The annual shopping extravaganza Singles’ Day is known for its record-breaking sales as businesses engage consumers throughout Southeast Asia and beyond with festive deals, loyalty promotions, and immersive ecommerce experiences.

To gain insights into the evolving Double Dates shopping holiday, we examined Singles’ Day data from hundreds of Criteo’s retailer partners in Southeast Asia and the Greater China region.

Here are the top seven consumer behavior trends that defined this year’s event.

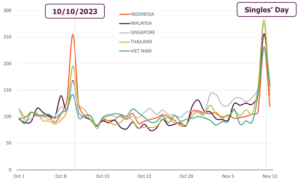

1. Singles’ Day sales surge in Southeast Asia

Online retail transactions spiked +140% on Singles’ Day compared to the first week of October in Southeast Asia.

Criteo’s country-level data shows that this impressive surge remained consistent throughout the region with sales increasing +182% in Thailand, +176% in Singapore, +156% in Malaysia, +131% in Indonesia, and +129% in Vietnam.

Source: Indexed transactions using data from SEA* retailers, on desktop, mobile and app.

Compared to average between Oct 1-7, 2023. *SEA countries: ID, SG, VN, MY, PH & TH

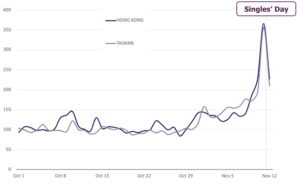

2. Singles’ Day shopping grows even more popular in Greater China

Singles’ Day is continuing to grow in the Greater China region. Online transactions in Greater China rose an impressive +237% on 11/11.

Singles’ Day sales were particularly strong in Hong Kong and Taiwan, with each market experiencing a +266% and +256% increase respectively.

In terms of year-over-year growth, the Greater China region saw a +9% transactions uptick on November 11, 2023 compared to the same day last year.

Daily Retail Trends by Country in Greater China, October – November 2023

Source: Indexed transactions using data from GCR* retailers, on desktop, mobile and app.

Compared to average between Oct 1-7, 2023. *GCR countries: HK & TW

3. Product sales show shoppers are ready to be seen

Product sales during Singles’ Day indicate that shoppers in Southeast Asia and the Greater China region are prioritizing self-care. Health & Beauty sales rose an impressive +352% in Southeast Asia and +417% in Greater China.

With air travel bookings on the rise in APAC, shoppers are on the go and ready to be seen. Luggage & Bags sales were up +311% in Greater China, while the Camera & Optics category saw a +266% sales increase in Southeast Asia.

4. Shoppers are prioritizing their home lives

Childcare is also top of mind. Baby & Toddler product sales rose +407% in Southeast Asia and +304% in Greater China. Toys & Games were also particularly popular in Greater China, generating a +311% uptick.

Many shoppers use Singles’ Day deals as an opportunity to invest in their homes. Retailers observed their Home & Garden sales rise +264% in Southeast Asia and +326% in Greater China. Furniture sales also increased +277% in Southeast Asia and +190% in Greater China.

Daily Product Category Trends in Southeast Asia, October – November 2023

Source: Indexed unit sales using data from SEA* retailers, on desktop, mobile and app.

Compared to average between Oct 1-7, 2023. *SEA countries: ID, SG, VN, MY, PH & TH

5. Larger basket sizes drive a boom in total unit sales

The average basket size (quantity of products purchased in a single transaction) in Southeast Asia rose +16% on Single’s Day compared to the first week of October. With shoppers adding more to their carts, unit sales (quantity of individual items sold) skyrocketed +178% during the same period.

Retailers in Greater China observed a similar trend. The average basket size in this region increased +6%, accompanying a +257% increase in unit sales.

6. Retailers offered significant Singles’ Day discounts this year

On Singles’ Day, the average unit price of retail goods dropped to its lowest level since October indicating that retailers offered striking price reductions this year. Average unit prices on Singles’ Day decreased -20% compared to the first week of October.

Daily Retail Trends in Southeast Asia, October – November 2023

Source: Indexed average unit price using data from SEA* retailers, on desktop, mobile and app.

Compared to average between Oct 1-7, 2023. *SEA countries: ID, SG, VN, MY, PH & TH

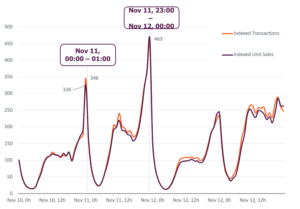

7. The first and final hours of the event are crucial

Shoppers in Southeast Asia jump to make the most of Singles’ Day discounts, with metrics spiking the highest within just the first hour of the event. When comparing retailer data during the November 11 0h-01 and the November 10 0h-01 timeslots, online retail transactions (+325%) and unit sales (+370%) surged tremendously.

On a typical non-holiday, purchases typically begin to cool off during the last two hours of the day. However, on Singles’ Day, the second highest spike was during the last hour of the event — indicating that last-minute shoppers in Southeast Asia rush to seize the deals available until midnight.

This trend is reversed in Greater China. Online retail transactions (+345%) and unit sales (+363%) spiked the highest during the last hour of Singles’ Day. Meanwhile, their second highest spike was seen during the first hour of the event.

Hourly Retail Trends in Greater China, November 10-12, 2023

Source: Hourly indexed transactions and unit sales using data from GCR* retailers, on desktop, mobile and app.

Compared to average in the first time slot (00:00-01:00). *GCR countries: HK & TW

Marketing takeaways for more Doubles Dates success

- Acquisition opportunities are strong before, during, and after Singles’ Day as purchases from new buyers spike on 11/11 and 12/12. Sustain the Singles’ Day sales momentum by continuing to activate acquisition campaigns well into December.

- Secure strong sales during the crucial first hour of Singles’ Day by introducing messaging and limited-time promotions that inspire urgency.

- Retarget shoppers throughout the day to remind last-minute shoppers to make the most of the event’s special deals before they expire at midnight.