- Interest in retail media offsite, in-store, and non-retail verticals is growing

- Improving measurement and budget management are the top unlocks to more budgets.

- Brands have high expectations for retail media in the next two to three years

- Brands have high expectations for retail media tech partners, too

- This is what brands want. What about the rest of the ecosystem?

Retail media and the larger world of commerce media, with its first-party data-based targeting and closed-loop reporting, has been a game-changer for brands. Though it’s got a few years under its belt, it’s still in its infancy and full of untapped potential. As the demand side of the ecosystem, brands hold a lot of sway over how that potential is shaped and how retail media and commerce media will evolve in the coming years.

To understand what brands (and retailers and publishers) want and need to keep the category growing, we conducted the largest survey ever of the complete commerce ecosystem, including hundreds of brand leaders around the world. We discovered that brands are already sold on the idea of retail media for more than driving point of sale purchases and are eager for operational and technical advances to pave the way for more investment. But don’t take our word for it. Here’s what brands told us they’re looking for.

Interest in retail media offsite, in-store, and non-retail verticals is growing

Our survey findings show that retail media is no longer seen as purely a bottom-funnel, performance play. A convincing majority (85%) of brands and agencies globally agree that the ability of retail media to drive upper-funnel awareness is growing stronger.

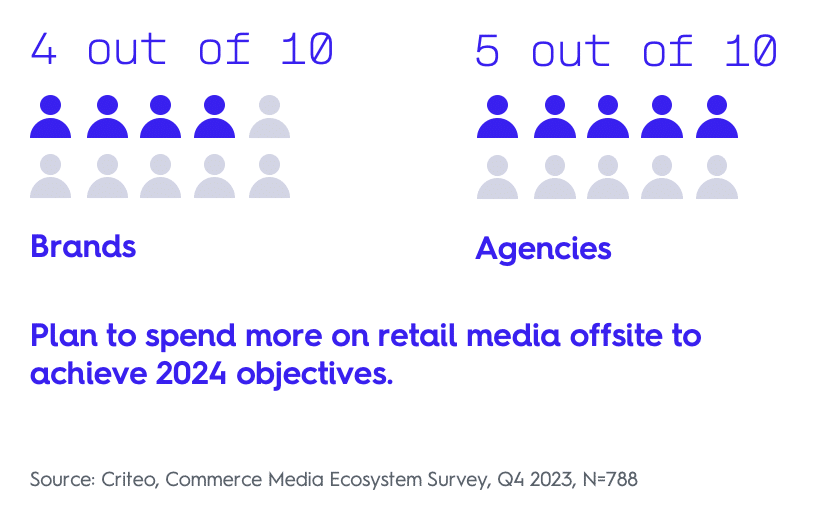

This is thanks, in part, to the addition of offsite which targets retailer audiences across the open web and enables marketers to engage shoppers in earlier stages of their journey. Adoption of retail media offsite is already strong, with 39% of brands globally planning to spend more on it in 2024. Half of retailers in our survey were wise to this opportunity, and plan to offer offsite this year. The other half, based on these findings, could be leaving money on the table.

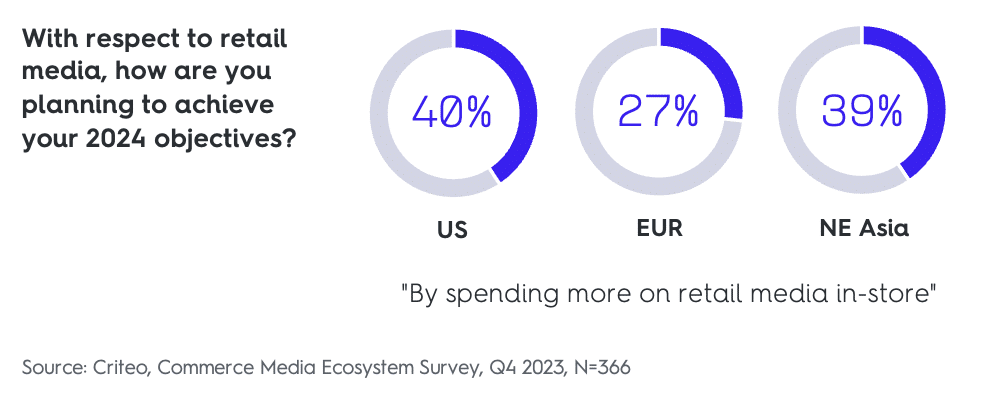

Retail media in-store (digital screens/point-of-sale displays in physical stores) is also garnering attention (and budgets) from brands. According to our survey, more than a third globally plan to spend more on it in 2024. This is another area where brand demand is pushing retailers to expand their offerings. Retailers who can offer a holistic retail media solution that offers onsite, offsite, and in-store will win big by connecting online and offline for brands.

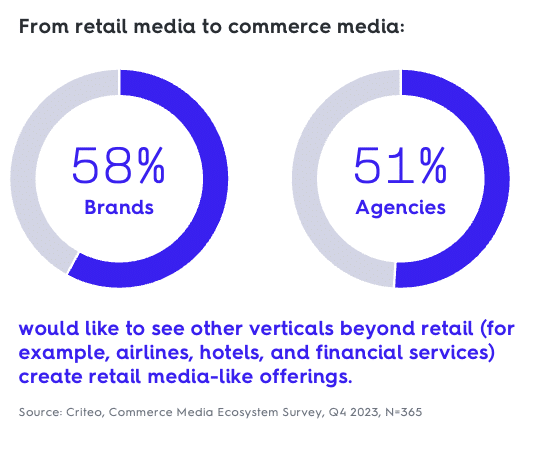

Brands and agencies made it clear that they are eager for the retail media model to expand beyond retail. More than half in our survey said they would like to see other verticals, such as airlines, hotels, and financial services, create retail media-like offerings. This opens the door for anyone with a unique audience and a monetization strategy to add a new revenue stream.

Improving measurement and budget management are the top unlocks to more budgets.

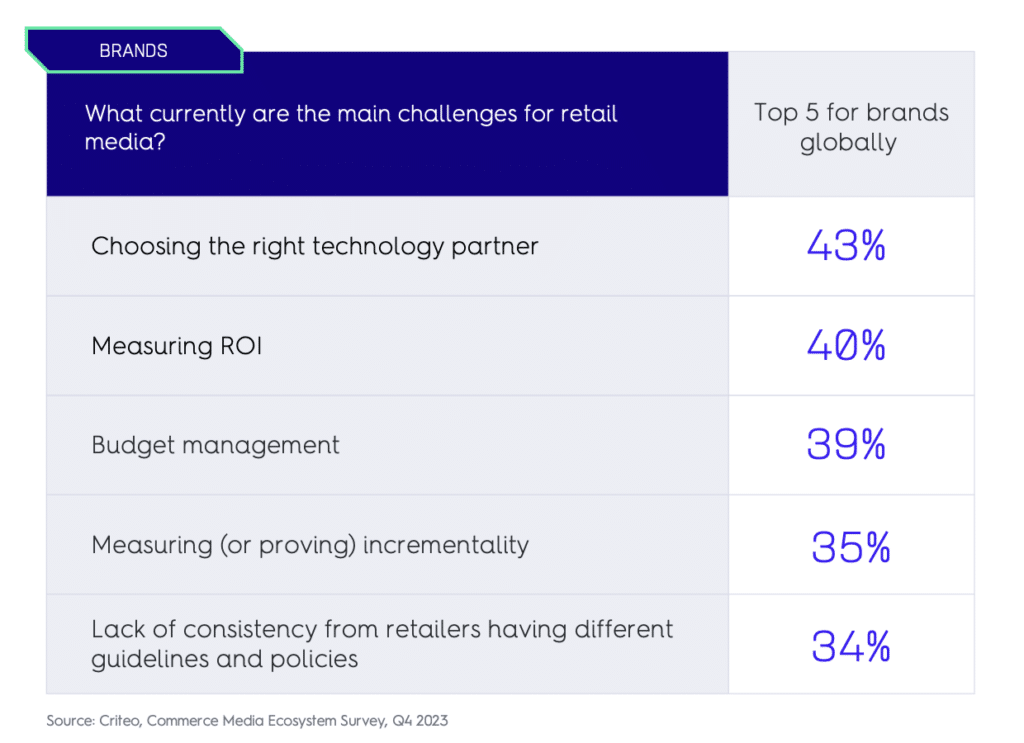

We asked brands about their top retail media challenges, and along with choosing the right technology partner, budget management, and measurement were top of the list across all regions. Lack of consistency across retailers was also a shared pain point.

These are directly connected to the larger issue of fragmentation. For brands—and the rest of the ecosystem—the key to growth is in finding solutions that can unite, streamline, and simplify the management and measurement of retail media. Standardization of measurement, where all players agree on common metrics, formats and guidelines, will also be essential to realizing the full potential of the category.

Brands have high expectations for retail media in the next two to three years

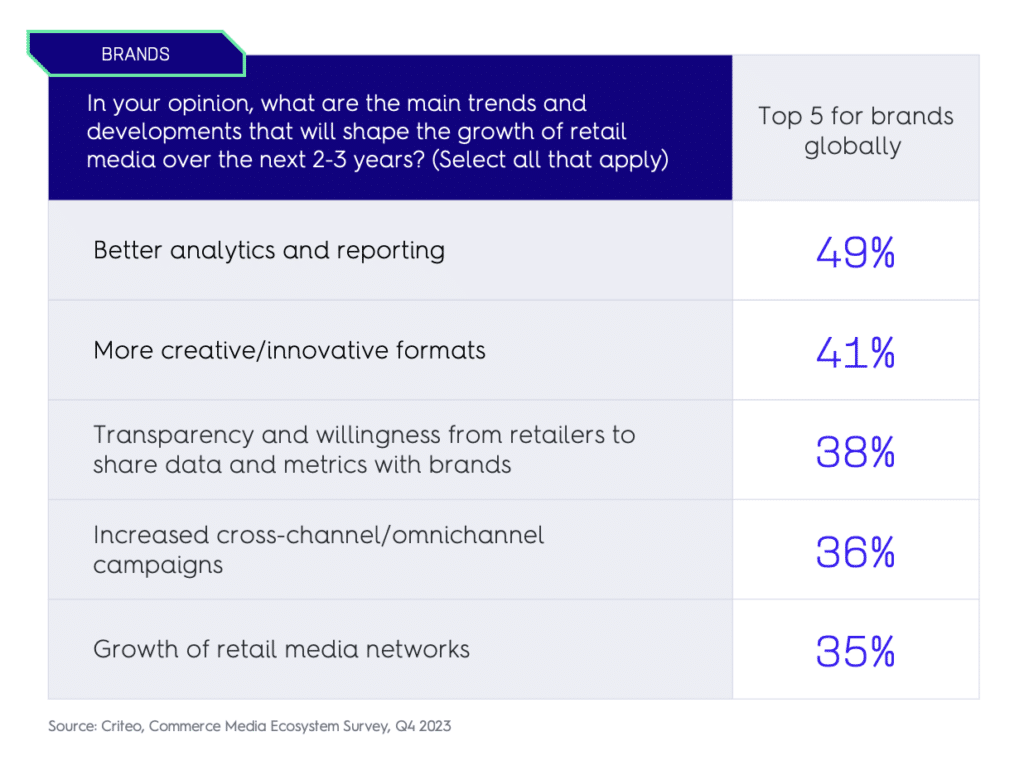

In terms of the forces that will shape the category’s growth in the near future, nearly half of brands say that better analytics and reporting will be a top driver. Around four in 10 also expect more creative ad formats and more transparency and willingness from retailers to share data and metrics with brands. They also want more omnichannel campaigns (hello, retail media in-store) and expect to see more retail media networks enter the game. Retailers, take note!

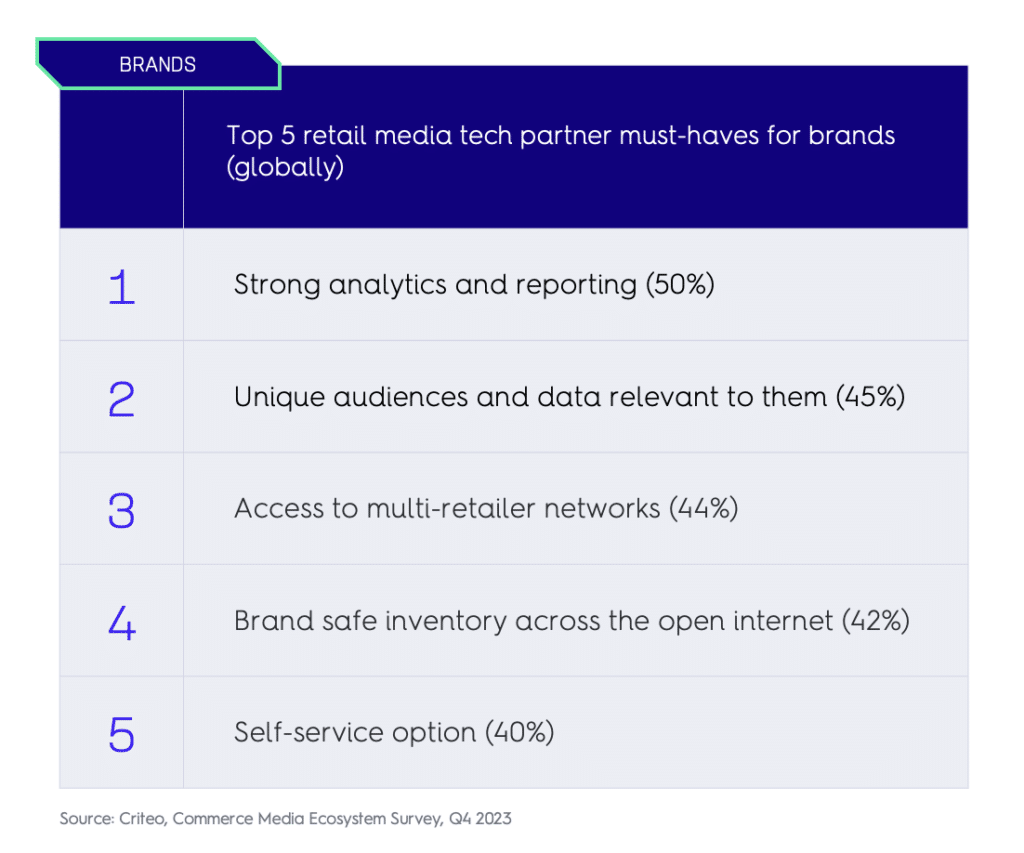

Brands have high expectations for retail media tech partners, too

When asked about their key considerations when choosing a technology partner for retail media, half of brands globally said that strong analytics and reporting was their number one must-have, followed closely by access to unique audiences and data. As RMNs proliferate, brands are also seeking tech partners that can simplify management and optimize performance by providing access to multi-retailer networks.

This is what brands want. What about the rest of the ecosystem?

See what agencies, retailers, and publishers also have to say about commerce media in our new report, The Great Defrag: How commerce media will unite advertising in 2024. Click below to download!