What started in China as a shopping holiday to celebrate singlehood (in contrast to Valentine’s Day), has led to a growth series of some of the world’s largest annual ‘double days’ shopping events starting with 9/9, 10/10, Singles’ Day or 11/11 and 12/12.

Founded by Alibaba in 2009, 11/11 started it all.

This year, the company held a pre-11/11 event from November 1 – 3 to boost sales in the wake of the pandemic. On the actual day, Alibaba livestreamed the event to drive buzz in China and featured hundreds of celebrities, influencers, and company executives. Alibaba-owned Taobao Live offered streaming sessions showcasing everything from cosmetics and electronics to cars and houses.

Between 11/11 and the early November promotions, Alibaba drove 498.2 billion yuan, or about $75 billion, in sales.

11/11 and the rest of the double days shopping events create opportunities for more than just the largest ecommerce players. They also create a halo effect for businesses of all sizes across Greater China and Southeast Asia.

At Criteo, we wanted to see just how big that halo effect was this year on 11/11 and what to expect for 12/12.

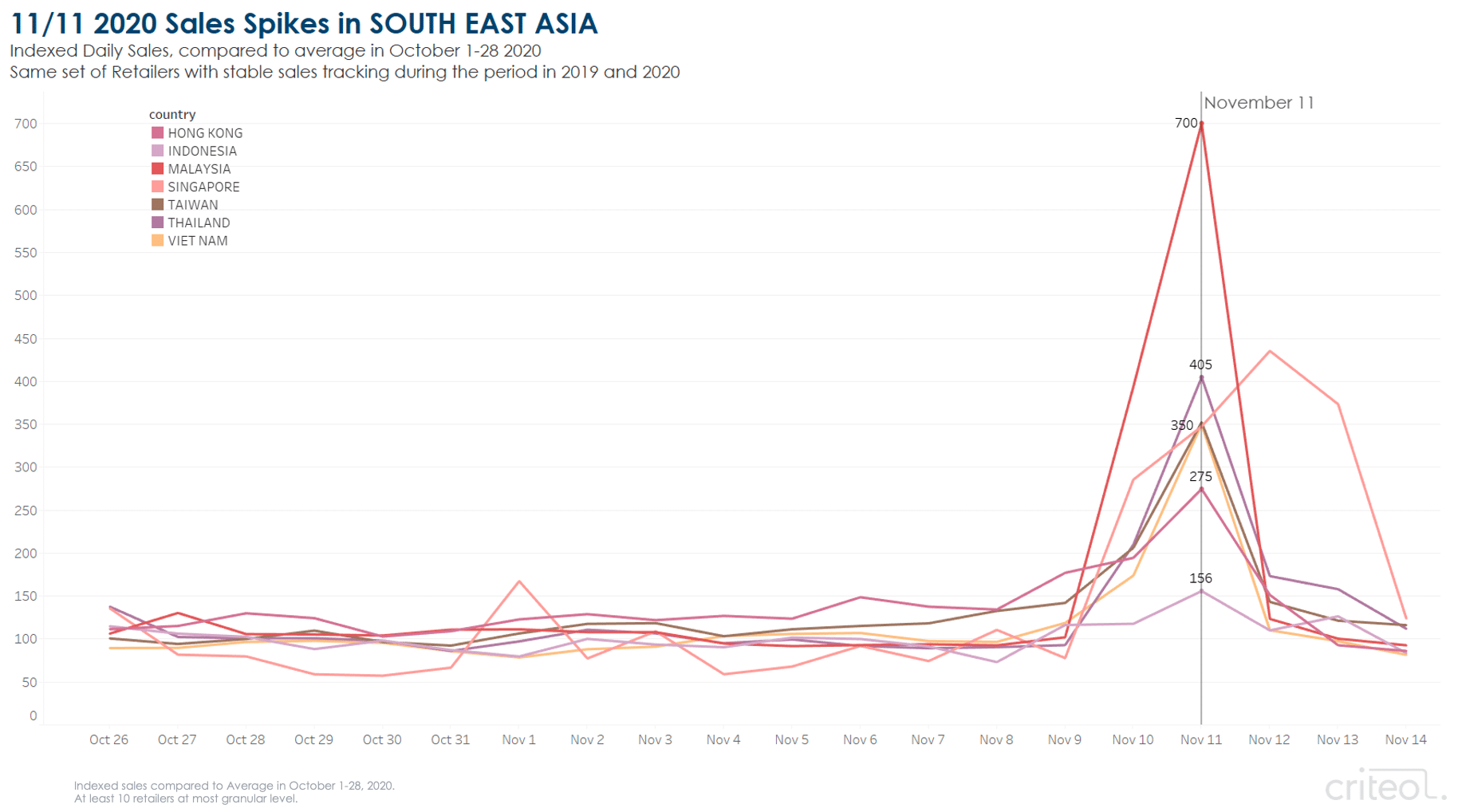

11/11 Sales Spike Outside of China

At Criteo, we analysed over 200,000,000 global transactions from October through mid-November. We compared sales on 11/11 to the average from October 1 – 28 this year and revealed the following sales spikes on 11/11 2020:

- +600% in Malaysia

- +305% in Thailand

- +250% in Singapore, Taiwan, and Vietnam

- +175% in Hong Kong

- +56% in Indonesia

We also took a closer look at what product categories saw major sales spikes on 11/11 compared to the average from September 1 – 28.1

In Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam, apparel and accessories was the most popular product category with the following products recording the greatest jump in sales:

- +436% for skirts

- +427% for earrings

- +344% for pants

- +343% for shirts and tops

- +324% for outerwear

In Hong Kong and Taiwan, health and beauty was the most popular product category on Singles’ Day, followed by apparel and accessories:

- +208% for health and beauty

- +174% for apparel and accessories

- +153% for food and beverage

Find out what happened worldwide on Singles’ Day 2020 in our global recap.

3 Predictions for 12/12

With the massive success of 11/11, other hugely popular double days shopping events have emerged. While 11/11 has become the largest annual shopping day in countries like Singapore, Malaysia and Vietnam, 12/12 has grown into Indonesia’s blockbuster shopping event.

Throughout 2020, Criteo surveyed consumers about how their shopping behaviours have evolved as a result of the pandemic. We know from the success of Singles’ Day that people are excited to shop right now and 12.12 has the potential to be huge. Here are our three predictions:

Don’t forget to download Criteo’s guide 12/12 in 2020: What Marketers Need to Know.

12/12 buyers will shop in new ways

During lockdowns, many stores had to close and consumers got accustomed to shopping online. During this time, they discovered new ways that they like to shop.

In our “Peak to Recovery” study, we surveyed over 18,000 consumers worldwide in May and found that 53% of people discovered at least one form of online shopping such as buying through mobile apps or picking up online orders in-store that they want to continue. The majority of those shoppers (85%) plan to keep purchasing from a new online store they found.2

Since the pandemic has accelerated ecommerce across Southeast Asia, we expect consumers to continue these same shopping behaviours on big sales days.

Now with safer in-store shopping options and wider adoption of online-meets-offline shopping like buy online and pick up in-store, shopping on 12.12 can take many forms and businesses should provide a variety of purchasing options.

More people will browse and buy in-app

In Criteo’s 2020 Global App Survey, we saw how much mobile commerce is skyrocketing in Asia. Over half (55%) of APAC respondents said they downloaded at least one shopping app during the peak of the COVID-19 pandemic.3

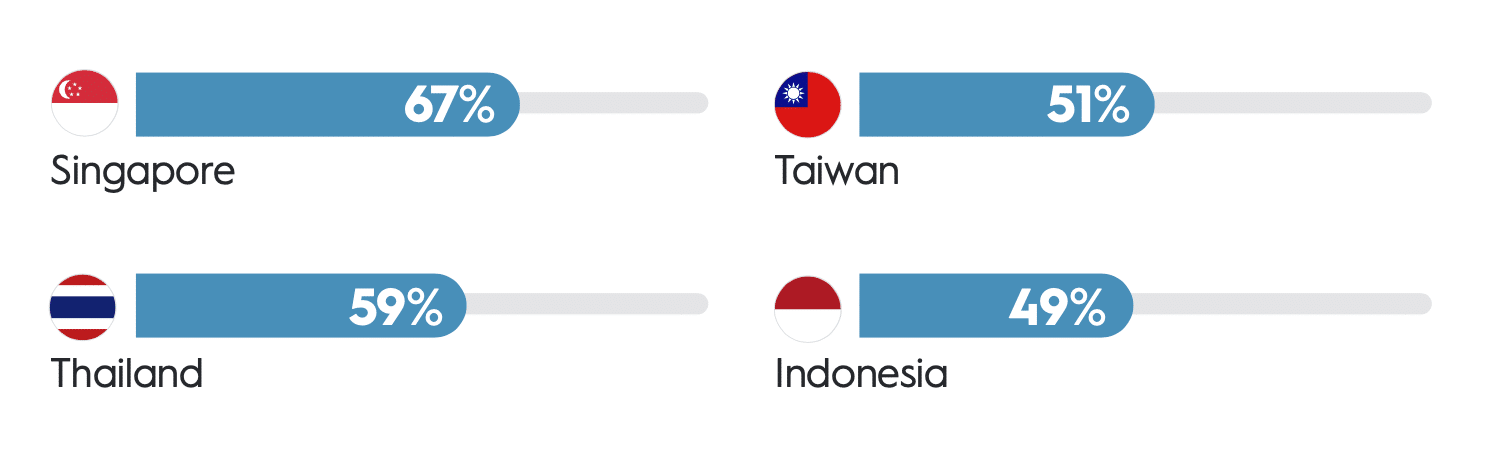

The share of consumers surveyed who recently downloaded a new retail app reached as high as 67%.

During a shopping event like 12/12, it is likely that consumers will bounce between devices to check for deals throughout the day and decide what to purchase. Businesses have to deliver seamless, multi-touchpoint experiences across devices so shoppers can easily pick up where they left off on any channel. For example, build persistent shopping carts across your website, your mobile website and app.

Consumers are open to ads in apps

In our Global App Survey, 51% of APAC shoppers said they clicked an in-app ad in the past six months. Half of these app users completed a subsequent purchase, indicating that app advertising is an effective way to draw shoppers to your deals on 12/12.

With app users being so open to engaging with ads, app retargeting campaigns are also effective on big deals days. App retargeting allows you to engage your existing app users across channels and bring them back to shop your 12/12 deals in-app. Offer a special discount just for app users to drive even more sales.

12/12, also known as National Online Shopping Day or Harbolnas Indonesia, is the final double day of the year. Make the most of Indonesia’ biggest shopping frenzy with Criteo’s free guide, 12/12 in 2020: What Marketers Need to Know, for the latest 12/12 ecommerce insights and trends. Learn how to create the right digital marketing strategy to boost 12/12 sales.

¹Indexed sales monitored on retailers who partner with Criteo Marketing Solutions and Criteo Retail Media. Data from >15,000 retailers worldwide. App excluded.

2Criteo “Peak to Recovery” Survey. Criteo surveyed 13,532 respondents having experienced partial or complete lockdown at any point within the past few months across 12 markets between May 13 and May 29, 2020. Respondents were asked to evaluate how forced social distancing had affected their daily habits and how they envisaged returning to normal. The sample is representative of the populations of the respective markets by age and gender (ethnicity in the US).

3 Criteo Global App Survey, APAC, April/May/June 2020 n=8162 (ID=1026, SG=1006, TH=1022, and TW=994).

Criteo Data, Indexed sales by category compared to Average in Jan 1-28, 2019. At least 5 retailers per category. Markets include TW, SG, MY, ID, TH, PH.