Even in the most challenging times, consumers have shown that they will honor holiday shopping and gift-giving traditions. But the way consumers discover and buy gifts has changed forever. After a year of record-breaking ecommerce growth, what will holiday shopping look like in 2021?

In 2020, consumers made their seasonal purchases online more than they ever had before. Criteo’s global sales data shows that online retail sales increased 22% year over year in early December 2020—a time when retail sales are already at their highest annual level.1

Our data from mid-2021 shows that in-store shopping is back while ecommerce sales remain significantly higher than pre-pandemic levels. With this data, we predict that consumers will use a mix of online and offline channels as they make purchase decisions in the peak shopping season.

But we wanted to know more, so we recently surveyed over 3,900 consumers globally to get a pulse on their holiday shopping plans.2

Read on to explore the top five holiday shopping trends from our survey, and download The 2021 Holiday Commerce Report for more data and predictions.

Holiday Shopping Trend #1: Consumers consider their gift purchases months ahead of the holiday season.

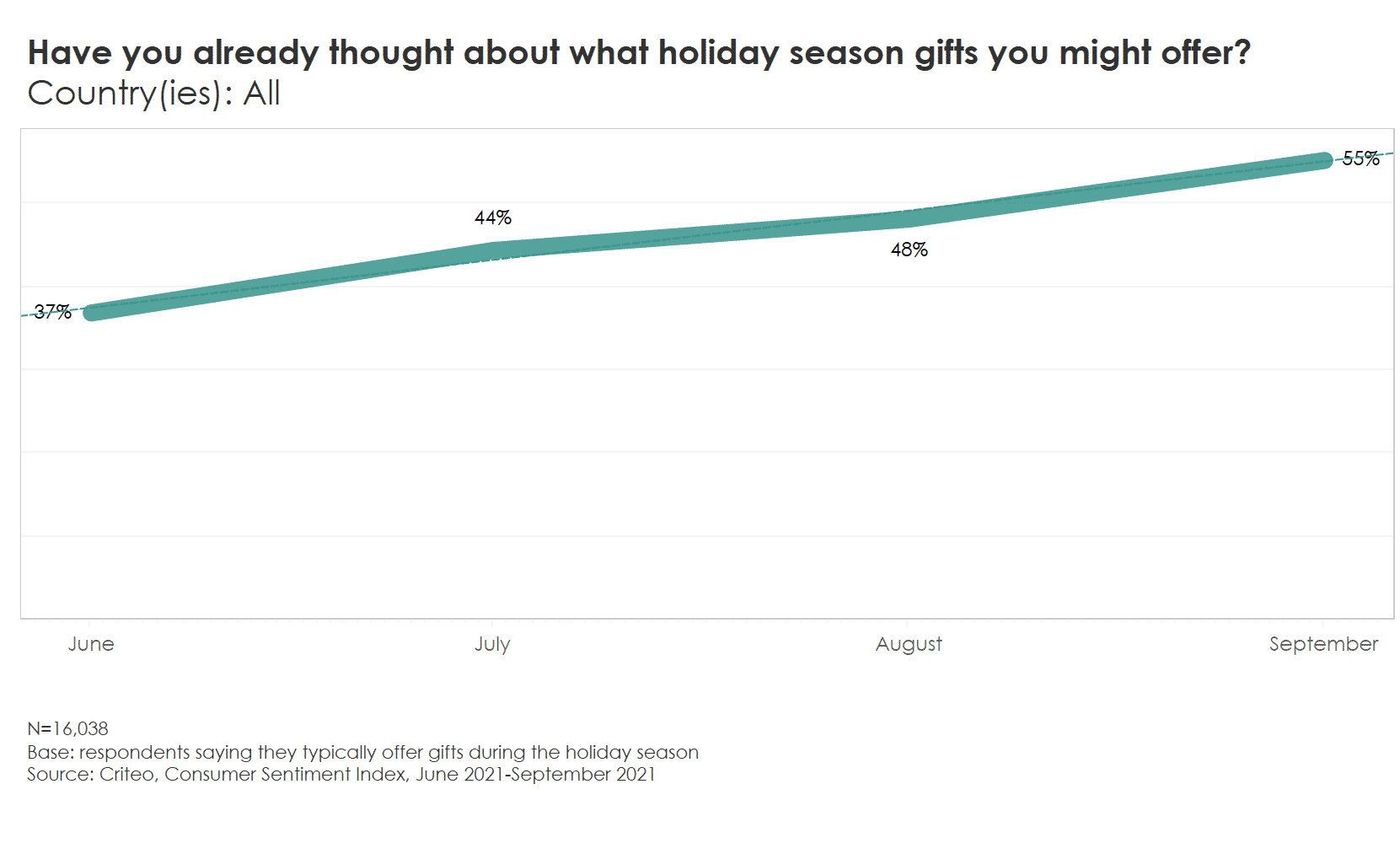

As part of our survey, every month we asked consumers if they are thinking about what holiday gifts they want to buy this year.

In June, more than one-third of consumers are already considering what gifts to buy. Three months later, this grows to over half of consumers (55%) thinking about gifts in September.

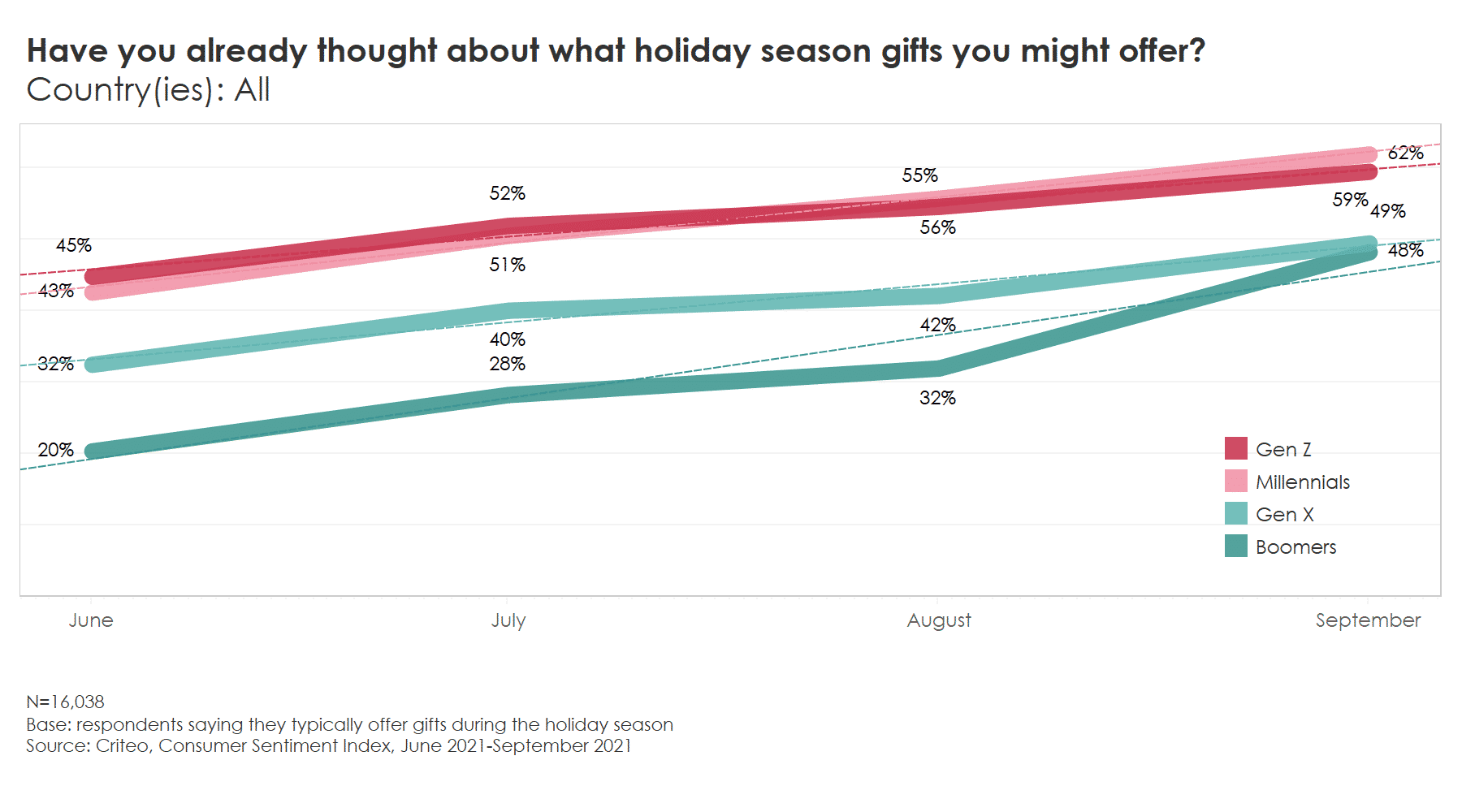

Our survey also shows that the younger age groups are more likely to start shopping early. By September, 59% of Gen Zers and 62% of Millennials are already thinking about what gifts they might buy vs. 49% of Gen Xers and 48% of Boomers.

Holiday Shopping Trend #2: Most Gen Zers will spend more in-store this year.

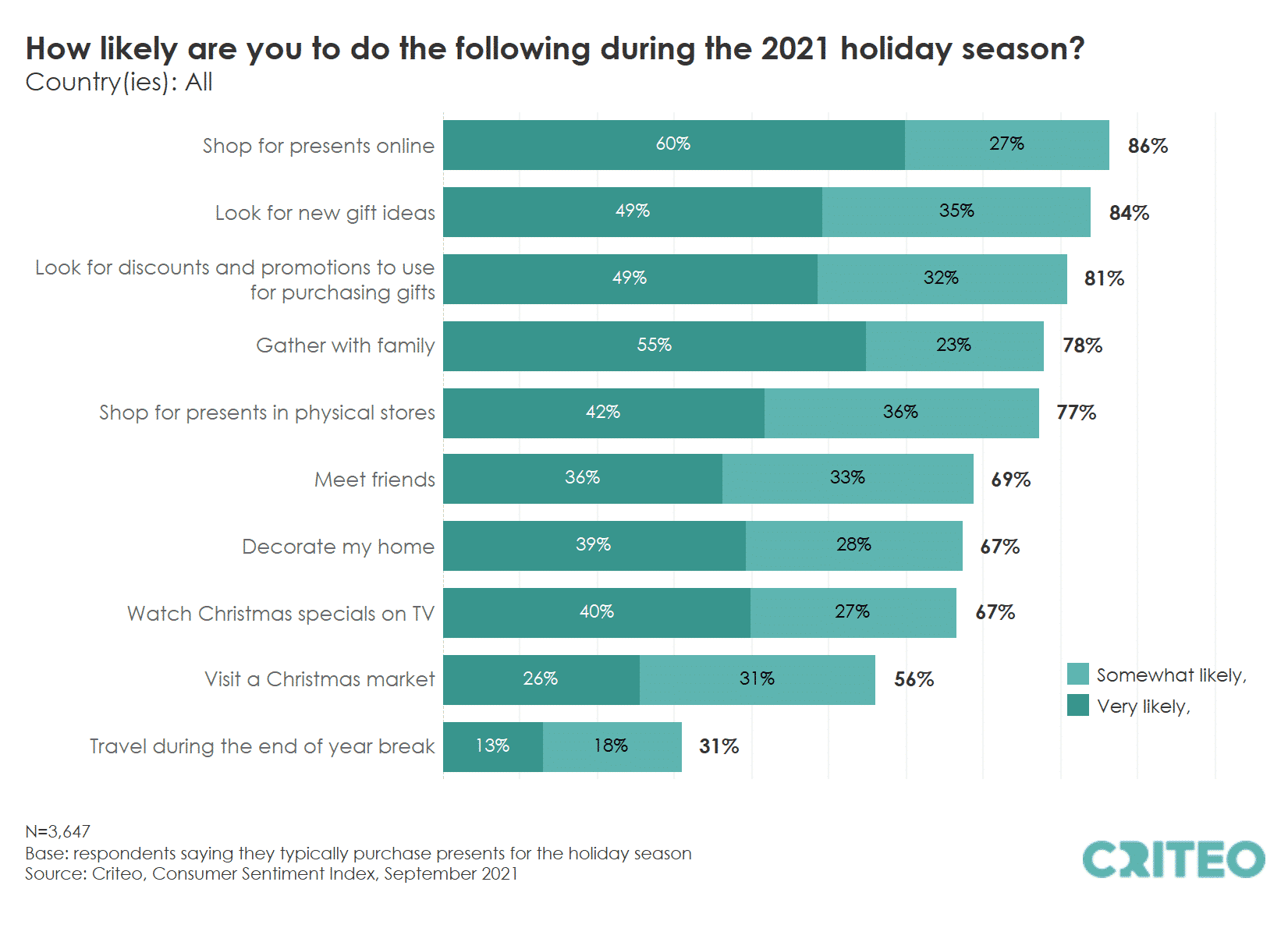

Like 2020, most consumers (86%) will shop for gifts online in the 2021 holiday season. But almost the same amount (77%) plan to shop for presents in-store.

Explore trends in every country:

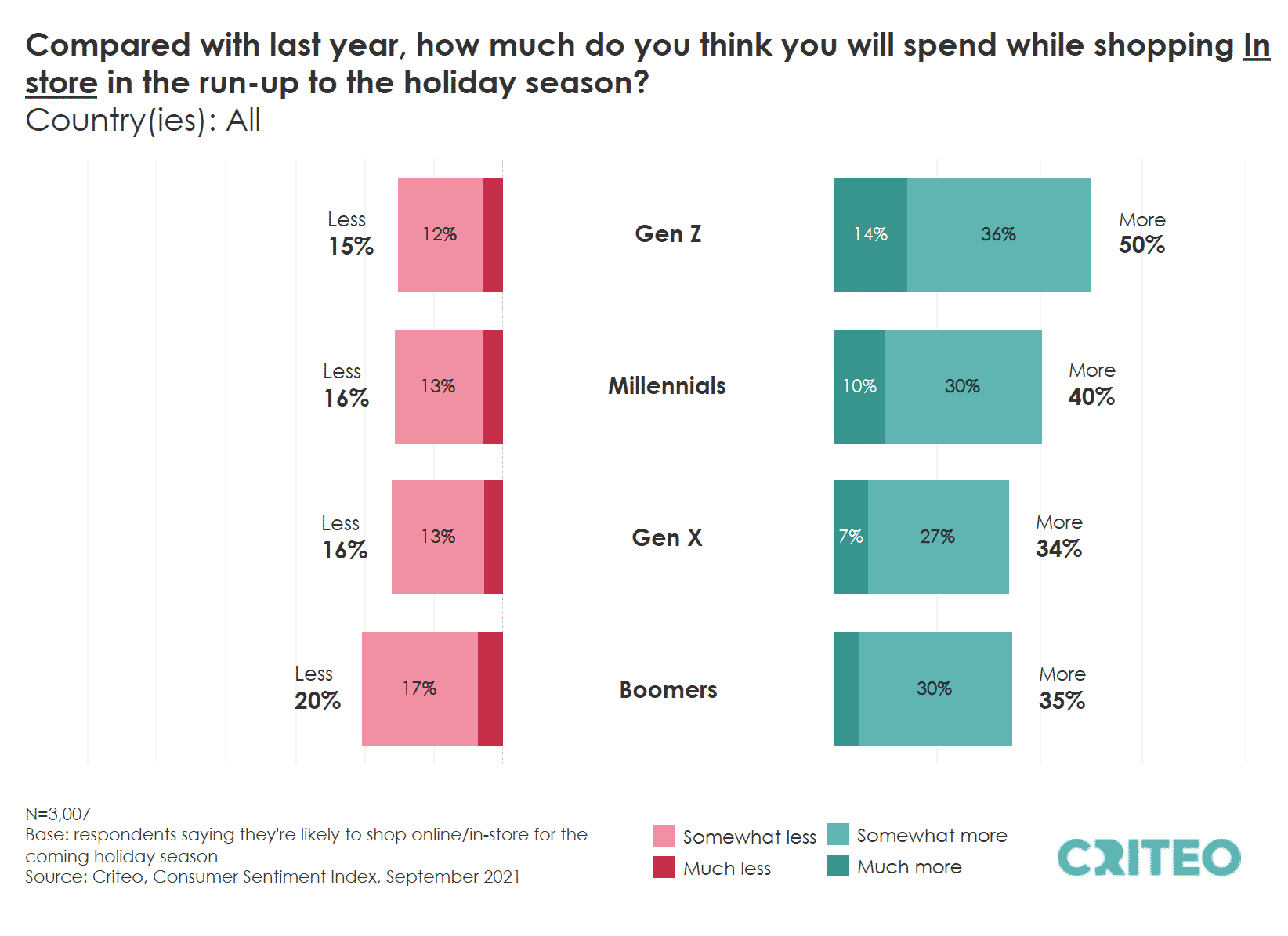

Among the age groups, Gen Z consumers have the highest propensity to spend more in physical stores than they did last year. Half of Gen Zers say they’ll increase their spending in-store for the holiday season, compared to 40% of Millennials, 34% of Gen X, and 35% of Boomers.

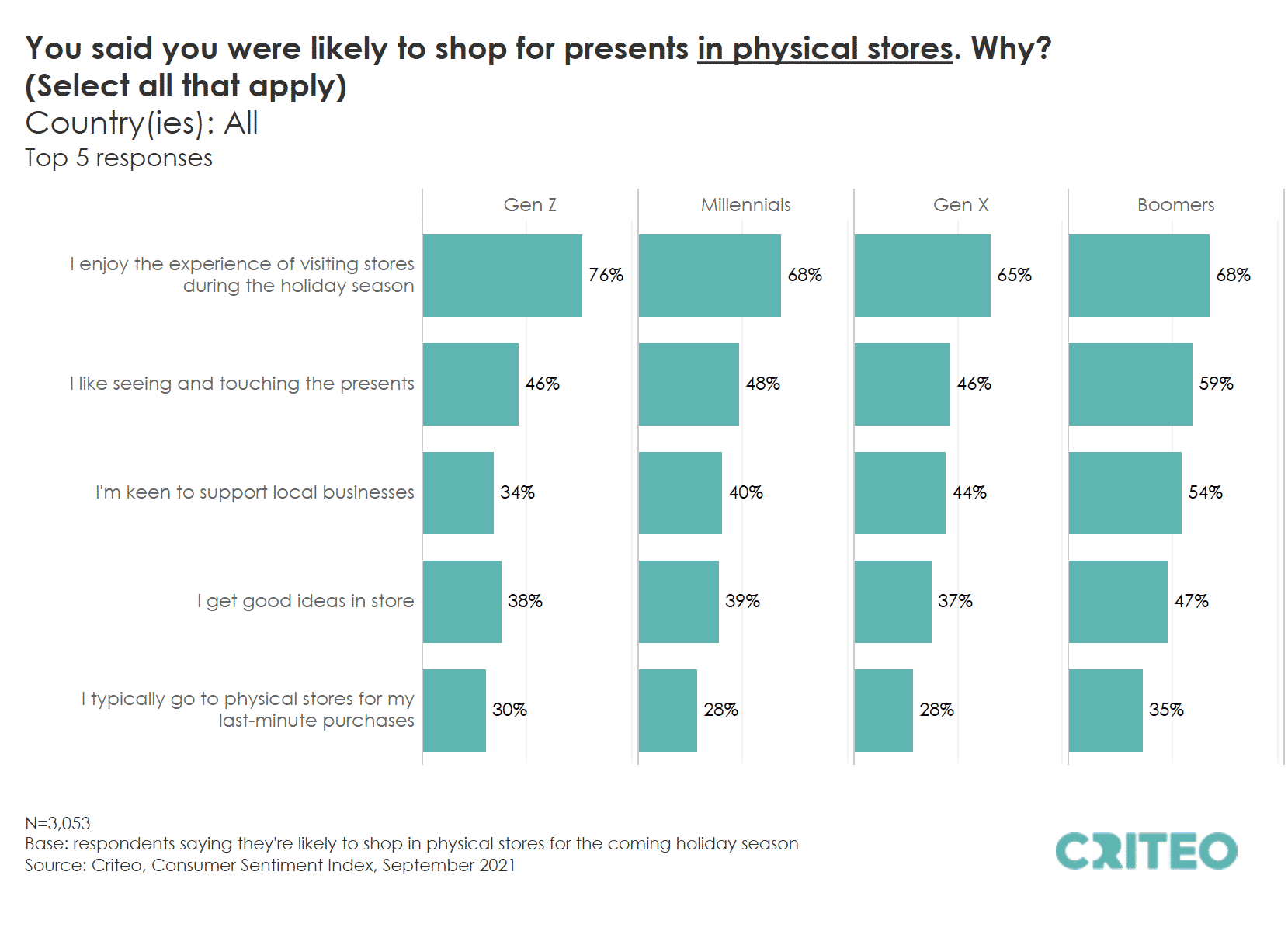

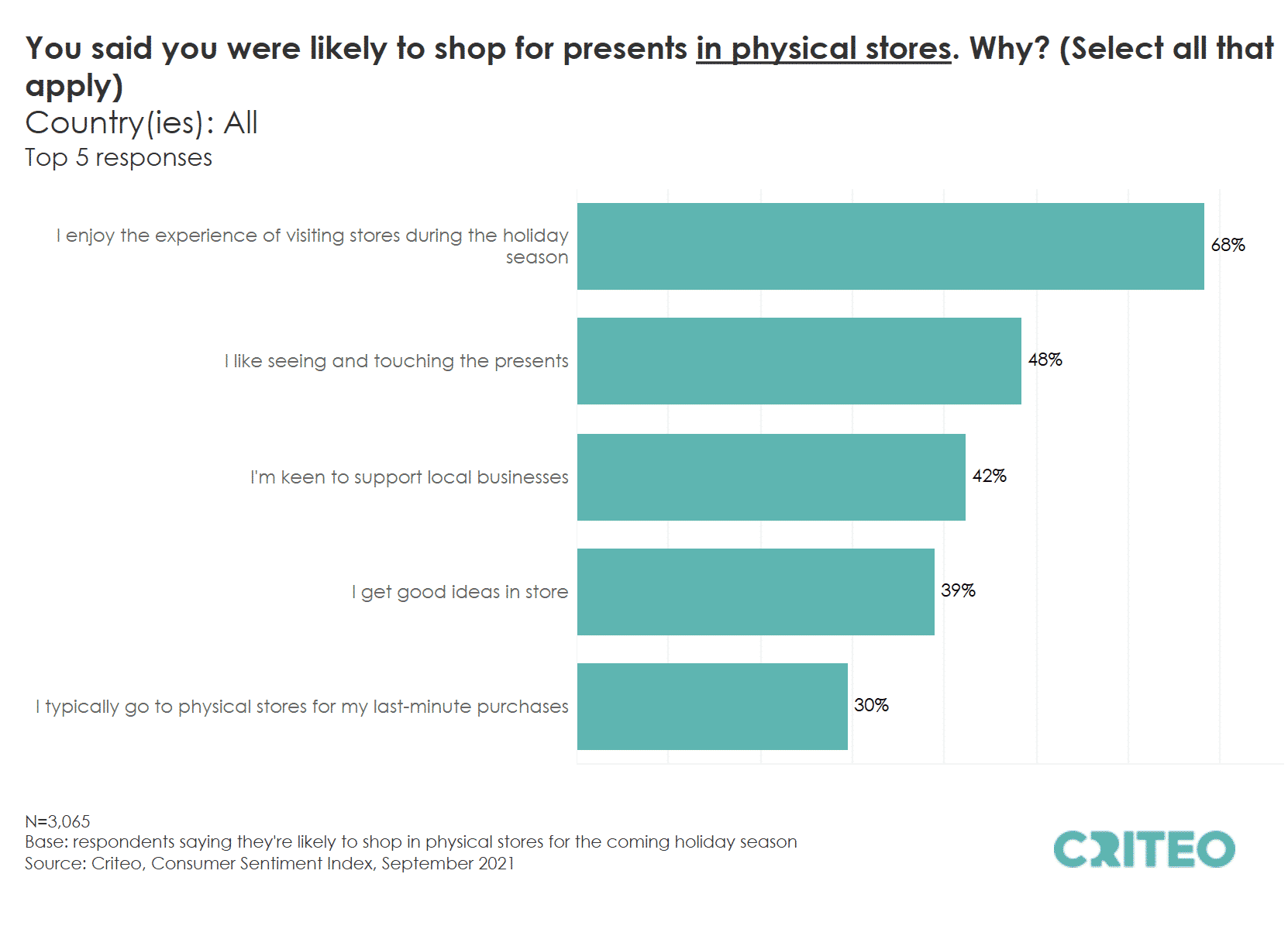

Holiday Shopping Trend #3: Experience will drive in-store shopping.

Most consumers say the experience of shopping in-store is why they’ll look for gifts offline this year. However, this trend is more pronounced among Gen Z consumers (76%) than in other age groups: 68% of Millennials, 65% of Gen Xers, and 68% of Boomers.

Meanwhile, close to 6 in 10 Boomers (59%) say they plan to shop in-store because it allows them to see and touch products, but this factor doesn’t resonate as much among other age groups.

Boomers are also more likely than other age groups to want to support local businesses through in-store shopping.

Explore trends in every country:

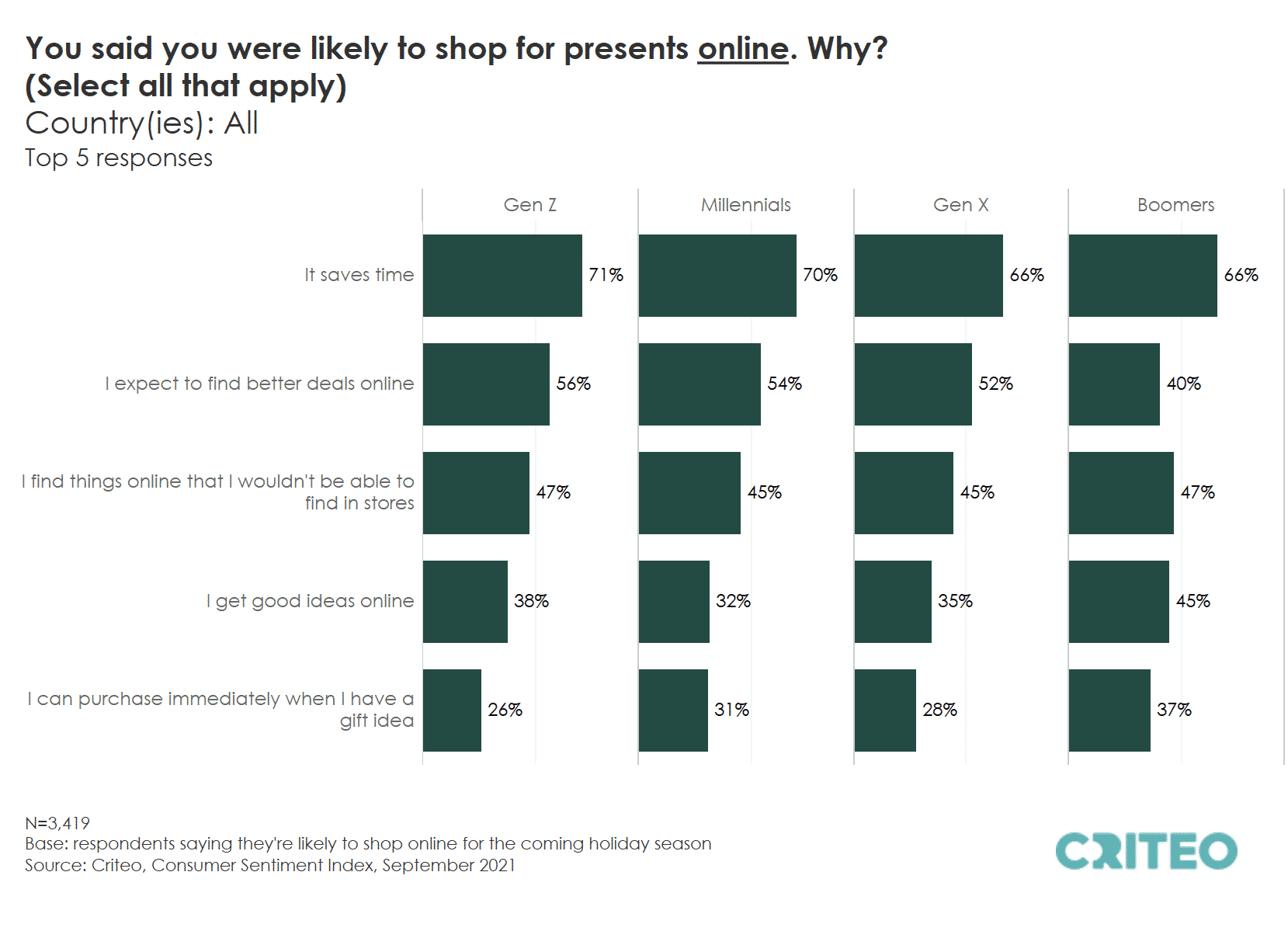

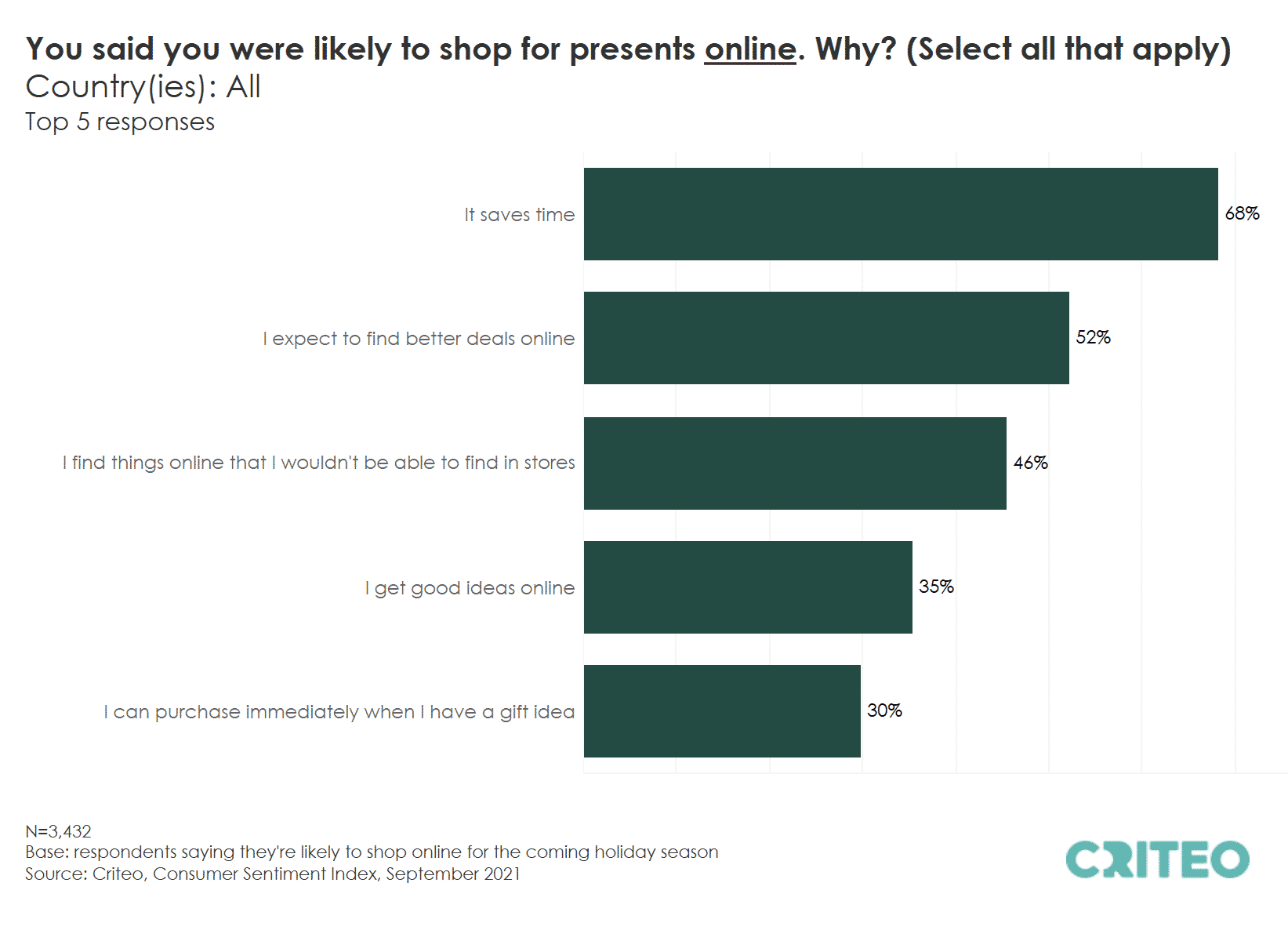

Holiday Trend #4: Convenience drives online shopping.

When asked why they plan to shop for gifts online, consumers overwhelmingly say they do so because it saves time (68%).

Younger consumers also believe they will find better prices online: More than half of Gen Zers (56%) and Millennials (54%) say they plan to shop for gifts online because this is where they expect to find better deals—compared to only 40% of Boomers.

Boomers have a higher propensity to buy gifts online because they get good ideas there or because it allows them to purchase immediately.

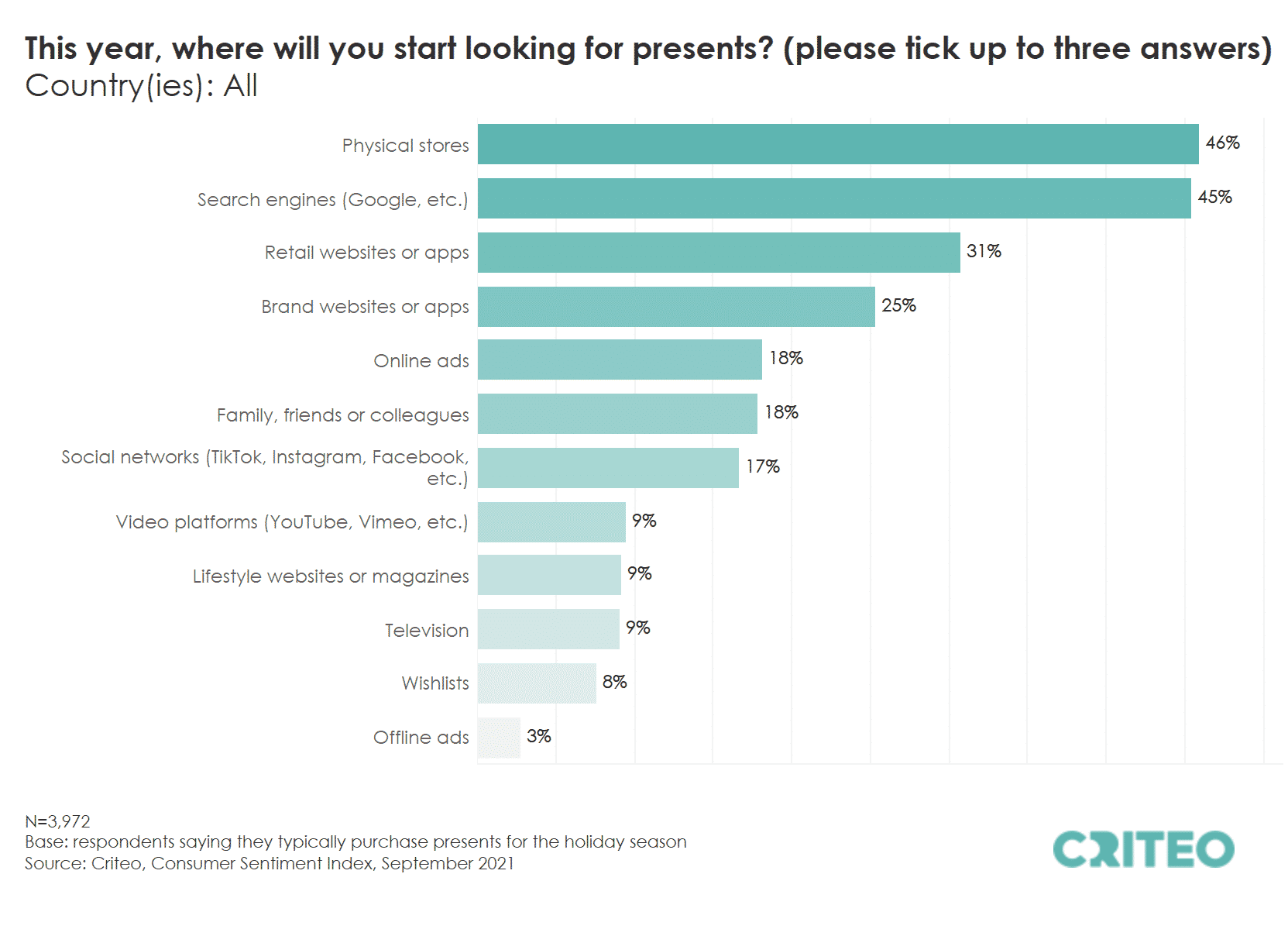

Holiday Trend #5: Gift discovery starts in stores, on search engines, and on retail websites.

The largest number of consumers plan to start looking for gifts in physical stores (46%), followed by search engines (45%), retail websites or apps (31%) and brand sites or apps (25%).

Our survey shows that retailers are a key source of inspiration for holiday shoppers: More than 7 in 10 respondents will start gift shopping at a retail touchpoint (physical stores, retail sites, or brand sites).

Explore trends in every country:

At a time when consumers are driving shifts in global commerce, marketers need to take a new approach for the new seasonal shopper.

Get three steps to renew your seasonal ad strategy inside The 2021 Holiday Commerce Report. Download your copy below and reach out to your Criteo contact to start building your campaigns.

1Criteo Global Data, 10 days between December 4-13, 2020 compared with December 6-15, 2019.

2Criteo’s Consumer Sentiment Index Survey, September 2021, Global (US, UK, France, Germany, Italy, Spain, Japan, South Korea, Australia), n=3,972. Base: respondents saying they typically purchase presents for the holiday season.