If there’s one constant in digital advertising, it’s change.

With seismic shifts on the horizon around consumer privacy, the deprecation of the third-party cookie, and the ever-looming growth of walled gardens, publishers need a way to thrive in this new reality.

At Criteo, we think the answer is commerce media, but how does the industry feel about where we’re headed? To get a pulse check, we fielded the largest ever survey across all corners of our ecosystem, covering brands, retailers, agencies, and—of course—publishers. We learned that global publishers are already planning ways to diversify revenue through integrated commerce strategies, with almost half (46%) either actively running commerce-based strategies or in the process of implementing them.

But that’s just the start. Here’s what else we discovered.

Publishers are learning to think like retailers

Since the earliest days of retail media, brands and retailers have forged strong relationships to deliver results for both sides. Today, it’s clear that publishers want and need those retailer connections, too.

What will this new retail trio look like in practice? As a publisher, the world is your oyster, but we’re already seeing publishers deploy commerce-focused strategies like digital storefronts, affiliate programs, sponsored and commerce content, editor-curated subscription boxes, and more.

By seeing their editorial strategy through a commerce lens, new opportunities to unlock incremental revenue will open up for publishers.

Total revenue remains the north star, but the gap is closing

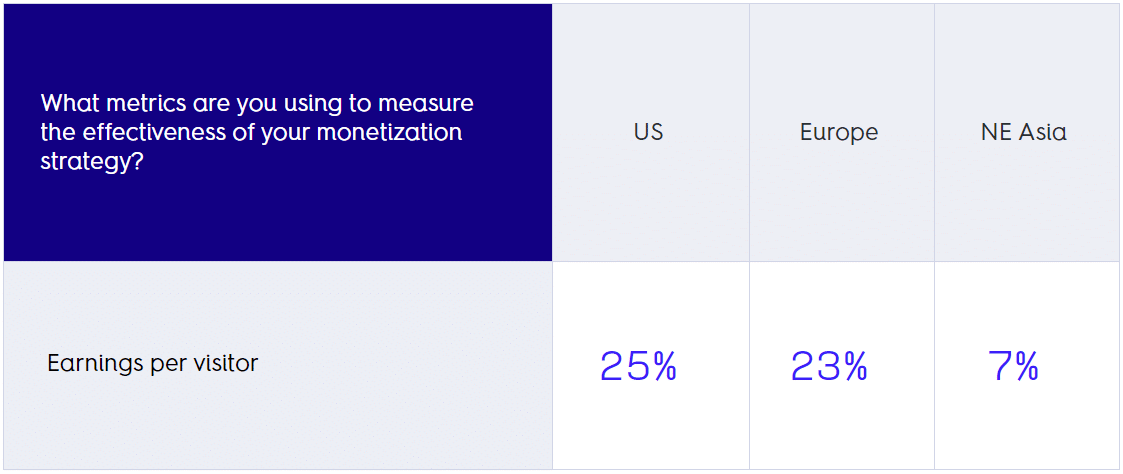

For publishers, assessing the effectiveness of their holistic monetization strategy is key. It’s what keeps the engine ticking. And our results bear that out, with 53% of global publishers reporting total revenue as a primary metric for success.

But while total revenue offers an excellent view from 30,000 feet, our survey suggests that what’s happening closer to the ground could be what really moves the needle this year.

Our results show that almost a quarter (22%) of global publishers are already tracking revenue on the per-user level, suggesting a greater understanding of the value of an audience monetization strategy.

Supply-side deals trading is on the rise

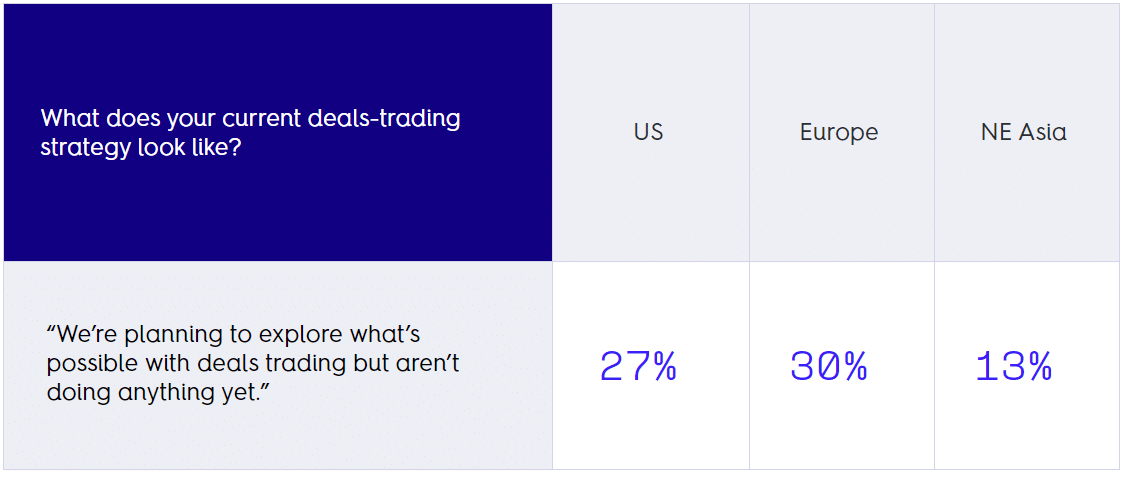

For publishers with the right scale, trading private deals with demand-side partners can be a lucrative revenue stream—and it’s an opportunity that’s only set to grow. Even better, a robust deals-trading strategy benefits both publishers and advertisers, so it’s a win-win.

According to the global publishers we surveyed, deals trading is already quite well established in both EMEA and the US, with over a third of publishers in those regions already up and running with a direct sales team. In APAC, things are more nascent, with 13% actively trading deals right now.

What’s more interesting might be that an equal number of publishers are planning to explore what’s possible with deals trading in the coming year. All told, that’s 60% of US and EMEA publishers either already trading deals or planning to.

Generative AI is here, but it’s a game of two halves

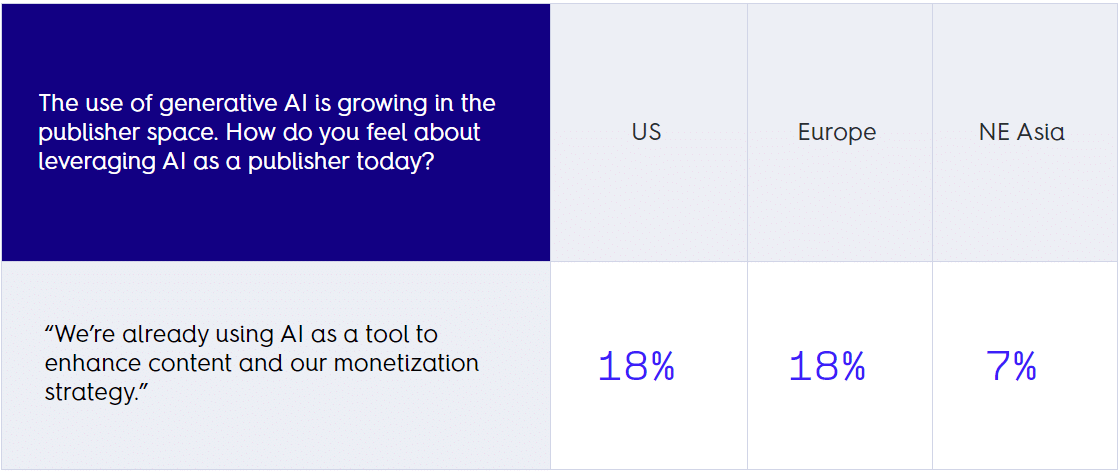

Few technologies have made as big an impact in such as short space of time as generative AI. With tools like ChatGPT making headlines every day, it’s no wonder that publishers are weighing up how best to incorporate this technology into their workflow.

But the results weren’t exactly what we expected. In fact, opinion seems split on a global scale.

European publishers are the most bullish on AI, with 42% expecting it to become a more integral part of their process. In APAC, on the other hand, the sentiment was almost exactly the opposite, with 80% of publishers there reporting that they have no plans at all to leverage AI-assisted content on their sites.

In terms of who is already using AI within their editorial output, it’s clear that publishers are taking a cautious approach, with a global average of 16% using the tools right now.

That’s the supply side of the story. How does everyone else feel?

It’s not just publishers who are shifting focus to the commerce opportunity. To learn how brands, agencies, and retailers are planning to incorporate commerce into their strategy for 2024, download the full The Great Defrag report by clicking below.