amazon, that meant assembling a new team dedicated to retail media. But not every retailer can afford to build its own business in-house.

The right technology partner will not only get their business up and running, but also bring them into a broader retail media ecosystem, where retailers come together to create enough scale to compete in the advertising marketplace and attract more brand advertisers.

“Even small merchants, which may not have scale but do have attractive, passionate audiences, can partner with technology vendors in the space and cultivate ad partnerships that are valuable for their customers and marketers,” Kodali writes in Forrester’s report. “Consider partnering with companies like Criteo Retail Media and Intent Media, which have turnkey offerings to help commerce companies get set up and mine their first-party data to intelligently showcase ads to different audiences.”

Myth #2: Ads Will Ruin the Shopper Experience on My Website

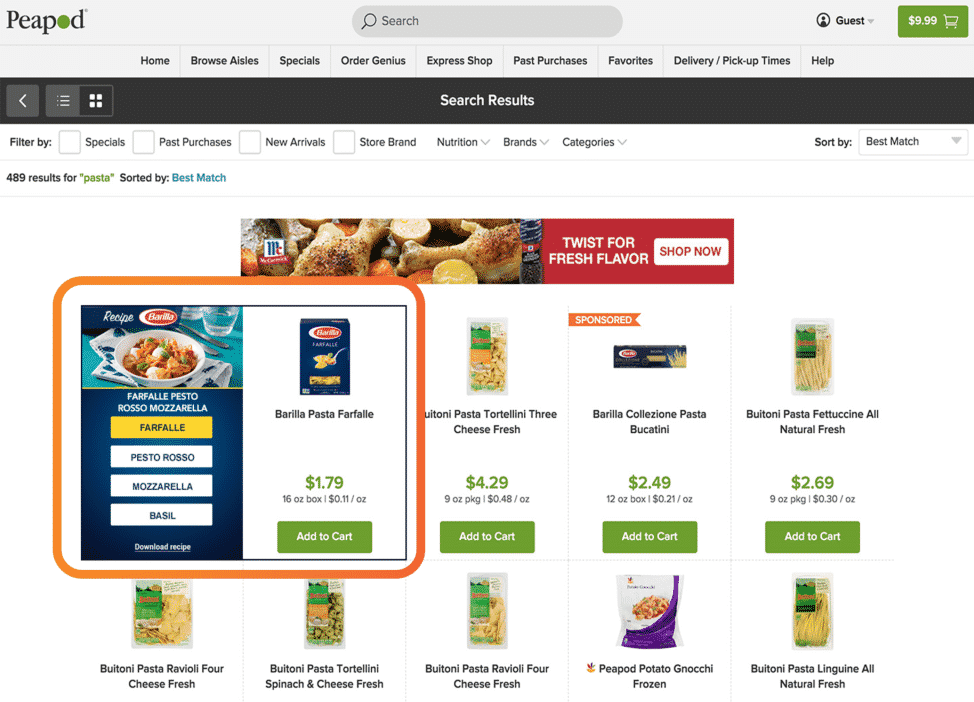

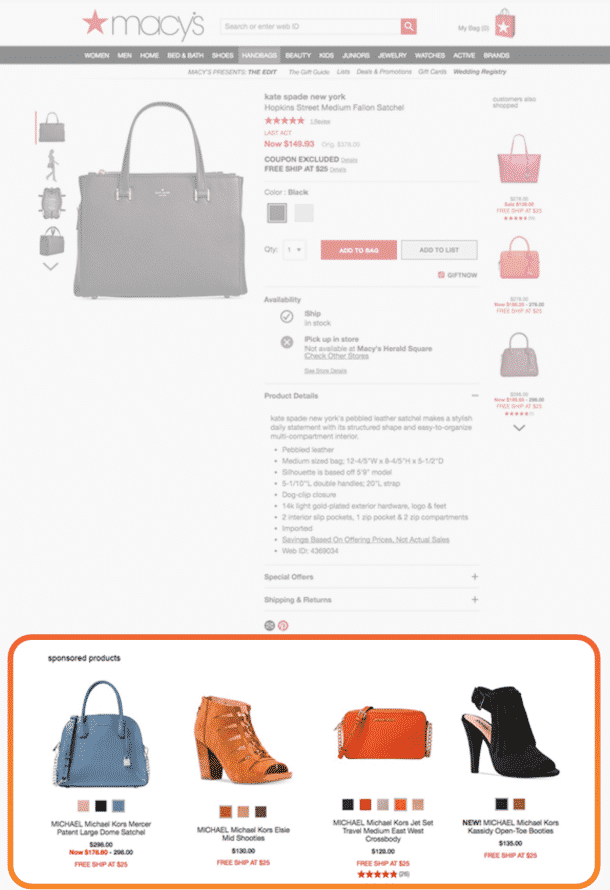

The shopper experience should always come first. When advertising on ecommerce sites is done right, the ads feel like part of the browsing experience and help shoppers make more informed purchase decisions.

Native retail media ads should appear in the right context and not disrupt the shopping session, like sponsored search results that match the look and feel of organic results. Great ads also give helpful information like real-time pricing and product availability.

While shoppers get relevant product recommendations that help them find what they want to buy, brands generate more interest in their products and together, brands and retailers drive more sales.

As Kodali writes in the Forrester report, “the needs of shoppers, marketers, and retailers have converged, leading commerce companies to explore opportunities from ad revenue.”

Myth #3: Retail Media Will Put My Customers’ Personal Data at Risk

Consumers are getting more protective over their personal data. But at the same time, brands are eager to target retailers’ valuable audience segments defined by their first-party data.

There are ways for retailers to provide value to brand advertisers while also protecting consumer privacy. The first step is making privacy the No. 1 priority when they’re looking for a partner.

“Marketers expect retailers to share conversion and sales data with brands, but retailers have found it prudent to protect their shoppers’ data and not fall foul of the same discussions around privacy violations that Facebook and other third-party retargeters have experienced,” according to Forrester’s report. “With rich purchase graphs, match-back analyses, and media mix models, retailer-led media networks have nonetheless proven valuable to marketers without the need for extraneous data.”

Retailers should ask their potential technology partners two key questions: Are you helping me leverage data that’s collected in a privacy-compliant way? And do you have tools that let me control exactly who has access to my audience data? The right partner can do both.

The retail media opportunity is now

Global digital ad spending is still growing. Brands want to invest in channels where they can drive conversions and attribute their spend back to sales, and they want better placements on crowded digital shelves.

Forrester’s report predicts that retail media will become a standard part of retailer revenue.

It’s not too late for retailers to build competitive media businesses, but if they don’t start now, they risk falling behind.

We built Criteo Retail Media to solve every challenge that’s keeping retailers from opening this new revenue stream—including all of the above and more.