The rapid growth of digital commerce and the fundamental changes happening in the advertising industry are leading marketers to rethink their strategies. They’re looking for new ways to drive sales and loyalty while creating better ad experiences and respecting consumer privacy.

For agencies, this means you have a bigger job to do for your clients.

Agencies are now responsible for creating new growth strategies, as well as for recommending ways to sustain this growth and future-proof these strategies.

The best place to start is by looking at the entire path to purchase. Where are consumers discovering new brands today? Where are they spending time when they’re in a buying mindset? On the other hand, how can you create great ad campaigns for your clients without relying on third-party cookies?

Download the Agency Edition of The 2021 Digital Advertising Manual: New Opportunities to Drive Client Growth to get checklists for launching campaigns across five important channels and tactics:

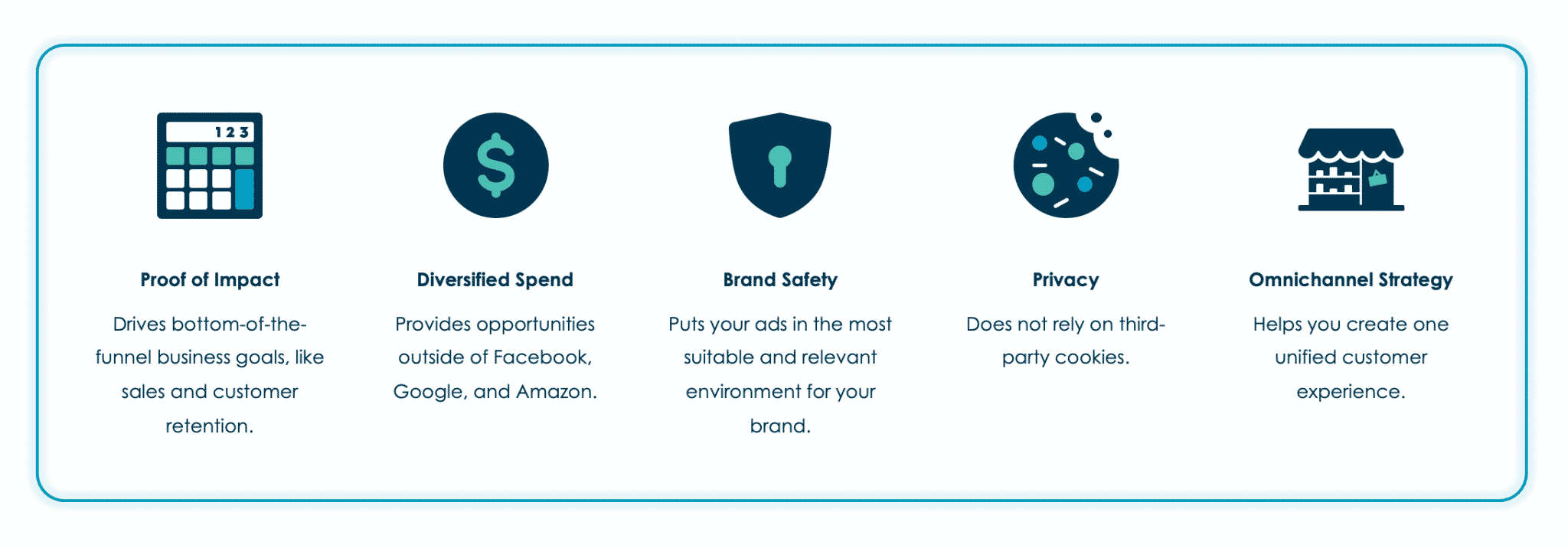

Benefits Key

Each advertising opportunity below helps you and your clients overcome challenges in the digital advertising ecosystem. Look for these symbols that represent the benefits as you read.

Connected TV

People around the world are forgoing traditional, linear TV to stream shows and movies on demand via over-the-top (OTT) services and their connected TVs (those with a built-in internet connection).

Netflix, the most popular OTT service in the world, reached 203 million paid subscribers in Q4 2020, up from 167 million in Q4 2019. Disney+ gained 73 million subscribers within a year of its launch.

Smart marketers are eyeing these streaming audiences and beginning to invest in connected TV advertising.

The Benefits

![]() Diversified Spend

Diversified Spend

Reach targeted audiences on a new channel where viewers are hyper-engaged. Plus, reach cord-cutters and cord-nevers (those who don’t see traditional TV commercials).

![]() Brand Safety

Brand Safety

Minimize the risk to a brand’s reputation with ads that appear with high-quality streaming content from top TV networks and movie studios.

![]() Privacy

Privacy

Target ads using OTT and CTV services’ first-party data or your client’s first-party data.

Video

Digital video has reached peak popularity among consumers. In fact, the average video consumption per week increased 85% from 2016 to 2020, and consumers watched nearly eight hours of online video per week in 2020.1

But that’s not the only factor driving marketers to invest in video advertising: Video is also becoming one of the most important touchpoints in the customer journey.

It started with the rise of unboxing videos and product reviews on YouTube. Then came Instagram Stories with shoppable features.

Today, people are consuming all types of video content with a buying mindset, and they’re purchasing further up the funnel as they’re just discovering a brand.

The Benefits

![]() Proof of Impact

Proof of Impact

Measure engagement and connect results to a client’s business goals (unlike broad-based TV and out-of-home campaigns).

![]() Diversified Spend

Diversified Spend

Get access to video inventory across desktop and app to engage consumers in the open internet.

![]() Omnichannel Strategy

Omnichannel Strategy

Use first- and third-party data to target specific audiences that are most likely to engage with a client’s brand and their products or services.

Retail Media

Retailers have taken on the same role as publishers and are allowing brands to reach their first-party audiences through retail media advertising.

Brands that sell their products through retail partners are increasing their investment in retail media to get a better spot on the “digital shelf.” In fact, according to a Forrester Consulting survey commissioned by Criteo, 76% of consumer product marketers in the US and 92% in the EU say the growth of their business depends on retail media advertising.2

The Benefits

![]() Proof of Impact

Proof of Impact

Attribute ad spend directly to sales as consumers discover and buy products via a client’s ads.

![]() Diversified Spend

Diversified Spend

Reach consumers at the digital point-of-sale on retailer websites.

![]() Brand Safety

Brand Safety

Ensure suitable placements with ads that only appear alongside products.

![]() Privacy

Privacy

Target ads using retailers’ first-party data.

Store Campaigns

Around the world, 80% of retail sales will occur offline in 2021.3 However, for every offline transaction, there can be numerous online touchpoints that precede it.

Offline data is often an untapped resource in digital advertising. Store ad campaigns use a client’s offline sales and customer data to engage in-store shoppers and drive both online and offline outcomes—whether it’s store visits or sales, in-store or curbside pickup, or online purchases.

The Benefits

![]() Proof of Impact

Proof of Impact

See how store campaigns directly influence a client’s sales, loyalty, and store visits.

![]() Diversified Spend

Diversified Spend

Reach consumers in the open web and remind them about online and offline offers.

![]() Privacy

Privacy

Target consumers based on first-party data like hashed email addresses.

![]() Omnichannel Strategy

Omnichannel Strategy

Connect the dots across online and offline journeys and optimize campaigns based on the true lifetime value of a client’s customers.

Contextual Targeting

Contextual targeting has been around for decades, but it’s back in the spotlight because it serves as an effective solution for digital advertising without third-party cookies.

This type of targeting matches an ad to a website page based on the content of that page. The focus is on the content being consumed—not who is consuming it.

Marketers need to explore the possibilities of contextual targeting as a way to engage audiences without cookies.

The Benefits

![]() Diversified Spend

Diversified Spend

Test and learn today ahead of the deprecation of third-party cookies.

![]() Brand Safety

Brand Safety

Ads only appear next to content that is relevant to a client’s products and services.

![]() Privacy

Privacy

Because contextual doesn’t target specific users, it doesn’t rely on third-party cookies in any way.

Download the Agency Edition of The 2021 Digital Advertising Manual: New Opportunities to Drive Client Growth for data and advertising strategies that will help you serve your clients in new ways:

1Limelight’s State of Online Video 2020, Global (US, France, Germany, UK, India, Indonesia, Italy, Japan, Singapore & South Korea), n=5,000; responses from consumers who watch one hour or more of online video content each week.

2A commissioned study conducted by Forrester Consulting on behalf of Criteo, North America, July 2020; EMEA, August 2020

3eMarketer, December 2020