This year, we find ourselves in yet another unique peak shopping season. More of us are vaccinated, and in many places, restrictions and mask mandates remain lifted. At the same time, COVID is surging again as colder weather sets in and we spend more time indoors. The surge plus the emergence of new variants is leading to increased restrictions in some European countries, with Austria being the first to re-enter a full lockdown.

The trend of early sales also continued this year, solidifying what is now being called “Cyber Month” or “Black November”. This, along with fears about the impact of supply chain issues on shipping times and inventory, had shoppers purchasing gifts early and in earnest.

With so many new factors at play, Black Friday 2021’s sales performance was an open question. Now that it’s over, we have some answers. We analyzed sales from thousands of clients around the world to understand the state of Black Friday 2021 and its new cousin, Cyber Month. Here’s what you need to know:

Black Friday Sales Were Down, But Cyber Month Sales Were Above Pre-Pandemic Levels

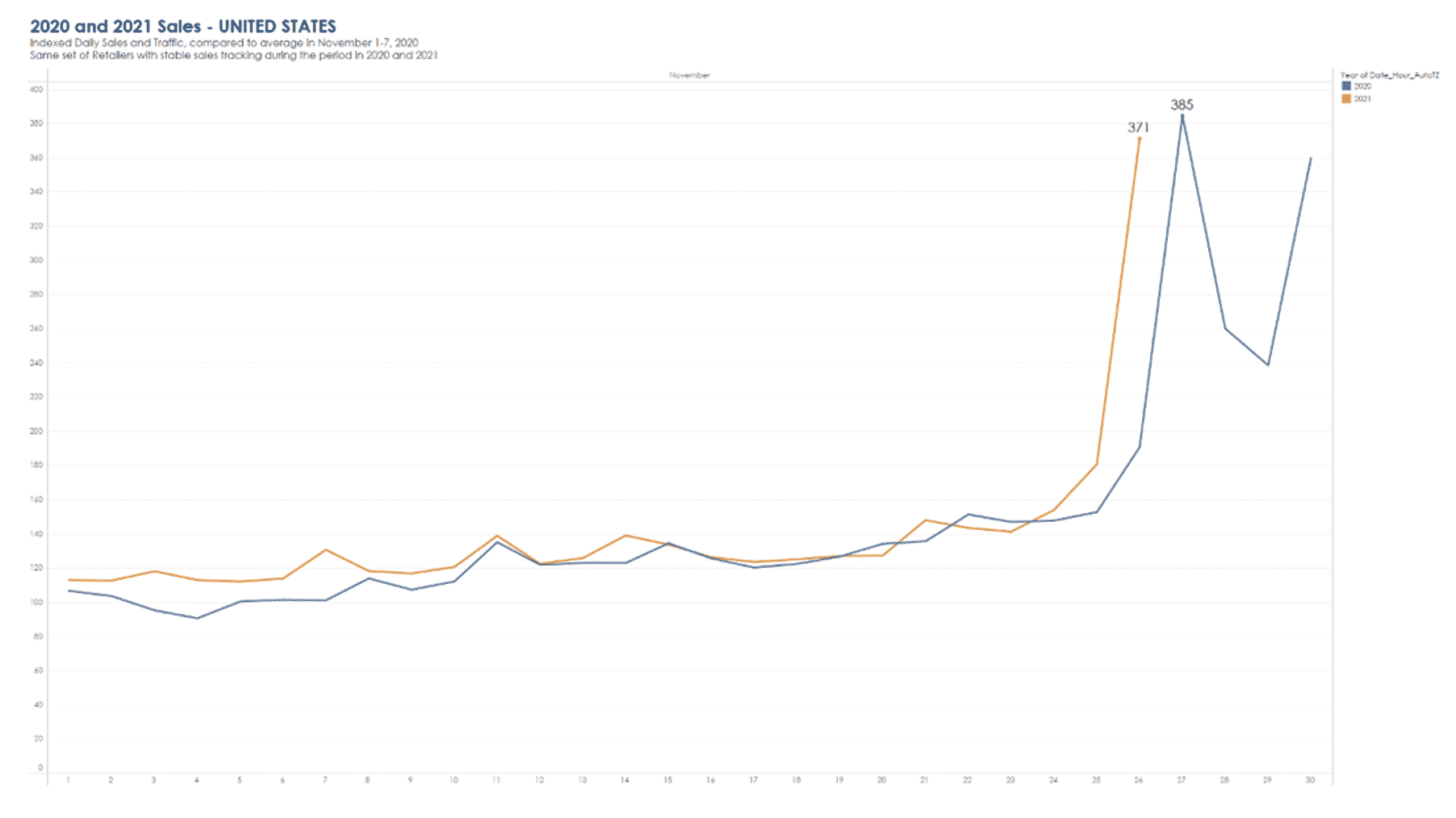

In the US, online sales on Black Friday were +271% compared to the average from November 1-7, 2020. This is down from the +285% peak recorded last year.

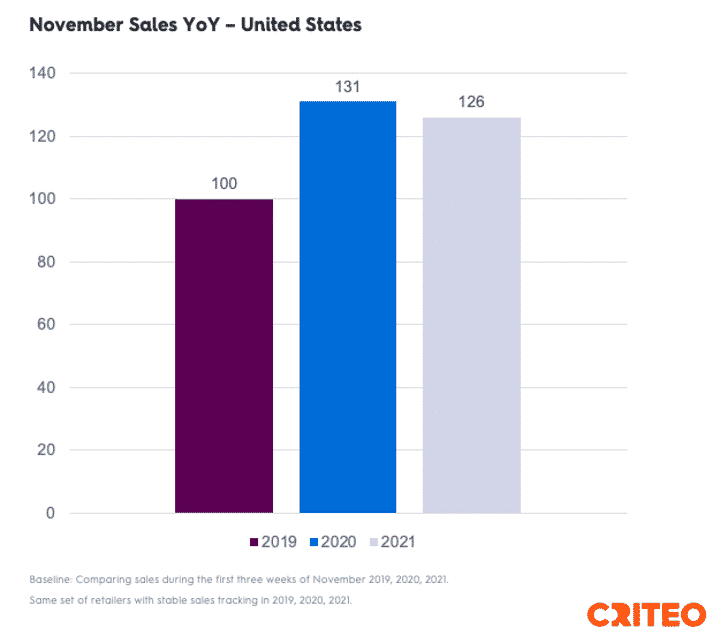

Our data confirms that the traction for Cyber Month that we saw last year continues to be strong this year. Sales for the first three weeks of November 2021 were up 26% compared to the same period in 2019. This is slightly lower than November sales in 2020, which were up 31% vs 2019 numbers.

When we looked at category-by-category sales, the Jewelry/Luxury/Eyewear category was the runaway winner, with a 357% increase in sales vs. November 1-7, 2021. The Apparel and Lifestyle categories also did well, up 278% and 277%, respectively. In addition, our analysis shows that average order value was up 10% over last year and up 7% over 2019.

Midnight Shopping Sprees Shifted to the Morning for Americans

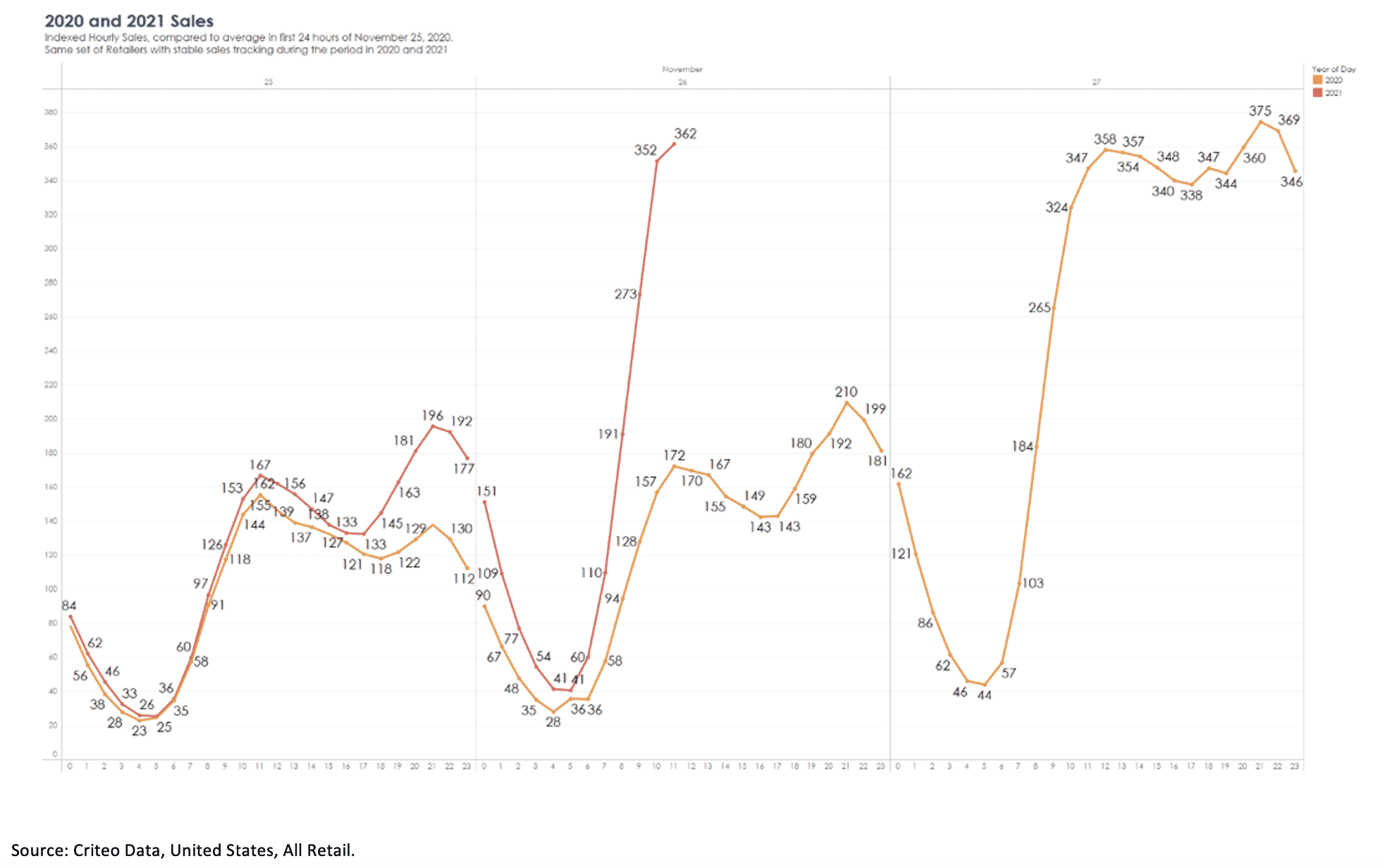

This year, Criteo’s data team added a unique layer to their analysis, looking at hour-by-hour sales trends. They discovered that in 2021, Americans opted to sleep rather than shop in the wee hours of Black Friday. The chart below shows that on Black Friday 2020 (which fell on November 27), the indexes were higher during the first 8 hours of the event (midnight to 8 am). On Black Friday 2021, sales indexed higher from 8 am to 12 pm. Among other factors, this might be related to the fact that for the second year in a row, some of the nation’s biggest stores were closed on Thanksgiving, giving families more time together and reducing the urgency to grab early doorbuster deals.

Black Friday 2021 in Europe

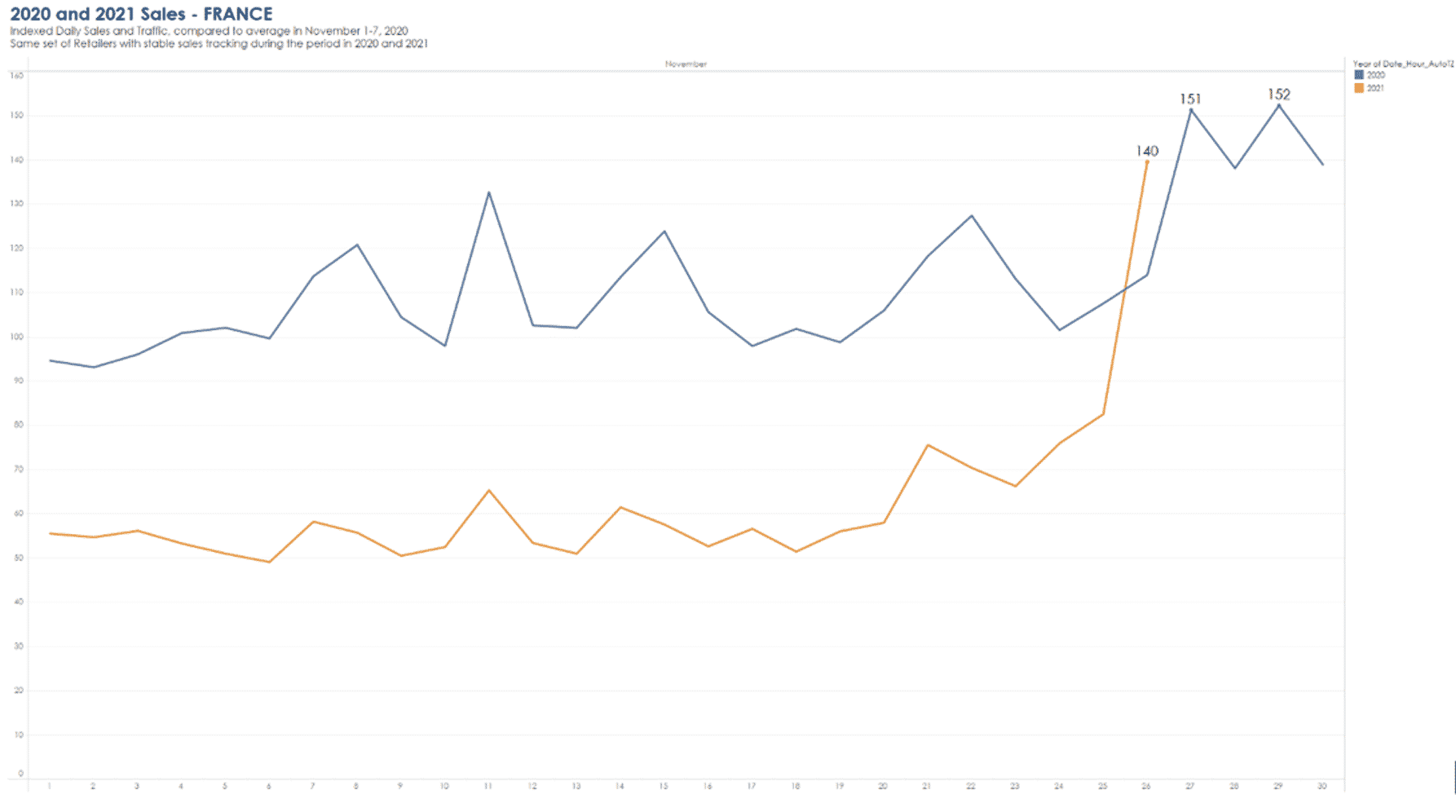

In France, Black Friday 2021 online sales were 40% above the average for November 1-7, 2020. In 2020, the peak was +51%. Though down from 2020, the increase in online sales vs. early November of this year was significant, jumping nearly 160%. Categories with the largest increases included Consumer Electronics (+185%), Apparel (+179%), and Jewelry/Luxury/Eyewear (+174%).

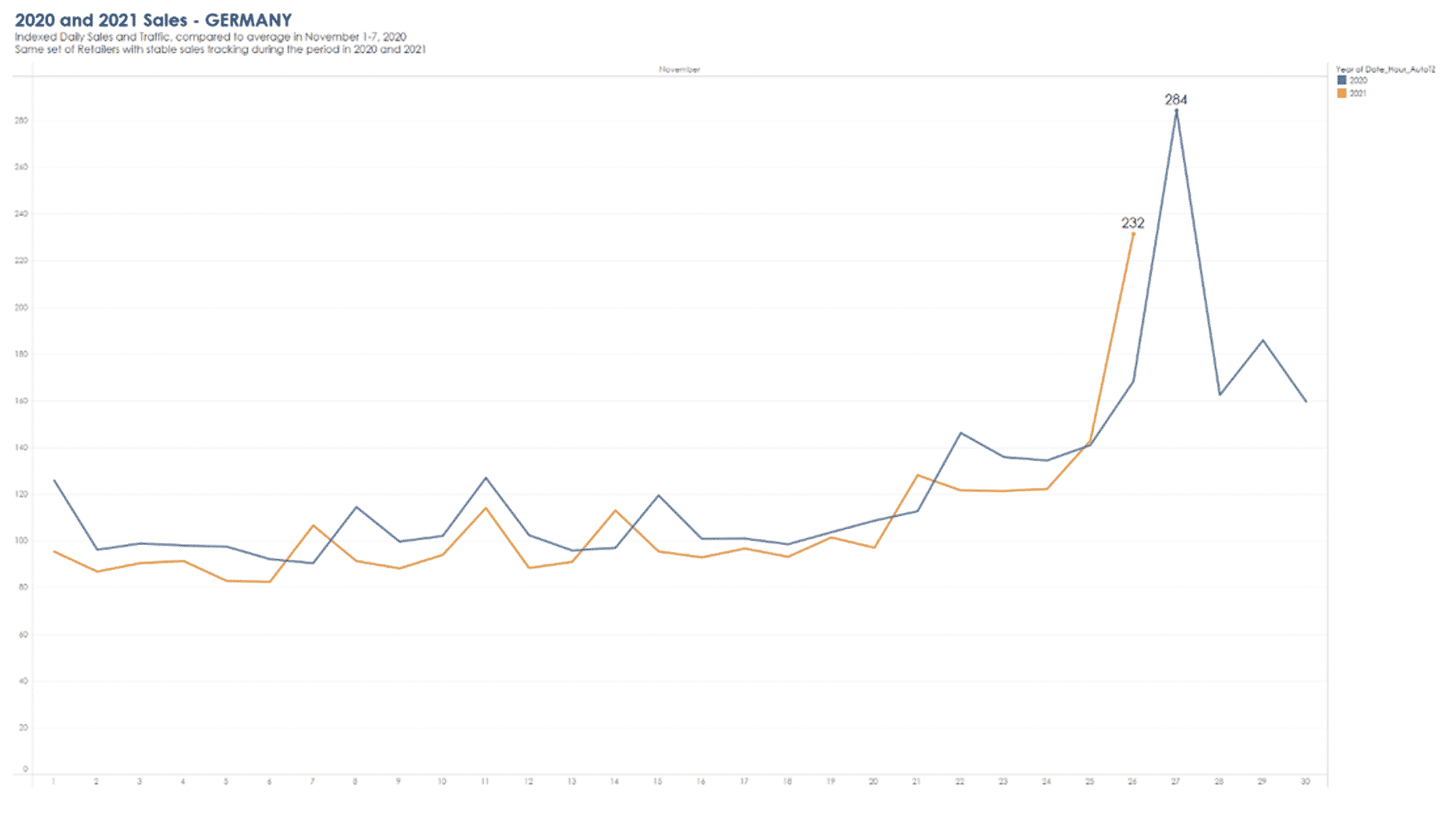

In Germany, online sales maxed out at +32% compared to the average for November 1-7, 2020. This is down quite a bit from 2020’s +84% spike. The Lifestyle, Consumer Electronics, and Hobbies & Leisure categories saw the most growth compared to average sales from November 1-November 7, 2021, with +190%, +181%, and +174%, respectively.

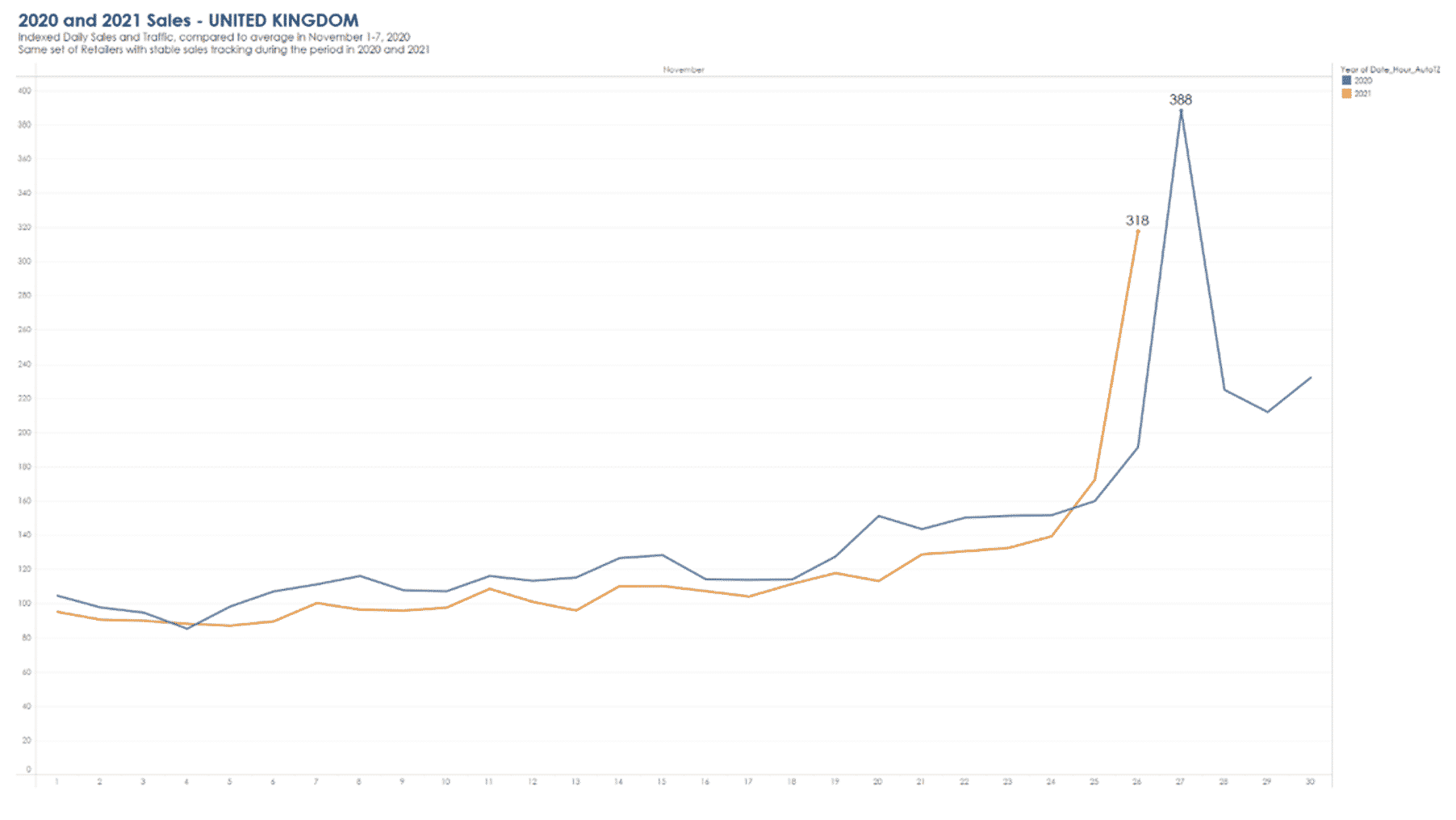

The UK also saw a smaller online sales spike this Black Friday, clocking in at +218% vs early November of last year. 2020 saw a +288% increase vs the same period. Compared to the average for early November of this year, online sales grew 247%. As in the US, Jewelry/Luxury/Eyewear category sales saw tremendous growth, up 405%. Other category leaders were Lifestyle (+378%) and Apparel (+254%).

Is This Goodbye, Black Friday?

This is not the death of Black Friday, but rather a repositioning. It’s becoming the exclamation point, instead of the whole sentence. The crescendo in a month-long holiday song. Black Friday will still be a major revenue driver in the future, but it’s reasonable to expect smaller spikes than in past years, balanced out by steadily increasing sales throughout the month. Marketers who are already thinking about next year will want to consider their plans and budgets not just for Black Friday, but with the whole of Cyber Month in mind.

Want more sales data? Check out our Commerce Trends dashboard. For more holiday insights and strategies, download the The 2021 Holiday Commerce Report: