The holiday season isn’t just about feasting on turkey and pie—it’s also a feast for Consumer Packaged Goods (CPG) sales. Black Friday and the surrounding weeks mark a pivotal time for brands and retailers, with sales skyrocketing as more shoppers globally stock up for festive gatherings and year-end celebrations.

Criteo’s report, The State of CPG, uncovers the trends you need to know to engage shoppers during peak Q4 shopping moments. Dive into the data to uncover the behaviors fueling this holiday shopping spree.

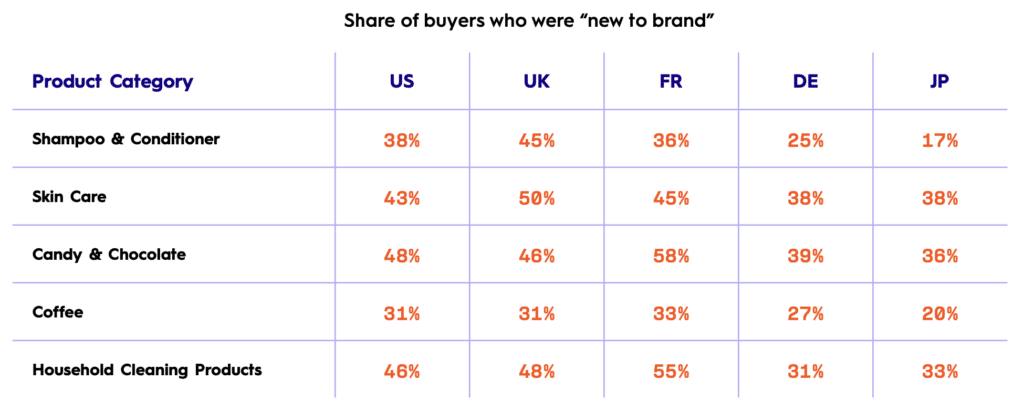

Carts are prone to switching lanes

Brand loyalty isn’t always a given, especially during the holiday season when deals and variety take center stage. In fact, up to 58% of frequent CPG shoppers globally chose a brand they hadn’t bought from in the past year for their most recent purchase.

With shoppers open to exploring new options, the holiday season is a prime opportunity for brands to capture attention and convert new shoppers.

Black Friday shoppers are more than just one-timers

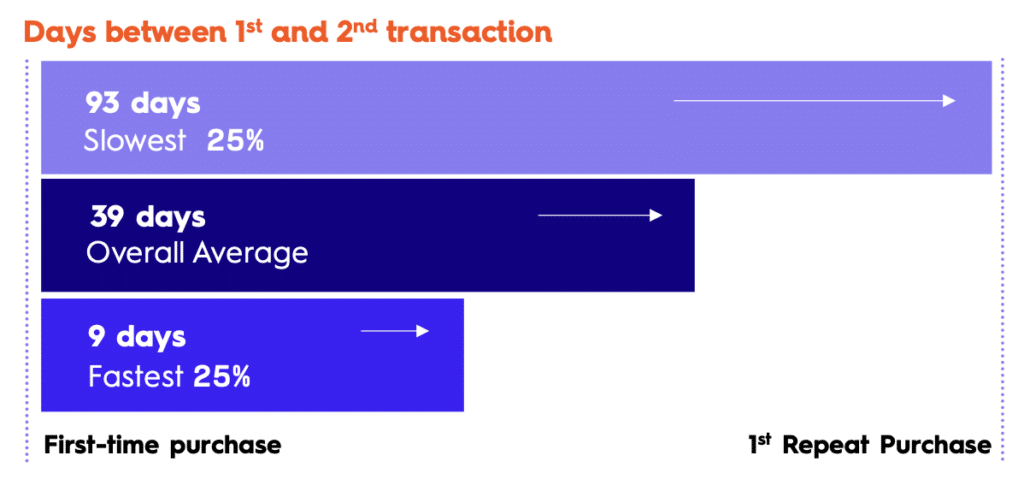

Black Friday isn’t just a one-time event for many shoppers—it often sparks longer-term buying habits. Last year, shoppers who purchased from a retailer for the first time returned for repeat purchases at impressive rates:

- US shoppers averaged 3.2 repeat purchases per retailer following Black Friday.

- 76% of these shoppers explored a new product category during their repeat purchases.

- 24% of new buyers* returned to the same retailer within six months, with 57% making another purchase within four weeks.

Timing varied widely, with some shoppers coming back within 9 days while others took as long as 93 days.

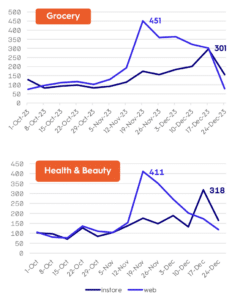

Holiday shopping is all about flexibility

CPG products see the highest online sales growth in the US leading up to Thanksgiving. However, as Christmas approaches and the rush of last-minute purchases kicks in, shoppers lean into omnichannel offerings. In-store sales surge during the final week before Christmas, catering to urgent, in-the-moment needs.

Shoppers who combine both online and in-store visits are particularly valuable, purchasing 1.8X more frequently than those who stick to in-store only shopping.

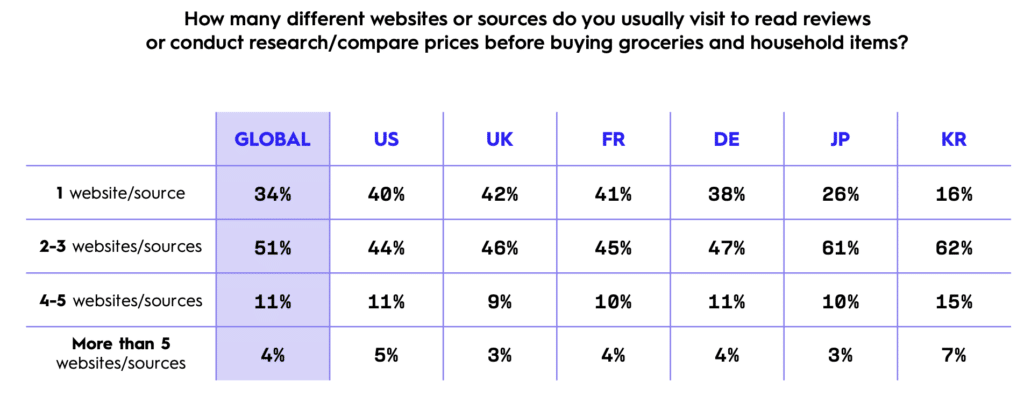

Shoppers scour the web for the freshest finds

When it comes to Grocery shopping, today’s consumers are doing their homework. Globally, 66% of frequent Grocery shoppers visit multiple websites to research products before making a purchase.

Multi-retailer browsing not only helps shoppers compare options but also significantly broadens their brand exposure.

In fact, shoppers globally view 65% more brands when exploring across multiple retailers for Groceries and Household Supplies than when sticking with a single retailer. For brands, this highlights the importance of strong online visibility and compelling digital experiences to stand out in a competitive, research-driven landscape.

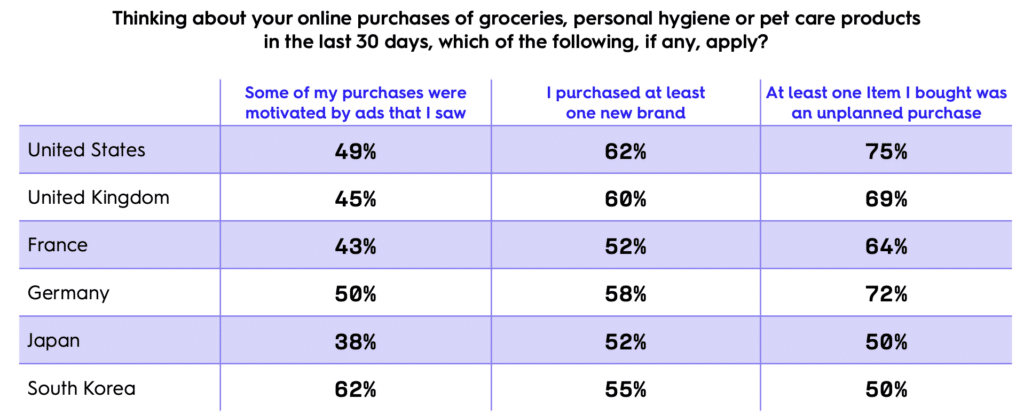

Ads inspire action

When it comes to CPG, ads pack a serious punch. Globally, 48% of CPG shoppers reported making a purchase inspired by an ad they saw. And these purchases aren’t limited to their usual favorites:

- More than half of shoppers (56%) bought from at least one brand for the first time.

- Over 3 in 5 shoppers (63%) bought at least one item that was an unplanned purchase.

When ads resonate, they drive CPG shoppers to go all in—from trying new brands to making impulse buys and adding extra items to their carts.

Seizing the holiday momentum

The holiday season presents a whirlwind of CPG advertising opportunities as shoppers embrace new habits, explore fresh brands, and stock up for celebrations. With nearly half of shoppers inspired by ads, and a growing preference for omnichannel experiences, brands have more avenues than ever to connect with their audiences.

Bernie Che, Director of Omnichannel Platforms, at Flywheel shared:

“The CPG landscape and its shoppers are becoming more complex, with people browsing and purchasing from multiple retailers, both online and in-store. Every touchpoint across every channel is an opportunity to engage with these shoppers. That’s why a diversified retail media strategy is critical to connect with them at every step of their purchasing journey.”

Takeaways for CPG brands and retailers:

- Meet your customers where they are. CPG shoppers consistently view more brands when shopping across multiple retailers. Use multi-retailer campaign tools to amplify reach wherever shoppers are browsing.

- Harness always-on campaigns. The path to purchase length for Groceries can vary widely. Maintaining an always-on strategy, in addition to targeted campaigns, ensures you remain top of mind throughout the entire decision-making process.

- Leverage in-store and online data to bridge omnichannel gaps. Ensure your marketing efforts are synchronized at every touchpoint to deliver consistent awareness messages.

For more insights to push your CPG strategy to the top shelf, read The State of CPG report.