Is 2024 the year of the glow up? It very well might be—according to our latest research, Health and Beauty shoppers kicked their buying into high gear this year. Where did those purchases happen (online, in-store, both)? How many brands did they view before making a decision? And how long did the buying journey take? Answers to these questions and many more are in our new State of Health & Beauty report, based on a survey of 14,000 global shoppers combined with organic sales and traffic numbers from hundreds of brands and thousands of retailers worldwide.

These insights will help Health & Beauty brands and retailers carve out a competitive edge as we head towards the peak shopping season—and beyond. For a sneak peek of what’s inside, read on.

The World Went Glam in Q1

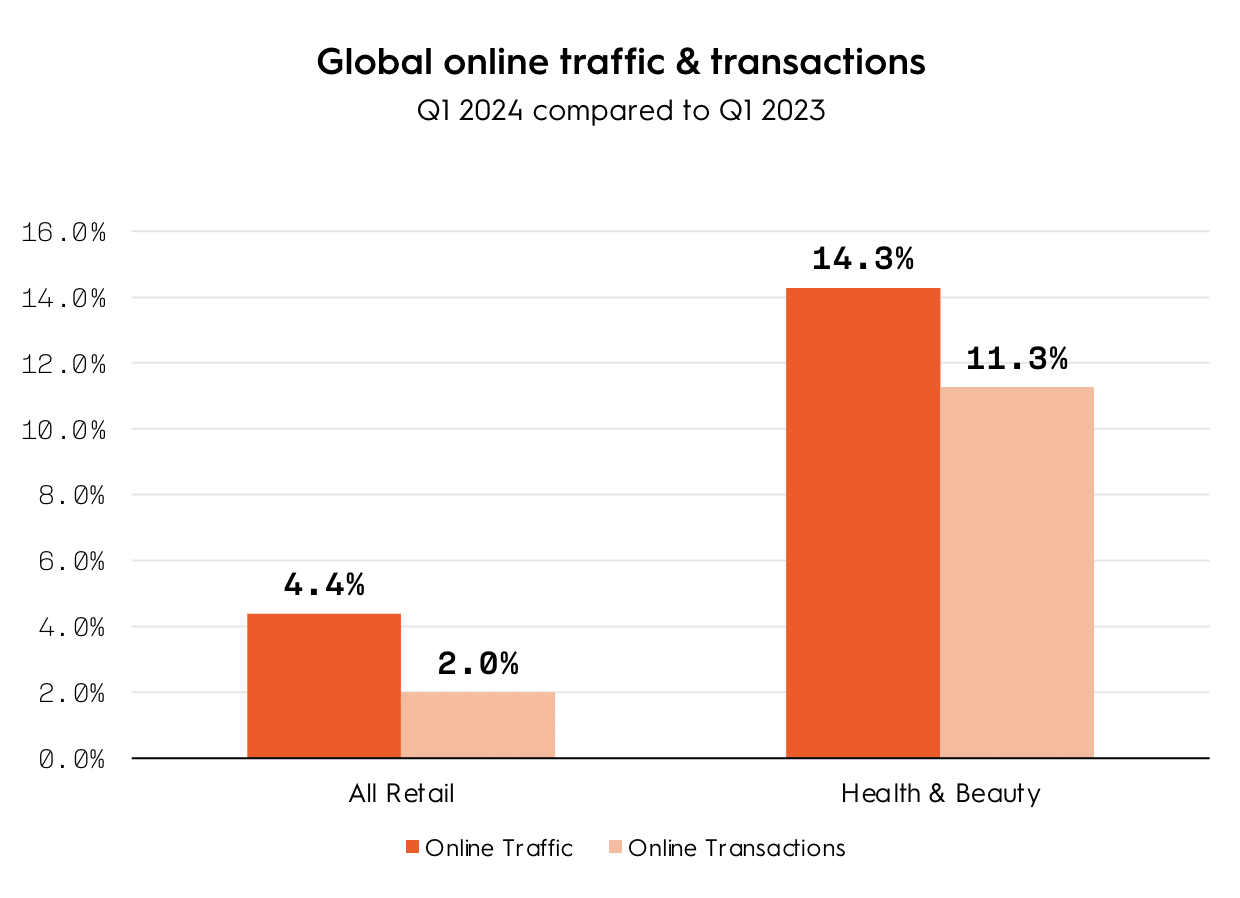

In Q1 of 2024, consumers around the world leaned into glamour, significantly boosting sales in health and beauty products. Online sales of beauty products were up 11% year over year in Q1 and year over year traffic and sales for online beauty significantly outpaced online retail overall.

Beauty Without Borders

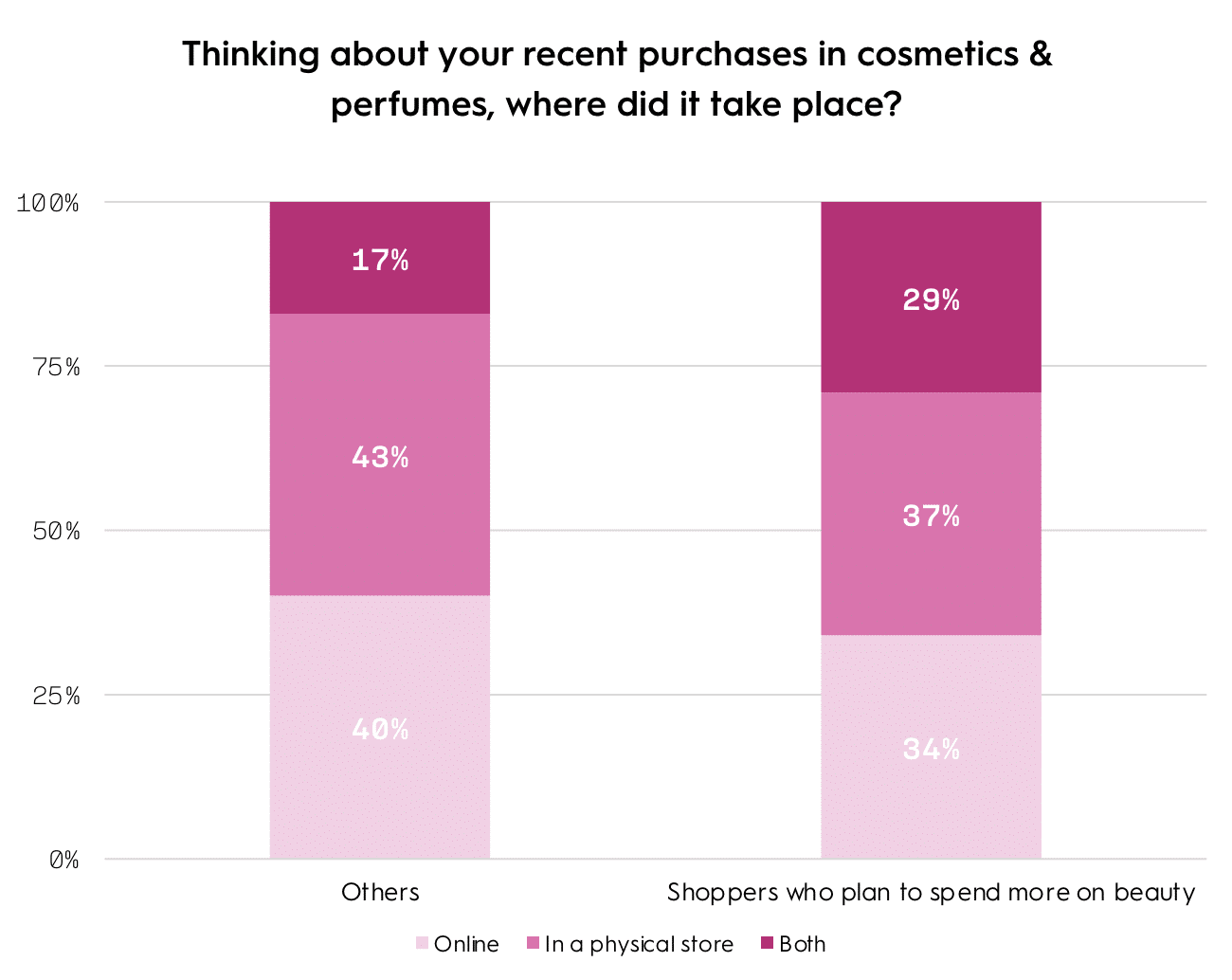

Beauty knows no boundaries, and this has never been more apparent. Our data shows that beauty buyers are more likely to be omnichannel shoppers who purchase both online and in a physical store. When asked about their recent purchases in cosmetics and perfumes, nearly a third of shoppers who plan to spend more on beauty confirmed that recent transactions took place both online and in a physical store. Only 17% of shoppers not planning to spend more on beauty said the same.

The More Retailers Visited, The More Brands Viewed

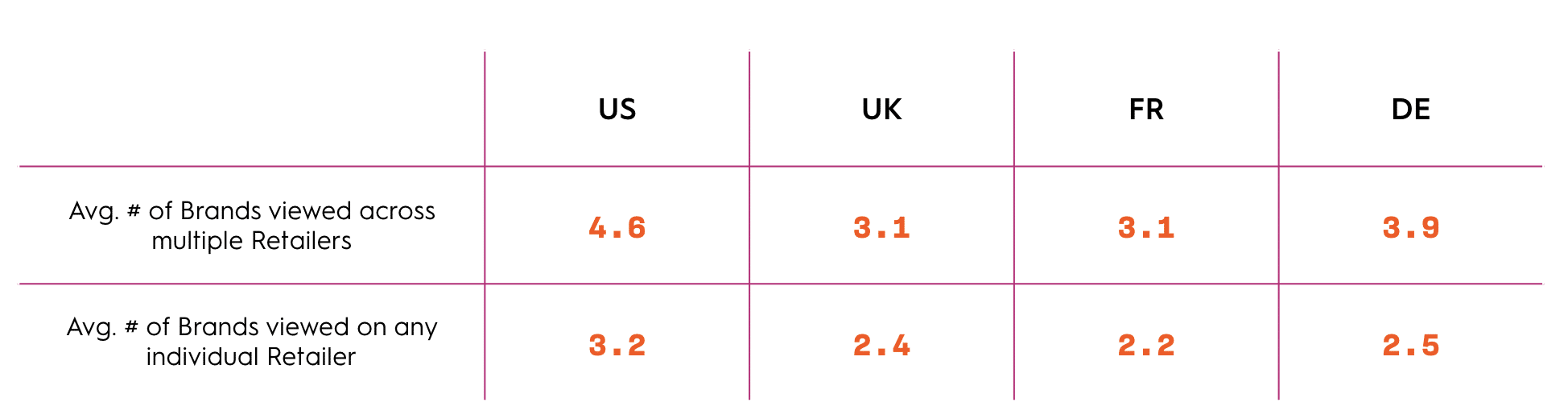

Our unique data set that spans many retailers and brands enables us to see that the more retailers consumers visit, the more brands they view. This behavior indicates that shoppers are not loyal to a single retailer or brand, but are instead exploring multiple options to find the best deals and products. For brands, this underscores the importance of being present across various retail platforms to increase visibility and engagement with potential customers.

Sponsored Product Campaigns Boosted Revenue Share

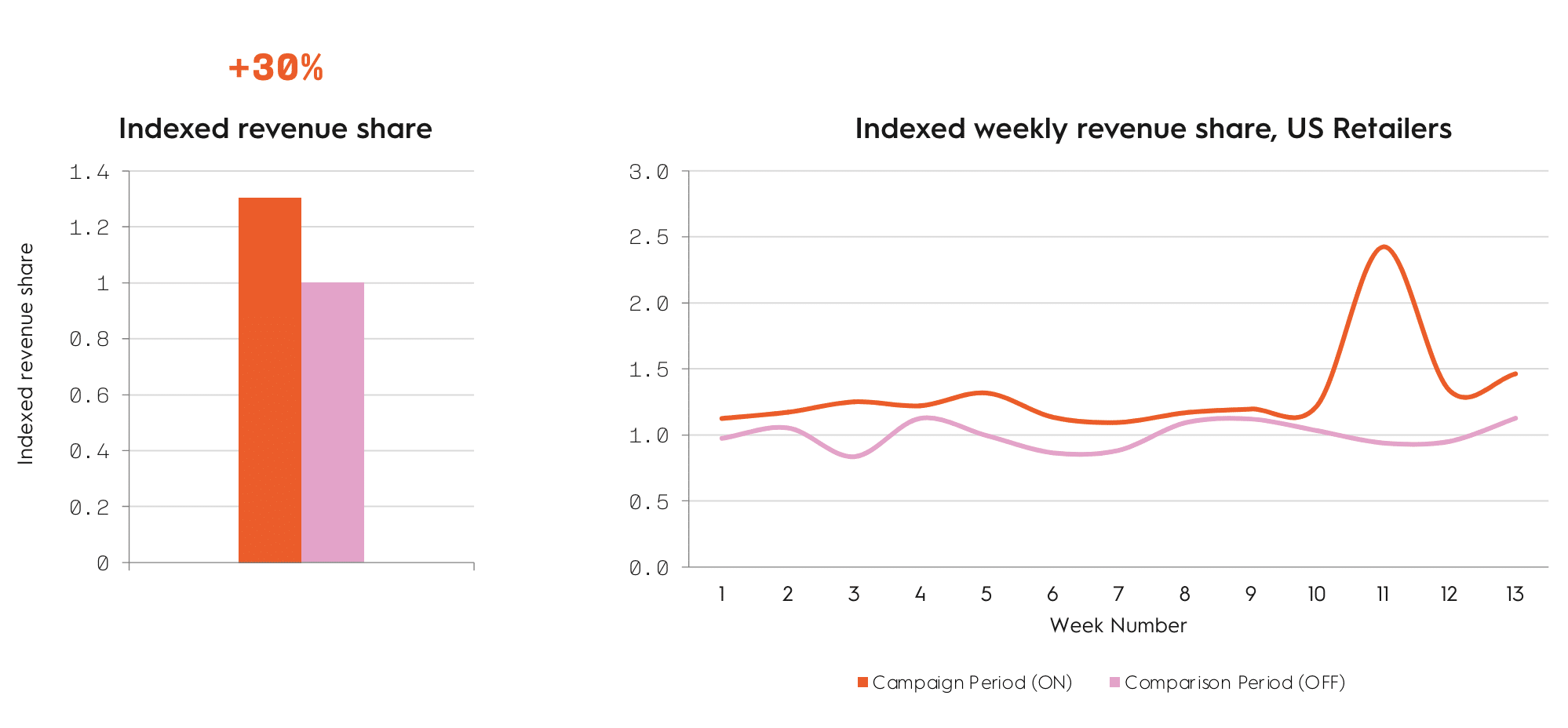

Our analysis also highlighted the effectiveness of Sponsored Product campaigns. Advertised products saw their share of revenue increase by an impressive 30% on average. This boost demonstrates the power of targeted advertising in driving sales and enhancing product visibility. Brands investing in Sponsored Product campaigns can significantly enhance their market presence and revenue, making it a strategic move for those looking to maximize their advertising budget.

Key Takeaways for Health and Beauty Brands

Beauty fans know that when you want to stand out you do a bold red lip. Beauty marketers can stand out by going bold in these key ways:

Meet your customers where they are. We see that beauty shoppers consistently view more brands when shopping across multiple retailers. Use multi-retailer campaign tools to amplify brand awareness and reach consumers wherever they are browsing.

Harness the halo effect. Our data shows that Sponsored Product campaigns boost revenue share across all products—not just the ones you advertise—by an average of 22%. Capitalize on this “halo” effect by promoting a wider range of product lines within your retail media campaigns.

Stay top-of-mind. Because shoppers consider multiple brands before making a purchase, leverage multiple ad placements, especially on product detail pages (PDPs), to keep your brand front-and-center as they move down the purchase funnel.

For a deeper dive into these trends and more, check out The State of Health & Beauty.