A decade ago, a cable television subscription was your ticket to news, entertainment, sports, and the shows everyone was talking about. Now, cable is just one of many ways that consumers can access video content thanks to the rise of connected TV.

Connected TV, or CTV, refers to the streaming of premium video content through smart TVs, internet-connected devices, tablets, laptops, gaming consoles, and more without using a traditional cable subscription. This is also called over-the-top or OTT when viewers go “over” a cable subscription and use apps to access content via the internet.

This year, 30% of the world’s population will use OTT video according to the Statista Market Forecast. In countries like Australia, Canada, Germany, Italy, the UK, and the US, user penetration is much higher at more than 70%.1

The rise of connected TV, accelerated by the need for affordable and high-quality entertainment at home, has created a wide-open opportunity for marketers.

This guide will help marketers begin and expand their connected TV advertising by addressing five of the biggest challenges for launching and measuring campaigns. Criteo’s video advertising solution includes OLV (Online Video Advertising) only.

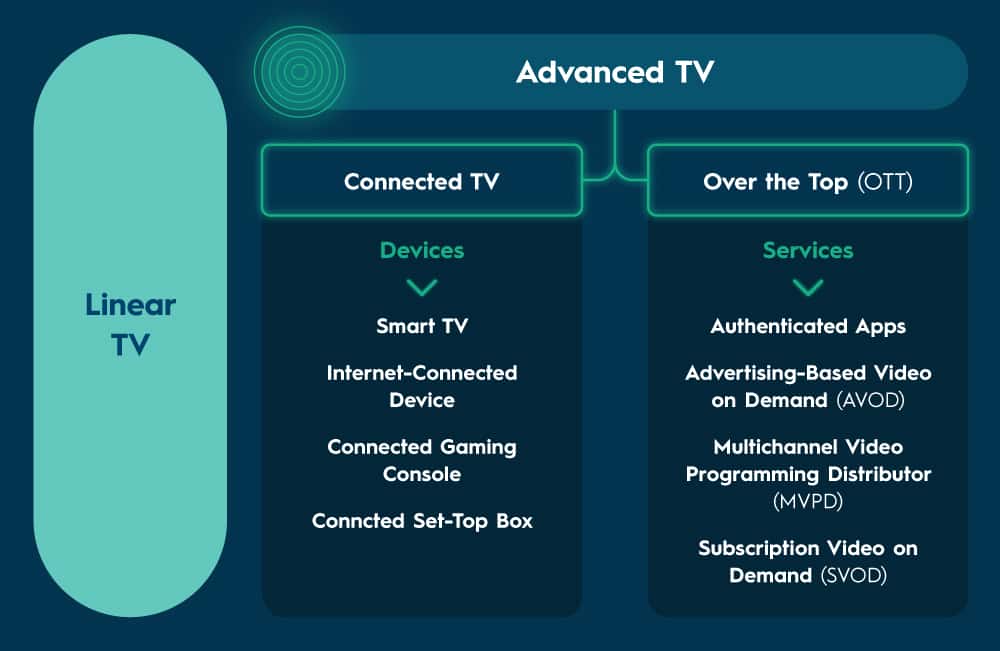

What is CTV vs. OTT vs. Addressable vs. Linear TV Advertising?

Like any emerging advertising channel, there is a new set of industry jargon that comes along with connected TV and OTT advertising. It can be a challenge just to talk about CTV and OTT campaigns.

Here, learn all the acronyms and common lingo before you get started.

Streaming Terms

Linear TV

Traditional cable or satellite TV with set viewing times.

Advanced TV

All TV content streamed via the internet, whether live or on demand.

Connected TV

Any device used to stream content from video providers via the internet.

Over the Top (OTT)

Any content streamed from a video provider’s app on a CTV or other device connected to the internet.

Devices

The physical devices used to access the internet and video content on CTV and OTT.

Smart TV

A TV with a built-in internet connection that gives access to streaming services.

Internet-Connected Device

A device that plugs into a non-smart TV to connect it to the internet and gives access to streaming services. Examples include Apple TV, Chromecast, and Roku.

Connected Gaming Console

A gaming system that connects a TV to the internet and gives access to streaming services. Examples include Xbox and PlayStation.

Connected Set-Top Box

A cable box that also connects a TV to the internet and gives access to streaming services.

Services

The apps from streaming companies (Netflix) or networks (Disney+) used for accessing their content via the internet.

Authenticated Apps

Streaming apps owned and operated by a cable or TV network to make streaming content available.

Advertising-Based Video on Demand (AVOD)

A video subscription service that is free to consumers but includes advertising. Examples include Crackle, Tubi, and Pluto.

Multichannel Video Programming Distributor (MVPD)

An aggregator service owned and operated by a streaming company that offers live and on-demand content from different networks. May include original content. Examples include Hulu and Sling TV.

Subscription Video on Demand (SVOD)

A subscription service owned and operated by a streaming company, such as Netflix, to offer on-demand video content.

Advertising Terms

Online Video (OLV) Advertising

A blanket term for all online video advertising, including in-stream pre-roll and mid-roll, outstream, and display.

In-stream

Video ads displayed before, in the middle, or at the end of streaming content that are often non-skippable.

Outstream

Video ads displayed outside of streaming video players.

Pre-roll

In-stream ads shown before video content.

Mid-roll

In-stream ads shown in the middle of video content.

Addressable TV Advertising

A term for delivering different ads to different households watching the same video content. Also talked about as Addressable VOD (Video on Demand).

Connected TV Advertising

Video advertising delivered through any content streamed from a video provider via a device connected to the internet.

OTT Advertising

Video advertising delivered through any content streamed from a video provider’s app on a TV via a device connected to the internet.

KPI Terms

Reach

The share of your audience exposed to at least one ad. Expressed as a percentage.

Completed View Rate

The share of impressions that are viewed to completion. Calculated as total impressions divided by total completed views.

Cost per Completed Video

The price you pay each time a video ad is viewed to completion. Calculated as total cost divided by total completed views.

Viewability

The share of ad impressions that are actually seen by consumers.

CPM

The price you pay per one thousand ad impressions. Calculated as total cost divided by total impressions times 1,000. Using CPM as a pricing model extends the scale and reach of video campaigns.

Solving 5 Challenges of CTV & OTT Advertising

As opposed to traditional TV spots that reach massive audiences but come with a high price tag, connected TV ads are proving to be an effective alternative for marketers. In Q4 2020, ad impressions in streaming video increased 31% quarter over quarter according to Conviva’s State of Streaming report series2. Ad impressions increased another 13% in Q1 2021.3

Connected TV advertising can reach targeted audiences of highly engaged viewers and provide more detailed campaign metrics than traditional TV, making it a more efficient investment. However, as marketers start testing connected TV, they’re running into new roadblocks.

Find solutions to the five biggest connected TV advertising challenges below.

Challenge #1: Connected TV isn’t as cost effective as other display advertising channels.

When digital marketers compare CTV to other advertising channels, they might calculate the high cost of connected TV ad creation and premium CTV/OTT ad inventory and think that this type of advertising isn’t for them.

Solution: Take a customer-centric approach to CTV advertising.

For any advertising campaign to be effective, your ads must reach audiences where they’re already consuming content. And as consumers stream more video content than ever, CTV advertising is not optional.

According to Limelight’s State of Online Video 2020 report, time spent streaming TV shows increased 48% globally year over year in 2020 to an average of 4.6 hours per week. In addition, time spent streaming movies increased 22% year over year to 4.5 hours per week.4

To scale your video creative and get the most return on your creative investment, run CTV ad campaigns together with all other video campaigns through one advertising partner. One great video creative can drive brand awareness across streaming devices, OTT services, desktop, mobile web, and in-app.

Both CTV and online video advertising allow for in-stream pre-roll or mid-roll ad placements, and online video offers outstream placements as well. When you use the right data to build your video audiences, your ads reach the most valuable customers for your business at times when they are hyper-engaged, allowing you to spend most efficiently.

Challenge #2: Connected TV inventory is too fragmented.

Marketers have the option to buy CTV inventory from multiple sources, including streaming device companies, smart TV makers, MVPDs, programmatic ad exchanges, digital video publishers, and networks. The inventory is spread out and marketers have trouble gaining access to enough quality ad inventory to scale CTV campaigns, especially compared to linear TV advertising.

Solution: Find one advertising partner with a large footprint.

Look for a connected TV advertising partner that has direct relationships with streaming services, major networks, and more and access to major supply-side partners (SSPs). Ask what devices (smart TVs, OTT devices, etc.) and services (authenticated apps, SVODs, etc.) that partner works with directly, as well as the exchanges they work with.

This allows you to reach consumers regardless of their streaming preferences.

Challenge #3: Measurement is nascent and inconsistent with other channels.

Lack of standard measurement is the top challenge of video advertising across devices, according to Advertiser Perceptions’ Video Advertising Convergence report. More than half (57%) of the in-house and agency marketers surveyed cited this as a hurdle.5

Solution: Get clear viewability metrics through your CTV advertising solution.

Before you begin to build a CTV campaign, know up front what metrics you will have access to through the campaign management platform. Look for standard metrics like reach, completed views, and viewability.

To increase completed view rates, make sure your CTV advertising partner offers non-skippable formats.

Challenge #4: Audience targeting is broader than expected on connected TV.

In digital advertising, the big benefit for marketers is being able to target the right audience at the right time on the right screen. With CTV, this can be challenging without access to the right data. Marketers may not know what household they’re reaching, let alone what individual is watching at that moment.

Solution: Build audiences with first-party data.

Use first-party data from CTV devices and streaming services combined with your own and your advertising partner’s first-party data to target audiences of consumers that are most likely to buy your products or services. Some examples of CTV audiences include:

Commerce Audiences

Reach new customers that are interested in products or services like yours. Build your audience with commerce data that shows products people are interested in, brands they like, and meaningful demographics such as purchase power and gender to drive interest and engagement.

Similar Audiences

Reach new customers that act like your best customers. Build your audience with commerce data that shows browsing and purchasing behaviors to drive interest and engagement.

Contact List

Reach online and offline customers already in your database. Build audiences using your first-party customer and transaction data to drive sales from known customers. Enhance these audiences with commerce data showing real customer journeys.

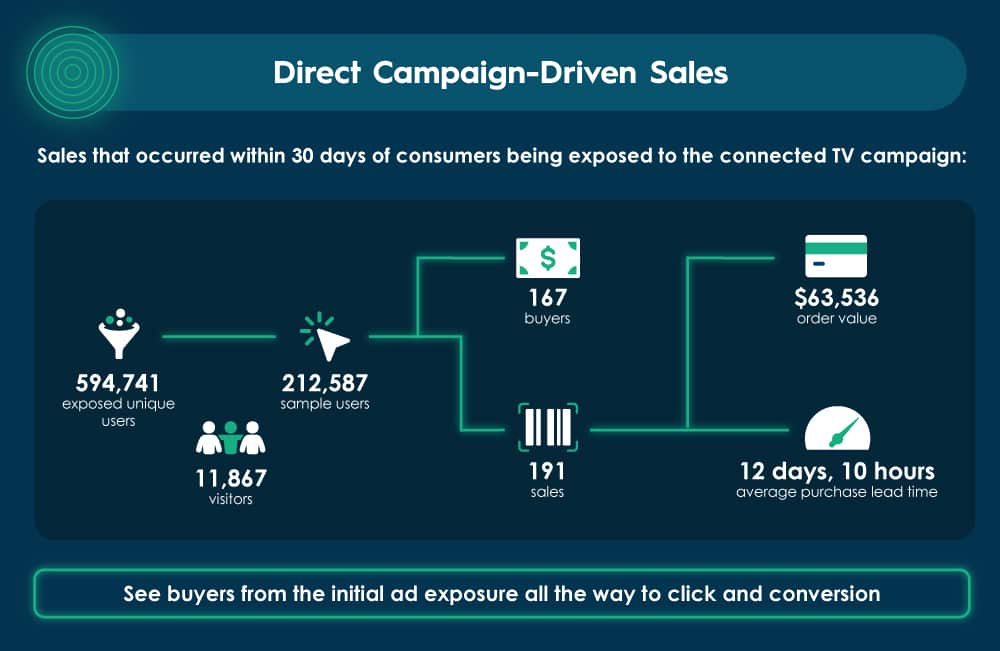

Challenge #5: Connected TV does not have a clear impact on sales and revenue.

Marketers are under increased pressure to prove ROI for every ad campaign and drive commerce outcomes like sales and revenue. For CTV advertising, marketers struggle to find the data they need from OTT device makers and streaming services to tie CTV spend back to real business results.

Solution: Build a full-funnel advertising strategy with a single media platform.

In addition to scaling creative and maximizing reach, running all CTV, video, and display campaigns together gives marketers more transparency into the customer journey and how upper-funnel campaigns influenced consumers at the point of sale—as long as your partner provides full-funnel reporting.

As you build CTV campaigns, have active mid- and lower-funnel campaigns ready to move customers from their first exposure to their purchase.

Using full-funnel reporting and cross-device data on real customer journeys, marketers can see the impact a connected TV campaign has on sales and revenue.

Here is a simple structure to follow for a full-funnel strategy, starting with a CTV campaign:

- Engage consumers likely to buy from you with awareness CTV ads

- Engage consumers who viewed your CTV ads with consideration video ads

- Engage qualified consumers from your consideration campaign with conversion display ads

Connected TV advertising is one of the solutions that marketers must test this year to be ready for the future of advertising. Get prepared by downloading our latest Shopper Story 2022 report and access more consumer trends and advertising strategies:

1Statista Market Forecast, OTT Video, Worldwide (Forecast adjusted for expected impact of COVID-19)

2Conviva’s State of Streaming Q4 2020, Global

3Conviva’s State of Streaming Q1 2021, Global

4Limelight’s State of Online Video 2020, Global (US, France, Germany, UK, India, Indonesia, Italy, Japan, Singapore & South Korea), n=5,000; responses from consumers who watch one hour or more of online video content each week

5Advertiser Perceptions’ Video Advertising Convergence 2H 2019, US, n=356 via eMarketer