Back-to-school is the second biggest consumer shopping season in the United States after the winter holiday season and it’s no wonder as parents, teens, and even grad students start searching for and purchasing the things they’ll need for success the year ahead.

We dove into our back-to-school data from across our brands and retailers and this is what we found:

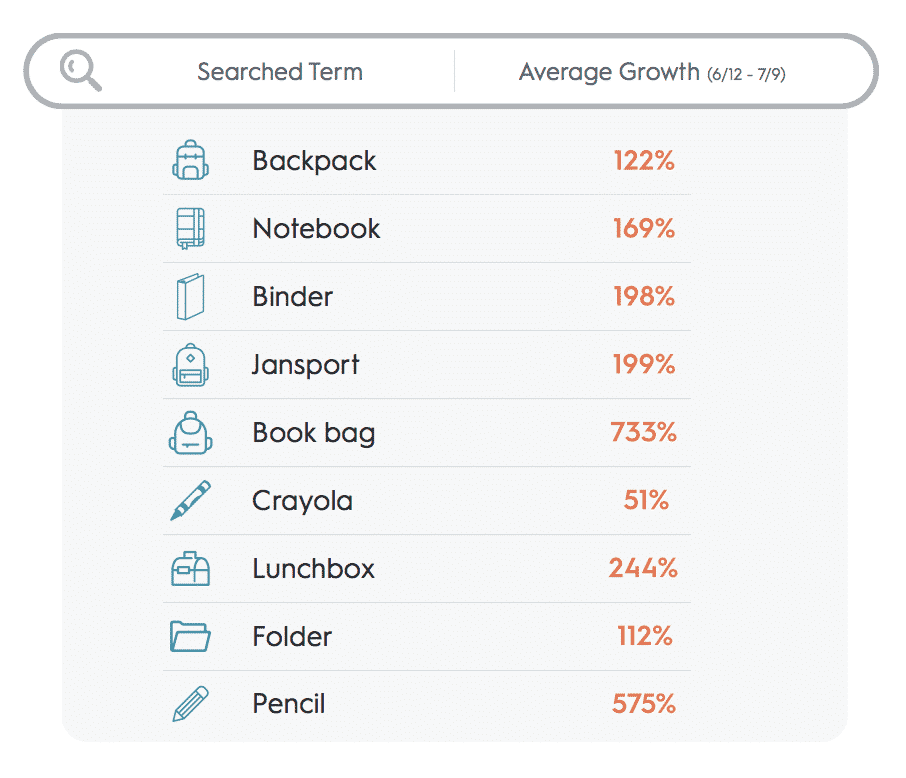

1. New backpacks, lunch boxes, and crayons get younger kids excited about school

Our data shows between mid-July and mid-August, searches surge for book bags, lunch boxes, notebooks, and pencils, indicating parents and students are looking for new gear to get kids in the right mindset for school.

Jansport – the backpack company founded in 1967 – is still a top searched term in backpacks, but “backpacks” is still the most searched term during back-to-school season. “Book bags” saw the highest growth in search – a 733% increase between mid-June and mid-July

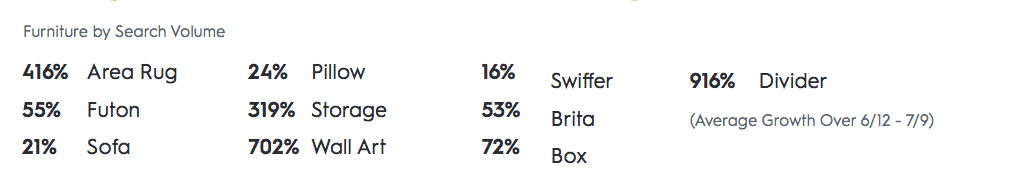

2. Dorms get decorated

For college and grad students, search starts a month later with much of it focused on making their living space more like home. Posters of favorite bands and idols no longer cut it; today’s college students aren’t afraid to spend their (or Mom and Dad’s) money on dorm furnishings. Between mid-August and mid-September, searches surge for wall art, area rugs, storage solutions, and pillows, all necessary to make barren dorm rooms seem more inviting after long days of lectures and studying.

School supplies like binders, notebooks and pencils are likely less searched for by college and grad students since much of the work is done electronically.

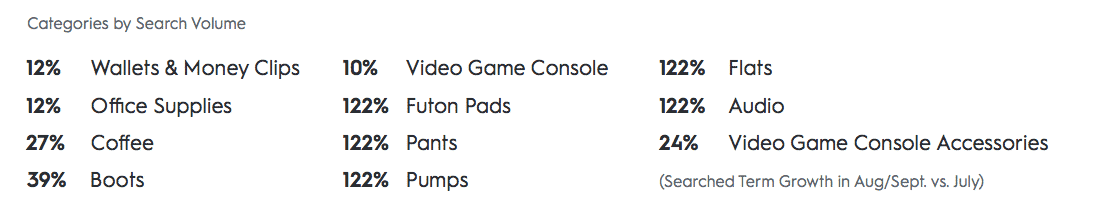

3. Students invest in camaraderie, caffeine and entertainment

College can be a lonely place, but not if you have an extra futon for visitors and an extra Xbox controller. Compared to July, purchases of futon pads increased a whopping 256%, and video game console accessories by 24%, indicating that most students arrive on campus with the latest video game consoles but are adding accessories to make the games more social.

And to get through their long days of classes and clubs and longer nights of studying and gaming, they’re buying lots of coffee. The caffeinated beverage saw a spike of 27% in August and September compared to July.

4. Fitness regimes kick into high gear

Ah college, the time to expand young minds… and muscles.

Our data shows that supplement searches grow 61% and 43% increase in body-building supplements in August and September, respectively, compared to July. Similarly, sales of diet supplements increase 29% and 55% in August and September, respectively, compared to July.

Takeaways

1. Keep your spend high with Criteo Sponsored Products from July through September. Our data indicates that parents start searching early July through mid-August for younger kids, and college-bound and grad students search for dorm room and apartment furnishings beginning early August through September.

2. For laptops, which have a longer lifecycle and are higher priced, Back to School season kicks off the consideration period that leads into big deal events like Black Friday.

3. There’s a huge opportunity for home furnishing and home goods retailers to win more sales come back-to-school with more deals and options for college students looking to make their dorm rooms homier. It’s clear from our data that students are searching for items that will both remind them of home and let them express themselves as they live on their own for the first time.