Shelter-in-place orders to prevent the spread of coronavirus have had an unprecedented effect on consumer behavior.

As businesses remain closed and people are told to stay at home, a global social distancing economy has formed. Consumers haven’t stopped making purchases, but the things they buy and how they buy them are different.

Many consumers are spending even more time online than usual. Verizon reported a 20% increase in web traffic in one week, while European telco company Telefonica reported a 30% increase, and web services company, Akami, cited a 50% increase in daily web traffic compared to the average. News websites are also seeing record-breaking traffic, with an increase of 57% year-over-year, as well as an increase of 56% in time spent on those sites.

Part of this increased time online is spent shopping. The social distancing economy is virtual, focused on ecommerce and delivery. Consumers are leaning into ecommerce to get what they need delivered to their homes while they stay indoors.

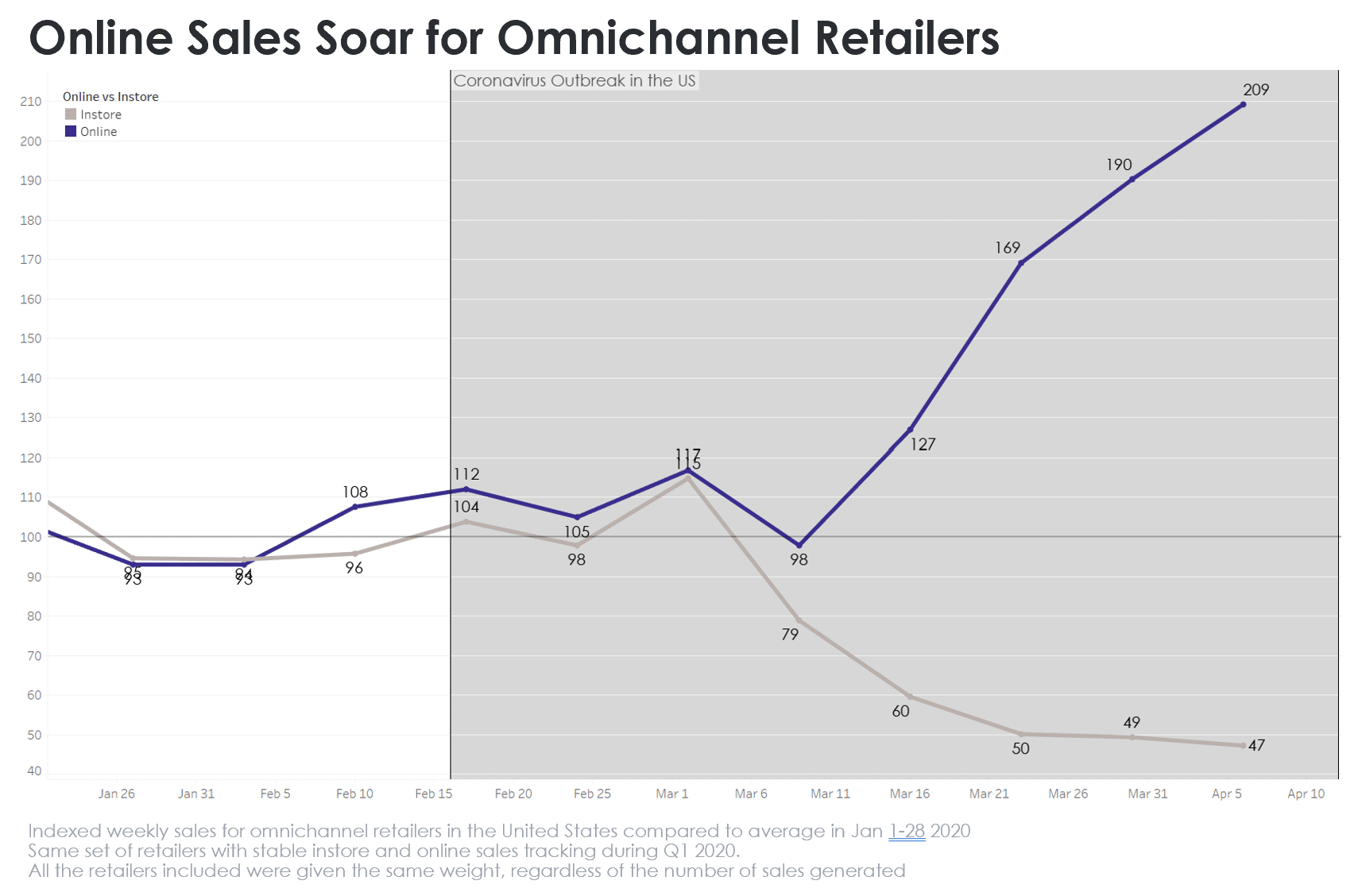

In the U.S. for instance, our data shows that online shopping took off between March 9 and March 16, and has been on an upward curve ever since (chart below).

What should marketers do now?

Since this pandemic is affecting consumers’ lives, marketers should acknowledge it. In a recent survey by Ace Metrix, 42% of consumers said that addressing coronavirus in their ads is okay, close to half (44%) said that it would depend on the message and/or the brands, while only 10% said that it wasn’t okay.

Since the social distancing economy is our new normal for the foreseeable future, marketers should focus on what customers really need, with messages that acknowledges their new reality. To determine what that new normal consists of, we analyzed ecommerce trends across our network of 20,000+ advertisers and created a Coronavirus Impact Dashboard to help navigate the changes.

At Criteo, we’re helping our advertisers make decisions and solve their biggest challenges during this time of rapid change. Here, we’re sharing five ways for advertisers to continue to drive revenue while meeting consumers’ unique needs as they adjust to their new way of life.

1. Focus on your best-performing marketing channels

Needless to say, a lot has changed since advertisers originally set their 2020 budgets and now they need to do more with less. Whether it be working with shrinking spend or a smaller staff, advertisers still need to meet their goals and keep their businesses growing. This means focusing on marketing activations that are driving results to work smarter — not harder.

How? For one, advertisers can use a single retargeter to pull back on spend while being more efficient with their advertising dollars. For companies who still use multiple retargeters, we’ve found this setup to be inefficient since advertisers actually end up in a bidding competition against themselves. Using a single retargeter eliminates that risk for advertisers as well as helps them get clearer attribution and avoid user fatigue from frequency blindness.

Advertisers can also switch to automated bidding wherever possible for more efficiency and performance. This process leverages machine learning and AI solutions to work on the advertiser’s behalf by adjusting bids in real-time, eliminating the need for manual adjustments and constant oversight.

2. Leverage loyalty to your stores to drive more online sales

With governments around the world closing brick-and-mortar locations, many advertisers are choosing to redistribute their budgets from stores and offline sales to online tactics and ecommerce. Since web traffic is increasing, this allows advertisers to maximize connections with consumers while stores remain closed.

The most direct way to do this is by targeting in-store buyers and engaging them online through first-party data such as a store transaction feed or other data from a customer relationship management (CRM), customer data platform (CDP), or data management platform (DMP) partner. To do this, advertisers need to share that first-party data with relevant vendors who can help create specific audiences of online shoppers. This lets advertisers leverage existing brand equity with privacy-protected data from in-store purchases, rather than targeting a general online audience.

3. Invest in retail media—including native ads on retailer websites

Brands that rely on their retail partners for in-store sales, are also looking to pivot to online sales. However, these brands don’t have point-of-sale data mentioned above. These advertisers would benefit from investing in retail media to reach online shoppers.

Retail media gives brand advertisers access to inventory on retailer sites with native onsite ads that reach consumers while they’re actively shopping. It also includes data-driven ads that reach consumers as they browse offsite on the open internet—all in a way that is engaging and shopper-friendly.

Consumers’ needs are changing dramatically as they adjust to their new reality, so advertisers should broaden priority stock-keeping units (SKUs) accordingly to promote items that address immediate shopper needs. They should also ensure their daily spend allows ads to run at all times of day since consumers are on their laptops and phones at all hours, rather than only standard working hours.

Moreover, advertisers should ensure their campaigns include multiple ad placements as consumers transition into this new normal of buying online. For example, in-store shopper loyalists are new to ecommerce and are still determining their go-to retailers. By allowing for multiple ad placements, advertisers can help consumers have easier and more seamless shopping experiences.

4. Reach new audiences that are actively shopping for in-demand products

The social distancing economy is driving high demand for products such as webcams, sleep and loungewear, as well as personal grooming accessories, and more. And while many advertisers are selling these must-have items, consumers may not know how to get them. This means advertisers need to reach new audiences to increase qualified traffic to their sites and encourage purchases.

To reach new customers, advertisers can track high-growth product categories and build target audiences using intent data for consumers who are actively browsing for and buying those products. This data is combined with related product categories, brand interest, and demographics to create new buyer personas that are emerging during the pandemic.

One example is a “work from home” buyer persona as many people recently started working from their apartments or houses. This persona can include consumers who recently purchased a new laptop, as they are also likely to purchase other items for their home office, including office supplies like desk organizers, binding supplies, file folders, as well as office furniture.

To determine these personas, advertisers need to think about how consumers are spending their time at home, including working, exercising, and being with their kids, then ask “What do my customers need?” This will help advertisers provide as much value as possible.

5. Prioritize the in-app customer experience to build long-term user relationships

With people spending more time online, advertisers may notice a boost in app traffic. According to our April 2020 Global App Survey, we found that three of every five app users, or about 60% of our survey respondents, are likely to make an in-app purchase in an app they downloaded during the pandemic. That’s why it’s in app marketers’ best interests to ensure users have seamless experiences to turn a potentially short-term app install and usage mindset into a loyal and active relationship.

Ways to do this include running app retargeting campaigns for high-demand products, features, and in-app offers. For example, advertisers providing high-demand products should consider a retargeting app campaign focused on shoppers who are actively looking for those specific products across the web. For advertisers who are already running web retargeting, this is a great way to boost conversions and create a multi-device, always-on experience for audiences.

While things are changing by the day, we’re continuously monitoring the latest trends and releasing weekly insights into what advertisers can expect during our new normal. We also hosted several webinars where I shared specific regional data and expanded on several more tactical recommendations for advertisers to adjust during COVID-19. To view those on-demand webinars, simply click the buttons below for your respective region.