Today’s world is digital-first. Many people already have multiple devices, and are connected 24 hours a day, seven days a week. You might think it would be easy for advertisers to reach their target consumers, but ad tech has never been more complicated.

Our research projects that by 2022, there will be 4.66 billion internet users in the world and 56% will have two or more connected devices. In the EU by 2022, there will be 441 million internet users and over 86% will have two or more connected devices. Online is now the second largest and fastest growing ad spend channel in the world, accounting for over one-third (34%) of total ad spend in 2017. Soon, it will overtake global ad spend on TV.

How can marketers in France capture more of the growing digital ad spend opportunity? In Criteo’s recent State of Ad Tech EMEA report, we dive into exclusive findings from our work with Euromonitor on the survey, “Acquire, Convert, Re-engage.” We spoke with 150 marketers in Europe about how they convert customers today — and what works best.

Inside the report, we cover the top 2019 ad-tech trends to watch, best strategies for re-engagement, metrics for measuring success, and more. In this post, we’re taking a closer look at the French ad-tech market.

The French Ad-Tech Opportunity

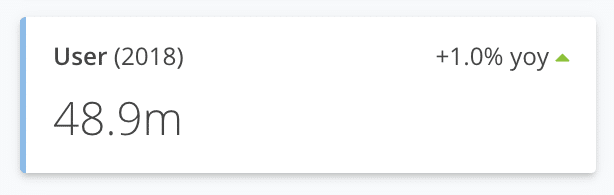

Statista research shows that about 72.8% of France’s population (or 48.9 million people) were ecommerce shoppers in 2018 (+1.0% YoY). User penetration is expected to hit 76.1% by 2023.

France’s largest ecommerce segment is Fashion, with a market volume of over 15 billion USD (about 13 billion euros) in 2018. Retailer La Redoute is one of the biggest fashion success stories in the region.

Mobile is rising in France.

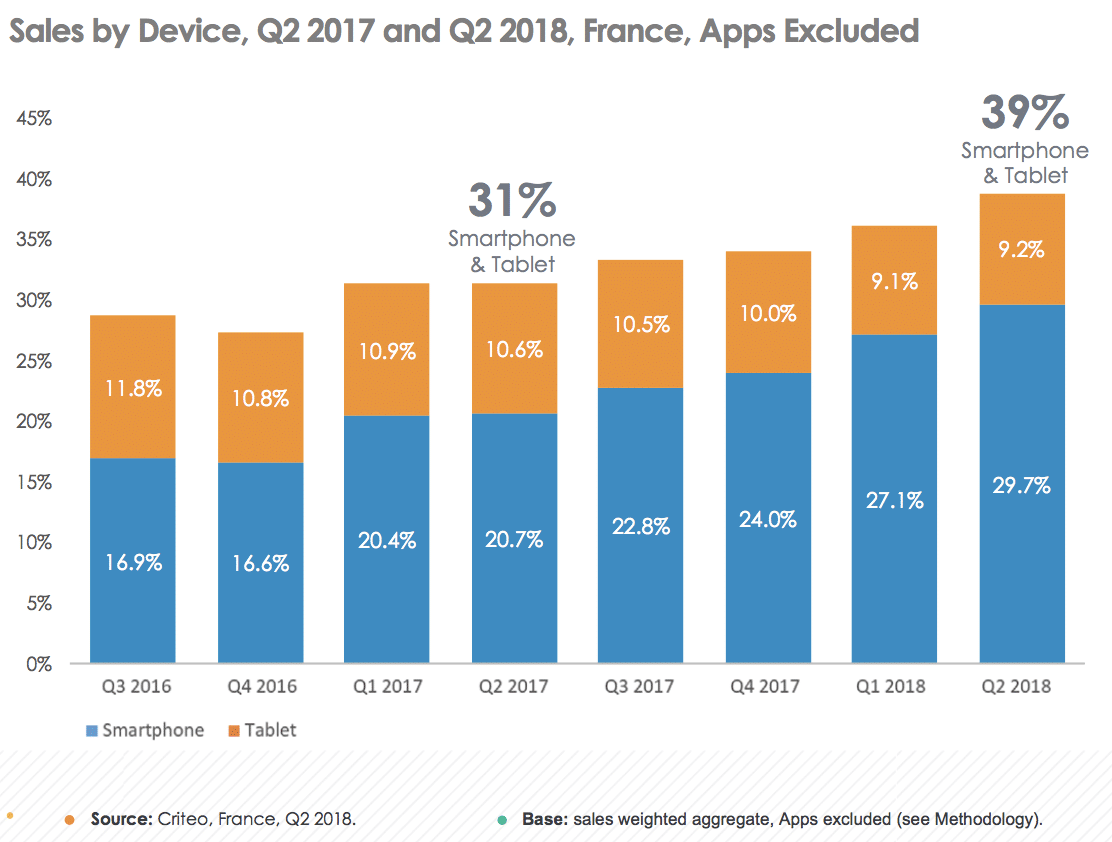

Driven by an increase in smartphone transactions, mobile shopping continues to steal online retail sales share in France. Criteo’s Global Commerce Review research supports the trend: In Q2 2018, 39% of online retail sales in France happened on smartphones or tablets — a +8% increase compared to Q2 2017.

The French love Facebook.

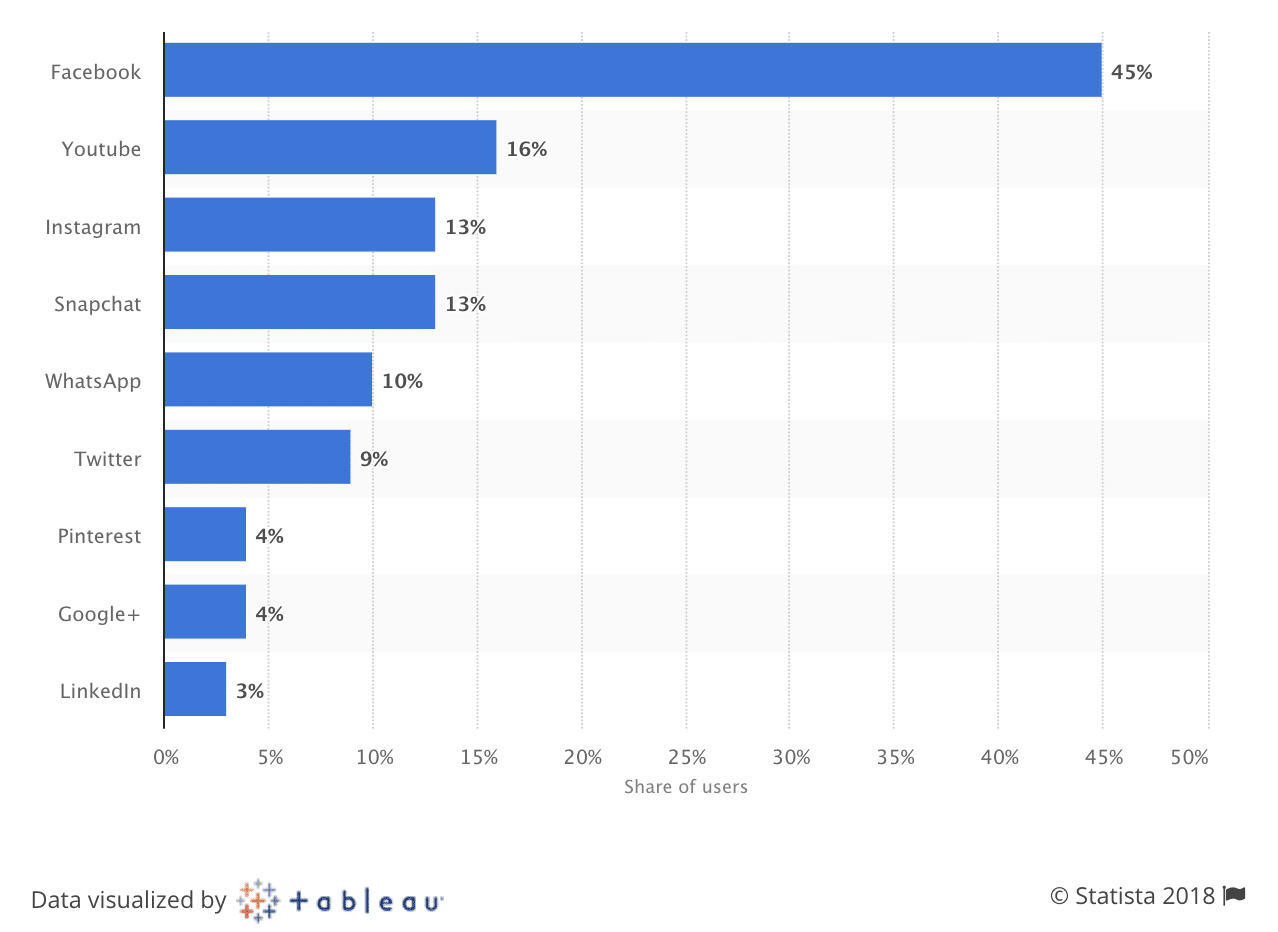

Facebook is the most popular social network in France, far outpacing the next most visited social platforms: Youtube, Instagram, and Snapchat. Data from Statista shows that in 2018, of the nearly 36 million Facebook users in France, 45% viewed the page every day.

Facebook usage is so ubiquitous in France, the French President, Emmanuel Macron, announced a six-month partnership late last year in which the country and the social media giant will attempt to figure out how to police hate speech on the platform.

To give you a sense of how much impact Facebook has in France, the region’s leadership has implemented a “GAFA tax” (named after Google, Apple, Facebook, and Amazon) to ensure these tech giants pay their fair share of taxes on the massive amount of business they do in Europe. The new tax went into effect on January 1, 2019.

State of Ad Tech Report: Ecommerce is Thriving in France

As our State of Ad Tech report shows, today more than 3.5 billion people are regular Internet users. Around the globe, 40.2% of total ad spend is now going to digital. At €93.2 billion, France is the second largest ecommerce market in the EU, just behind the United Kingdom (€178 billion) and in front of Germany (€93 billion).

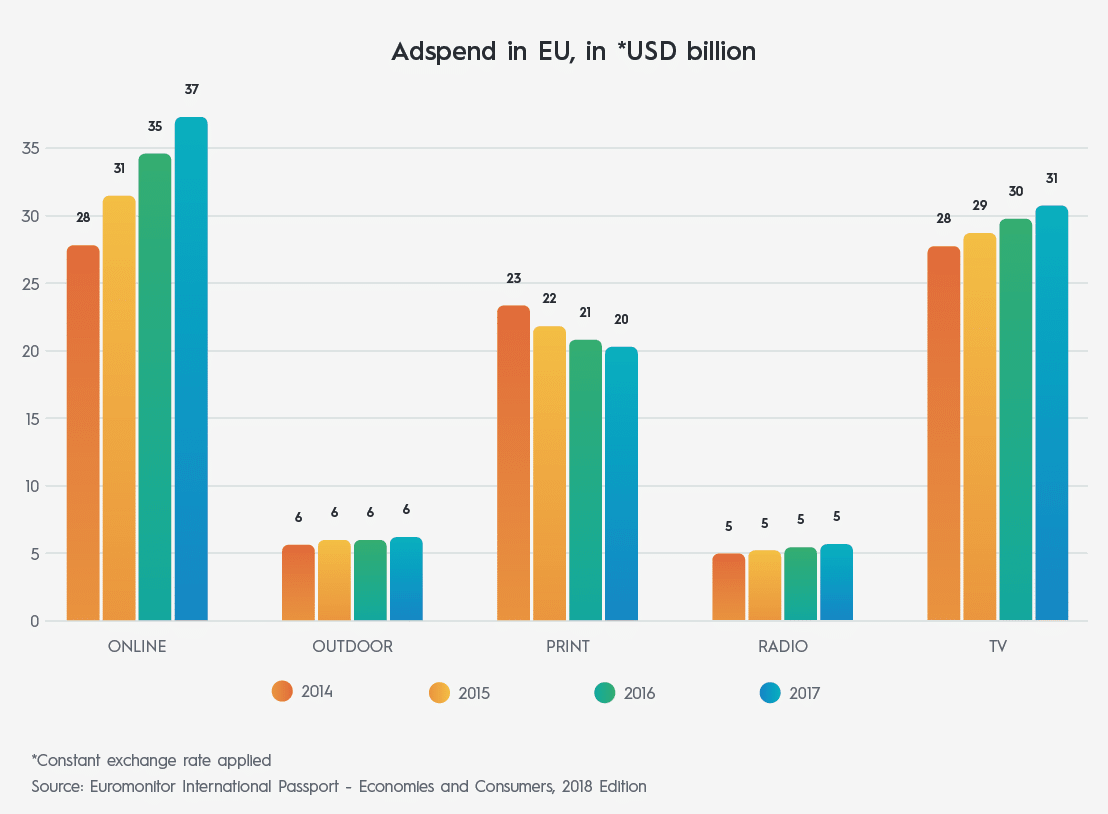

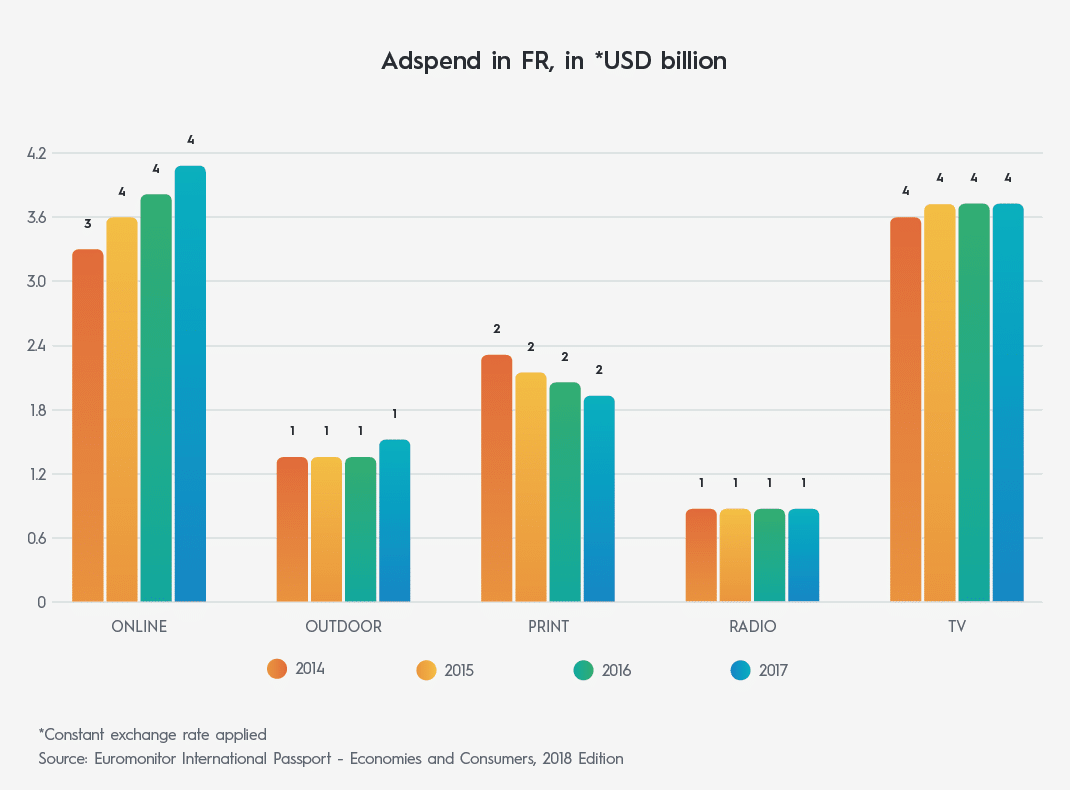

In step with the rise of ecommerce, overall ad spend in Europe is highest online, and has shown steady increases since 2014. TV also holds strong, but across the region, print is declining and outdoor and radio spend has stagnated.

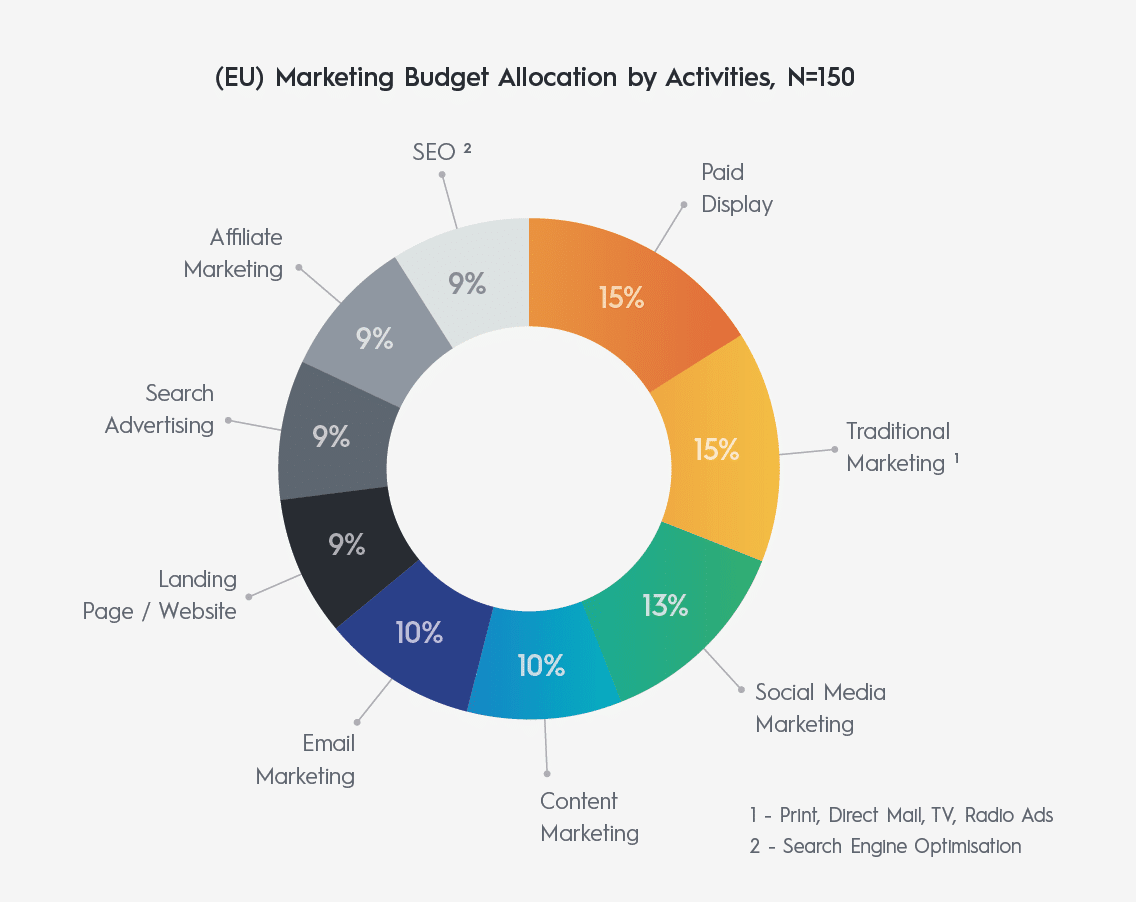

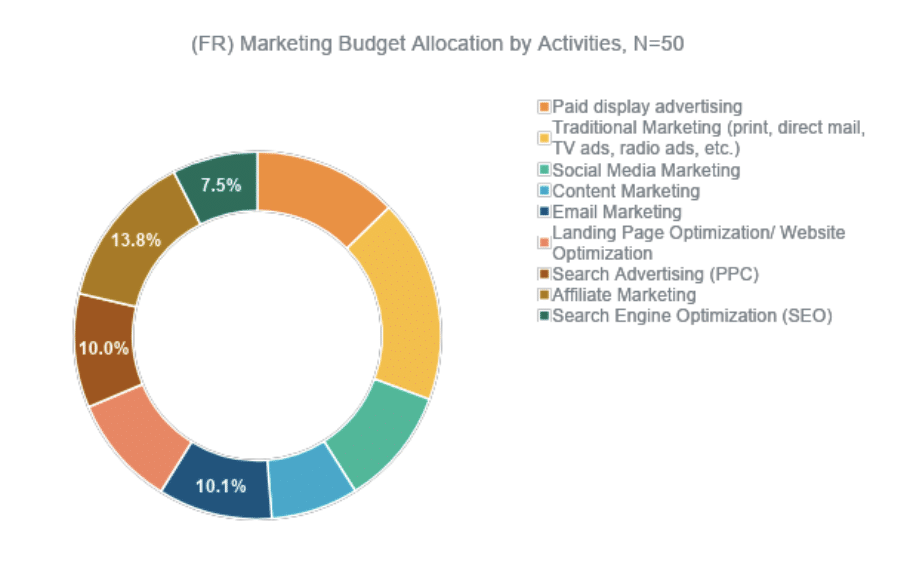

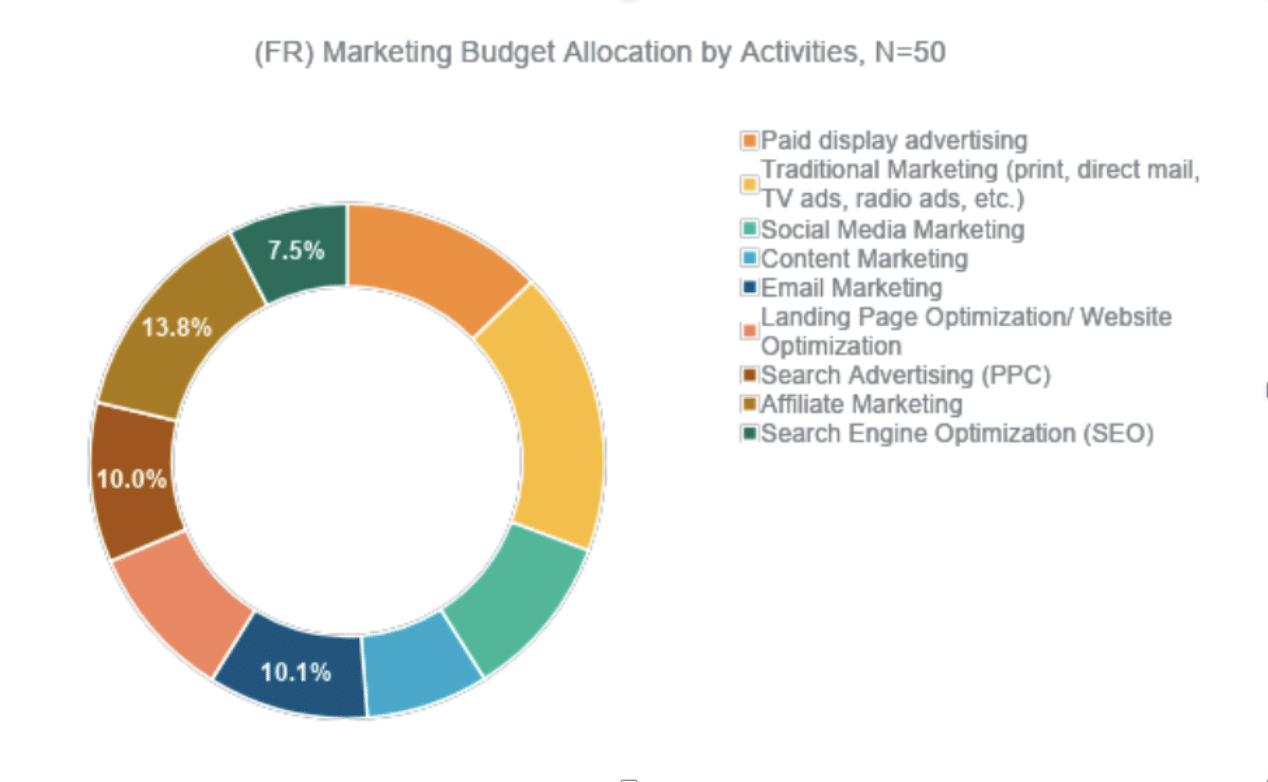

When it comes to tactics, EU marketers are spending significantly for paid display and traditional marketing (both at 15% of ad spend). Social media ad spend is next (13%) and growing.

In France, traditional marketing still takes up a significant share (18%) of ad spend as TV remains a major channel for ads. Just about 13% of budgets were spent on Paid Display Advertising tactics like retargeting and banner ads.

As the chart below shows, online ad spend is showing steady growth in France (unlike outdoor, print, and radio), even surpassing TV spend, which remains strong.

Strategies for Ad-Tech Success in France

Find the right partners.

Without being able to show what channels and tactics really move the needle, marketers aren’t able to secure enough budget or stakeholder buy-in. When you have the proper tools and partners in place to measure data-driven attribution, you can rest assured that your marketing dollars are being well-spent.

Incentivize shoppers.

EU marketers say offering discounts and making ads graphically engaging are keys to app re-activation. For repeat purchase campaigns, EU marketers agree that motivating with compelling discounts — which could be delivered through great emails, social media, or in-app — is the number one tactic.

Get creative.

Interactive ads, videos, unexpected ad placements (advertising on the steps leading down to the metro rather than on or in the trains), and experiential marketing are a few creative ideas that can help you target prospects at the right moment, in the right place. Think outside the display-ad box to win more shoppers’ hearts and minds in 2019.

To win in France, ads will need to do more than just sell.

In today’s competitive retail landscape, brands and retailers are realizing that to really connect with the modern consumer, ads have to do more than just push products.

“The best ads in 2019 won’t sell. They will entertain, educate, and inspire.”

— Criteo’s State of Ad Tech Report 2019

Francois Costa, Managing Director of Criteo France, notes how companies will need to rise to the challenge:

“2019 will be a year of transformation for the retail world, in which the customer will get more demanding in terms of retail experience, brand engagement, and the balance of choices, services, and prices. It means that retail will need to answer with the ability to connect every touchpoint, from desktop to in-store, and to engage with customers through inspirational contact and hyper-personalized dialogues.”